This is the fourth and final post in our series explaining how to gather data from various locations to centralize your book of business. In previous posts, we covered how to export data from email, Facebook, and LinkedIn. In this post, we’ll explain how to request data from carriers and BGAs.

Jump to a section:

Request Data from Carriers

Request Data from BGAs

Considerations

Request Client Data from Carriers

There are two ways to request your client data from a carrier. We'll go over both below.

Method 1: Agent Portal

Depending on the carrier(s) you work with, you may be able to access your book of business through their carrier-specific agent portal. If the portal offers this option, you’ll be able to download an in-force book of business as a CSV or Excel file.

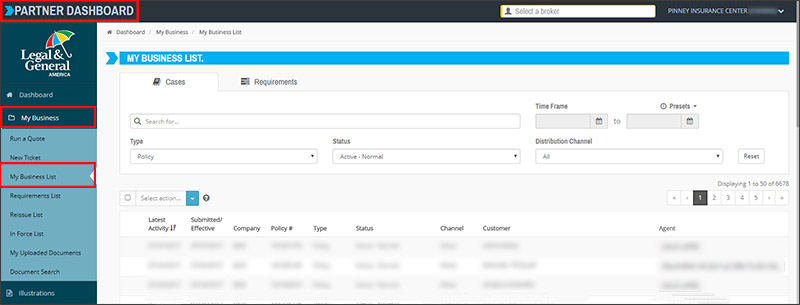

As an example, here’s what we see when we log into our L&G Partner Dashboard. We can use the search criteria to display only in-force policies. This is one of the benefits of retrieving client data from the carrier – they know which policies are in force. You can limit your download to information on clients who are still paying premiums.

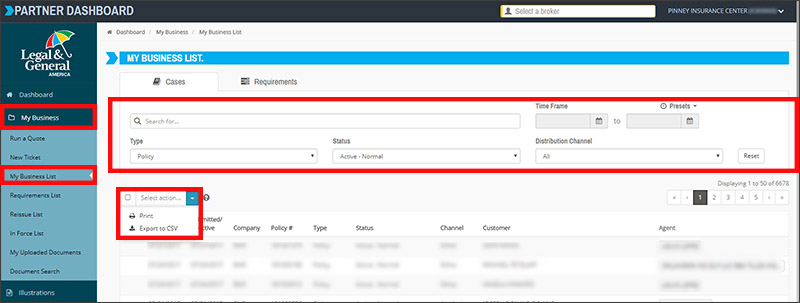

If a carrier's portal allows you to view and sort data, you can probably also export it. In this case, the option is a simple checkbox below the search parameters. To download our data, we'd narrow search criteria to active clients and select Export to CSV.

Once you have your CSV, you can combine that data with the data you’ve already exported from your email and social media.

Method 2: Manual Request

Other carriers require that you request your data through the policy owner service area or the sales desk/marketing department. If this is the case, you may need to send a letter or email requesting the data.

First, make a phone call to confirm where you should send your letter and to whom it should be addressed. Also ask what you should include in your request (i.e., writing agent name and/or code number).

Next, compose your letter. Remember, a carrier may be concerned that you’re going to market to these clients and potentially persuade them to switch carriers. It’s a good idea to mention your reason for the request, whether it’s to consolidate your client data in preparation for taking on a new partner, selling your business, or to review whether the client’s coverage is sufficient for their current financial situation.

Sample Request Letter:

To Whom It May Concern, (<-- replace with name of actual contact, if possible)

I’m requesting a list of all my current in force policies that reached in force status during the following date range: (month, year) through (month, year). These policies have (agent name) as the 100% writing agent with the agent code (insert your code).

I want to confirm that I have the most up-to-date contact information for these clients while I review whether the policy amount applied is enough for their current financial situation.

Thanks in advance for your help!

Sincerely,

Your Name

Finally, email or print your letter on company letterhead and send it to the appropriate address.

Keep in mind that it can take weeks or even months to receive your data. You may need to follow up multiple times to remind the carrier about your request.

The data you receive will likely contain a client’s name, policy information, address, and current beneficiaries. You may not get their email address(es) or current phone number(s). Plus, each carrier may provide your data in a different format, which can make the process of consolidating it more difficult.

For all these reasons, if you can’t do a direct download from your carrier’s agent portal, it may be easier to request the information from your BGA.

Request Client Data from BGAs

Most BGAs use one of several common agency management systems to process your business, such as iPipeline’s Agency Integrator or Ebix’s SmartOffice. These systems have robust reporting capabilities that make it easy and efficient for your BGA to provide you with a list of all clients, applicants, and policies that you submitted through them.

Some BGAs may have a policy not to offer this information or they may decide on a case-by-case basis, depending on your relationship. We find those to be few and far between. In most cases, the more recently you’ve worked with them, the more likely they are to provide the data for you. Most agents work with 2-3 BGAs at a time over the course of a year. Agents who’ve been in the business for a long time may have 8-10 BGAs they’ve worked with.

Tips & What to Expect

If you run into a roadblock, one way to entice your BGA to provide the data is to let them know there may be something in it for them. For example, if you’re going to use your data to run a marketing campaign, your BGA could benefit when you send extra business their way.

One downside of requesting data from a BGA is the potential lack of recent updates. You won’t get information on changes the consumer made since the policy went in force. However, one clear advantage is that you’ll almost always get consumer contact information (phone number and email at the time the app was submitted), while carriers will rarely provide this.

As with a carrier, make a phone call first. Ask whether your BGA can get you the information you need. If so, find out what they need from you to run the necessary report. In most cases, your request can probably be emailed. If not, print out a request letter on your agency letterhead.

Sample Request Letter:

To Whom It May Concern, (<-- replace with name of actual contact, if possible)

I’m requesting a list of all in-force policies your agency has processed on my behalf.

I plan on running a marketing campaign and want to be sure I have the most up-to-date contact information for these clients.

Thanks in advance for your help!

Sincerely,

Your Name

Considerations

Before you send your request, keep in mind that carriers and BGAs aren't required to provide you with your client data. They may tell you they can’t provide it due to client privacy considerations and/or HIPAA compliance. Still, it never hurts to ask.

If you do get the data, one way to validate and update it is through a data-appending service. These services will provide updated contact information, social media accounts, demographic info, and more. It usually costs $1 - $2 per contact name, depending on how much data you want them to find. It's significantly cheaper to add just a phone number or email address. Services that append phone numbers should also scrub your list against the Do-Not-Call registry. Depending on how much data you started with, this may be the best way to prepare your book of business for future marketing efforts.

That's our look at how to request client data from carriers & BGAs!

Have you requested data from a carrier or BGA? Are there any parts of the process you want more clarification on? Tell us in the comments!