Did you know that retirement portfolios with participating whole life provide more retirement income than plans that focus solely on investments?

That’s the conclusion of an Ernst & Young study that used Monte Carlo analysis to run 1,000 scenarios comparing 5 different investment strategies. For each strategy, analysts looked at two specific outcomes:

- How much after-tax retirement income does each strategy generate?

- What is the legacy value of each portfolio, after taxes on qualified assets and estate taxes, at age 95?

They wanted to compare a number of retirement strategies to see which one helps future retirees avoid some big problems they see on the horizon. They estimate that by 2030, we’ll be facing a $240 trillion retirement savings gap. That’s on top of an estimated $160 trillion protection gap. Given these huge risks, what’s the best way to avoid falling into those gaps? What sort of planning might prevent our clients from running out of retirement income or having nothing to leave as a legacy for their loved ones?

Let’s find out. You can check out our summary below, or read the full study here.

Jump to a section:

The 5 Investment Strategies

The 3 Hypothetical Investors

The Results

How Can You Use This Information?

The 5 Investment Strategies

The study looked at five specific investment strategies for someone planning to retire at age 65:

- Investments only, after maxing out contributions to qualified assets. Investments are split between stocks (more risk) and bonds (less risk).

- Investments + term life protection to age 65. One downside of this study? They modeled their results using an annual renewable product, which is an unlikely choice for today’s term life shopper. As you’ll see below, the youngest age modeled in this study was 25; that customer could have purchased a 40-year term to get them to age 65 and skipped the expense of an annual renewable policy. It’s a flaw in the study, but since the term life policy would have ended at age 65 either way, it adds nothing to the legacy of the hypothetical couples modeled. Any effect would only be in the money spent on the annual renewable policy that could otherwise have been invested.

- Investments + participating whole life, paid up at age 65. For these scenarios, all policy dividends were used to buy paid-up additions. During periods of market volatility, cash value would be expected to provide retirement income. The money to purchase a whole life policy came from the dollar value that would have been otherwise allocated to bonds (not stocks).

- Investments + deferred income annuity (DIA) with increasing income potential (IIP) For this study, IIP consists of persistency bonuses and non-guaranteed dividends. The DIA would be purchased at age 55. The money to buy it came from the dollar value that would have been otherwise allocated to bonds (not stocks).

- Investments + participating whole life + DIA with IIP, combining all of the above into a single strategy. The money to purchase a participating whole life policy and a DIA with IIP (at age 55) came from the dollar value that would have been otherwise allocated to bonds (not stocks).

The main question the study hoped to answer is this: After contributing the maximum allowed amount to a qualified asset like a 401(k), is an investor better off putting all their remaining money into stocks, bonds, and other equity assets? Or are they better off splitting that money between one or more insurance products and allocating what’s left to stocks and bonds?

The 1,000 Monte Carlo scenarios accounted for a range of market conditions, interest rates, and inflation rates. The study authors looked at the effect of varying the percentages allocated between equities, whole life, and an annuity. Next, the study authors calculated how much income our hypothetical investors would be able to withdraw from each income-generating product or investment, subtracting federal and state tax where necessary.

Back to topNeed help with quotes, illustrations, or selecting the right product?

Our Brokerage Managers - Dave and David - can help. They have incredible depth and breadth in terms of product knowledge. Call 800-823-4852 and ask for a brokerage manager, or click the button below to email us!

The 3 Hypothetical Investors

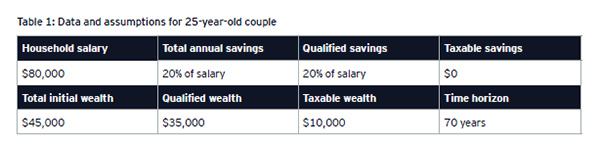

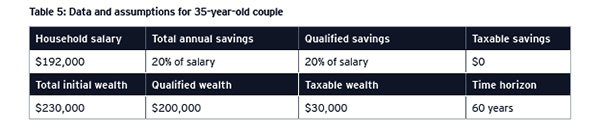

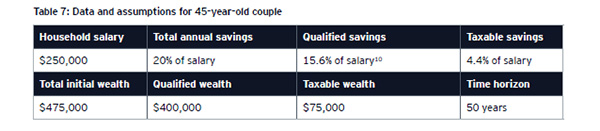

Next, the study authors created three hypothetical couples of different ages. Would the results be different for a young couple versus a middle-aged couple?

