Don’t sell many annuities? We found one that may change everything for you.

Whether your focus is on life insurance, financial planning, or P&C, we all have retired clients with money sitting on the sideline in CDs. With today's interest rates, we might as well call these “Certificates of Depreciation.” But there's a way you can multiply the return your clients are getting on their safe money: Lincoln’s MYGuaranteeSM Plus (MYGA). If your clients have a CD at their local bank, for example, they're probably getting 0.5% to 2% interest. Compare that to Lincoln's 3.5% rate for their five-year rate-guarantee annuity! With this product, you can easily help clients beat the bank and make their money do more for them.

How to Sell It

Here’s an easy and practical idea to increase your customers’ savings rates and grow your 2019 revenue. Just ask one simple question of every retirement-age client: “Are you happy with your CD returns?” The answer will almost always be “no,” and chances are you’ll have a better solution. Best of all, you don’t need to be an investment expert to help them simply beat the bank!

Our Brokerage Manager’s Advice

What made Pinney Brokerage Manager Dave Cranfield recommend this annuity?

This annuity is very simple, and the interest rate is way above the competition for the same surrender period. It’s also way more than your client is likely to make at the bank. For example, the 5-year MYGA offers a 3.5% interest rate. We compared that to the big national banks on Bankrate.com, and this annuity beats every one of their five-year guarantees, PLUS your client can take out 10% every year penalty-free, let their money grow tax-deferred (unlike CDs), AND there’s no “re-lock” provision on the back end like many other CDs or annuities. The client is truly free to do with it what they want. They can leave it be at the new rates five years from now without locking it back in, or they can take their ball and go home… free and clear… no games.

As of January 1, 2019, here are the current guarantee periods and interest rates:

| Premium | 5 Years | 7 Years | 10 Years |

|---|---|---|---|

| Less than $100,000 | 3.20% | 3.10% | 3.10% |

| $100,000 or more | 3.50% | 3.25% | 3.30% |

Have a client who wants to apply? Call us at 800-823-4852 to get the current interest rates.

More about MYGA

Here are a few pointers to keep in mind for a discussion about annuities. You might want to bookmark this post and come back to it when you have a client who's interested on the phone or in your office.

Fixed Annuities in General

- An annuity like MYGA can be a good replacement for a financial product like a CD, which doesn't offer much return for the cash or savings you don't need for day-to-day expenses.

- The money you pay into an annuity accumulates interest over time – your assets grow with that fixed interest rate. It’s not dependent on market fluctuations, which is comforting in today's volatile market.

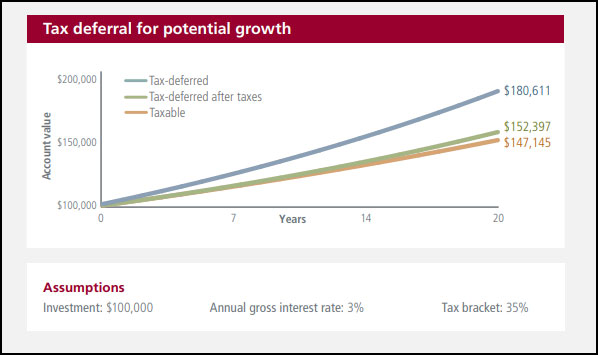

- Your interest-based growth is all tax-deferred. Mathematically, you’re going to end up with more than you would if you invested in a taxable product, like a CD.

- Although the idea is to wait to collect payouts until the annuity matures or the interest rate guarantee period is over, you do have access to that cash. You can access a percentage penalty-free; if you need more, there will likely be a Market Value Adjustment (MVA) and/or a surrender charge. With an MVA, the issuer adjusts your interest rate based on current rates. A surrender charge is a penalty, usually a small percentage of the amount you withdraw.

Lincoln MyGuarantee Plus Annuity (MYGA)

- MYGA is a single-premium deferred annuity that can be issued up to age 85, with as little as $10,000 in premium. As mentioned above, you can withdraw 10% of the accumulation value per contract year with no surrender charge.

- The initial fixed interest rate is determined by the guarantee period (5, 7, or 10 years). You get to choose how long you want that interest rate to last. If you don't need your extra cash for ten years, for example, you can lock in that interest rate for all 10 years. But if you want to start the payout phase earlier, you can choose a shorter 5-year term and score a slightly higher interest rate.

- There's a free look period of about 20 days (varies by state). Cancel within this period and get your money back, no questions asked.

- Change your mind after the guarantee period? Your minimum cash surrender value is 90% of the premium, accumulated at 1-3% minus any related taxes or fees for early withdrawals.

- If you die before the payout phase, Lincoln Financial pays your beneficiary the accumulation value of your annuity. Keep in mind this amount is subject to tax.

- You can start taking payments after the fifth contract year. If you wait until the annuity matures, your payouts will start either on the 10th anniversary of your contract, or the contract anniversary immediately after your 95th birthday (90 in New York).

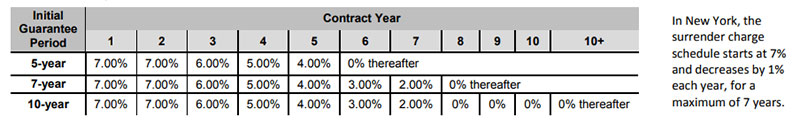

- Surrender charges are based on the guarantee period and max out at seven years, while your interest rate can be guaranteed for up to 10 years. That’s huge! That means you can go over the 10% withdrawal rate with no Market Value Adjustment (MVA) as long as that surrender charge period is over (5 years for a 5-year guaranteed period, 7 years for all other periods).

- After the guarantee period, your contract renews at a new interest rate each year. Subsequent rates will never be lower than the Guaranteed Minimum Interest Rate (GMIR) stated in the contract.

That’s our look at the Lincoln MYGuarantee Plus Annuity (MYGA)!

Have a client who wants to apply? First, call us at 800-823-4852 to get the current interest rates.