Get the Kit

How would you feel if you had to pay a $1,000,000 bill…with only $42,797 in your bank account?

It’s an overwhelming feeling. You might respond with fear, surprise, shock, doubt, or despair. That’s how many of your clients feel when they start thinking about retirement planning. Why? Because according to the Motley Fool, $42,797 is how much the average 50-year-old has saved for retirement.

That discrepancy is why it's so easy for clients to avoid talking about retirement savings. It's scary. Really scary. But it's our job to try and help them get past that fear.

Your clients already know you. They know you're at least somewhat familiar with their financial situation. Use that familiarity to show them how life insurance can help them prepare for retirement. Our kit will help you get the ball rolling.

What's in the Kit

Our FREE 43-page retirement planning sales kit for 2017 includes:

- 4 sales ideas

- 2 case studies

- 8-page client brochure on life insurance in retirement planning

- 2-page client handout: 10 reasons you may need life insurance in retirement

- 4-page retirement planning consumer guide

- 6-page marketing guide to longevity planning with permanent life insurance

- 12-page retirement income workbook to share with your clients

Why It Matters

45% of Americans have not saved anything for retirement, according to the Motley Fool.

In order to draw $5,000 per month for 30 years of retirement, that 50-year-old needs to have $1,060,751 in savings when they retire. The average American retires at age 63 – which means this person only has 13 years to make up a shortfall of $1,017,954. Of course, that’s expecting a 6% annual return on their retirement savings and 2% inflation.

But what if that annual return isn’t realized?

Or what if your client has a medical emergency that drains her savings?

And what if your client is counting on the value of his small business to fund his retirement?

How about high-net-worth clients who want more control over their retirement income and less potential tax liability?

Life insurance can help with each of these situations.

Get the KitHow to Use This Month’s Sales Kit

Use these sales ideas to show your clients how to move their money between assets – and include products like universal life insurance in their portfolio.

For example, the first sales idea in this month’s kit is about moving money from a bond portfolio to a guaranteed universal life survivorship policy. If interest rates take an uptick, the market value of a client’s bonds can actually decrease. Selling some of that client’s bond portfolio and investing a lump sum into a GUL policy may be a smart option. In the example (detailed in the kit), selling $100,000 of bonds can be parlayed into a policy with a $300,000+ death benefit. To give them even more bang for their buck, you could look into riders that let them access those funds if they get sick or become disabled.

Insureio Subscribers: Use Our Retirement Planning Marketing Campaign

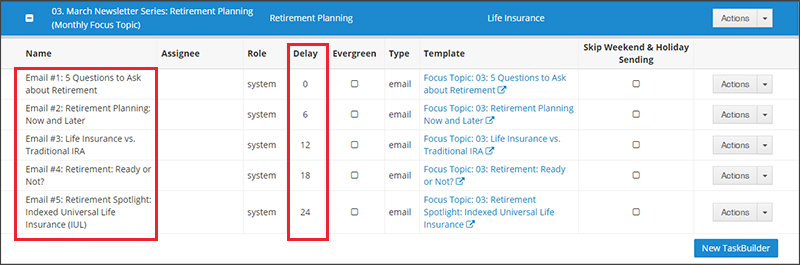

If you're an Insureio subscriber at the Standard or Professional level, you have access to our pre-written Retirement Planning marketing campaign. The campaign consists of five educational consumer emails pre-scheduled for delivery throughout the month.

To view the campaign, visit the Marketing Materials section of Insureio. Select Campaigns from the Material filter on the top left. Click March Newsletter Series: Retirement Planning. You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue links under Template.

Our Insureio Academy has a full explanation for how to enroll clients in a campaign. Click here to learn more.

Help Your Clients Plan a More Secure Financial Future