- 25-year-old couple with a combined income of $80,000.

- 35-year-old couple with a combined income of $192,000.

- 45-year-old couple with a combined income of $250,000.

The Results

For all three hypothetical couples, the strongest results – higher retirement income, more legacy to leave behind – came from scenarios that combined insurance products with investments.

Couple #1: 25-year-olds

The winning strategy? Assuming they have a low tolerance for risk, the best bet comes from a combination strategy as follows: high allocation percentages to a deferred income annuity with increasing income potential (up to 30%) along with a high allocation to participating whole life insurance for the maximum legacy (up to 30%). The remaining funds would then be allocated to investments (a mixture of stocks and bonds). That combo is the most likely to optimize both retirement income and the amount of legacy to leave their loved ones.

Couple #2: 35-year-olds

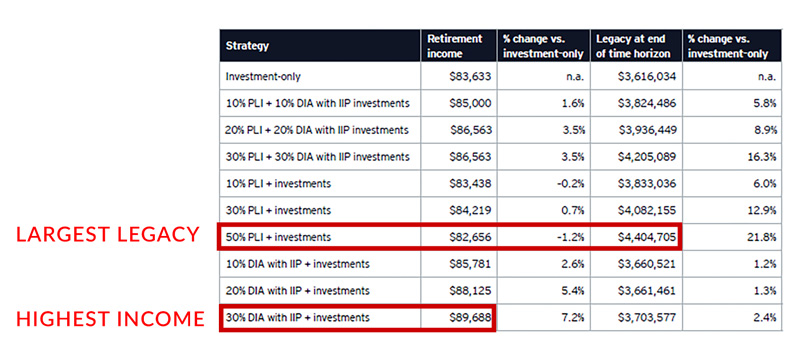

Their winning strategy? It depends whether they want to focus on retirement income or legacy. They would earn the most retirement income from a strategy of 30% allocated to a deferred income annuity with IIP + investments ($89,688), a 7.2% boost over the investment-only strategy. However, their top legacy at age 95 would come from a strategy of 30% allocated to participating whole life + 30% allocated to a deferred income annuity with IIP + the rest split in investments in stocks and bonds ($4,205,089).

Couple #3: 45-year-olds

Their best bet? The most retirement income came from the blended strategy of 30% participating whole life + 30% DIA with IIP + investments. This strategy worked best for them because with less time to save for retirement, a portfolio with less market risk generated the highest and safest returns.

Here’s the included chart that shows you the breakdown of percentages and strategies for the middle couple (35 years old). Unsurprisingly, it shows the couple would earn more retirement income by emphasizing the annuity, and more legacy by emphasizing the participating whole life:

Key findings for all

- A combination of investments and insurance products outperform investments alone, no matter whether you’re solving for retirement income or legacy.

- Solving for retirement income? The DIA with IIP + investment strategy worked best.

- Solving for legacy? Go bigger on your percentage allocated to participating whole life.

- Solving for both retirement income and legacy? Mix investments + 10%-30% participating whole life + 10%-30% in a DIA with IIP at age 55.

- Term life premiums acted “as a drag” on these portfolios – their words, not ours.

How Can You Use This Information?

No study is applicable to everyone’s situation. So how do these hypothetical results help you and your clients?

They give you a starting point – something to talk about.

Do you know whether your client would prefer to solve for income or legacy? Ask!

- If they choose income, are they aware that reallocating funds to a deferred income annuity can hedge against market risk and longevity?

- If they choose legacy, are they aware just how valuable the paid-up additions of participating whole life can be in generating cash value for them in addition to creating and preserving that death benefit for their legacy?

These are win-win situations. So no matter which answer they give, you can show them how either answer results in more for them.

Click here to read the full study (and see all the details about investment, market & tax assumptions).

Back to topThat’s what Ernst & Young has to say about participating whole life and deferred income annuities in retirement!

Do you agree or disagree with their conclusions? Tell us in the comments!

Need help with quotes, illustrations, or selecting the right product?

Our Brokerage Managers - Dave and David - can help. They have incredible depth and breadth in terms of product knowledge. Call 800-823-4852 and ask for a brokerage manager, or click the button below to email us!