There's plenty of marketing advice out there to help you identify and serve your ideal client – a person in a certain age group, career field, or stage of life. But what about people who don’t fit into that box?

No time to read? Watch our video overview:

“Niche down” – that’s the most common advice for creating stronger (and more valuable) connections with your clients and prospects. We agree that it’s extremely valuable to find a small segment of the market to serve. But most agents don’t want to turn away prospects just because they don’t quite fit into their niche. These prospects could be:

- Client referrals who don't fit your ideal client profile.

- Client referrals who aren’t ready to buy.

- People who used your online quoter and did not make a purchase, but whose information (age, requested policy face value) means they probably don’t fit your ideal client profile.

- People who contacted you via social media or your website who don't fit your ideal client profile.

So how do you continue to spend most of your time serving your niche…without turning away potentially valuable prospects?

You create a way to educate, nurture, and stay top-of-mind with these prospects until you learn a little more about them.

Step 1: Understand the Need

The best way to serve clients outside your ideal range of age or salary is to understand their needs. And what they need may not be the product you’re most familiar with. For example, according to an August 2022 survey by Nationwide, only 28% of Gen Z parents say they could cover an unexpected expense of $1,000. A whopping 74% live paycheck to paycheck, and 62% do not feel secure in their financial future.

Based on this information, does it seem likely that life insurance is going to be their top priority?

We’re guessing not.

But how about disability or critical illness protection? These products align more closely with the need to preserve and protect their income – the only way they can pay rent or put food on the table.

Take a moment to think about products you can sell that aren’t life insurance. If you’ve seen our post on the insurance matrix, you already have this list. If not, now’s the time to think about (a) what else carriers offer, or (b) who you can partner with to help expand your offerings.

Got your list? Let’s move on to the next step.

Step 2: Create a Get-to-Know You Survey

Think of this survey as the beginning of a sales funnel – it's an introduction to you, as well as a few questions a prospect can answer to help you serve them better.

Using your CRM or email marketing software, create an email or text message with a link to a survey they can fill out. Google Forms is free and easy to use; we use Formsite, a paid service that lets us integrate forms onto our website.

With the survey, your goal is to figure out which funnel to place them in. You may already know their age (if, for example, they used your online quoter but didn’t make a purchase). For this reason, asking their age again could be a waste of time. Consider asking related questions that will pinpoint their needs.

Here are a few examples:

- What is your biggest financial worry right now? (a) just paying the bills (b) getting out of debt (c) saving up for a house or other big expense (d) planning for retirement

- Do you have children?

Based on their responses, you can add them to the most relevant campaign (sales funnel) below.

Step 3: Create Multiple Sales Funnels

Creating multiple sales funnels based on needs/life stage will help you deliver the right message to the right client. The goal here is to take each of these prospects and turn them into a lead, complete with quote or application request. Automate the education and nurturing process so that when you speak to them, they’re grounded in the basics: who you are and how the product(s) you offer can help them.

If it sounds like a lot of work, don’t worry. For the moment, focus on the bare minimum you need to get started. In most cases, this is a sequence of 2-3 emails or text messages with a quoter/landing page.

To start, make a quick outline of target age groups and the financial products you think they need most.

Sample Outline for Sales Funnels

Prospects Age 20-35

*disability income insurance

*life insurance with living benefits

Prospects Age 35-45

*life insurance with living benefits

*disability income insurance

Prospects Age 45-55

*life insurance with LTC benefits

*critical illness insurance

Prospects Age 55+

*life insurance with LTC benefits

*annuities

*Medicare supplement insurance

This outline isn’t based on any specific information about your prospects. It simply captures the general needs they likely have based on their age. It's up to you whether you mention anything specific about age in your emails, however. If you do, you might make a stronger connection. But if you keep it age-agnostic, you could drop any new prospect into that campaign as long as their needs line up with the products you're promoting in that campaign. It's up to you.

Sample Outline for Funnel Content

- Email or text message 1: Trends you see in this life stage – what you’re selling to people facing the same financial worries. Call to action: ask a leading question for them to think about; tell them you’ll be in touch soon.

- Email or text message 2: Introduce a product in more detail – how would it help them? What are some sample rates? Call to action: get a quote.

- Email or text message 3: Introduce a second product in more detail – how would it help them? What are some sample rates? Call to action: get a quote.

- Email or text message 4: Why should they act now? Call to action: get a quote.

- Landing page: include quoter for first product; link to this from email 2.

- Landing page: include quoter for second product; link to this from email 3.

We use Insureio, our CRM of choice, to create email and text message campaigns.

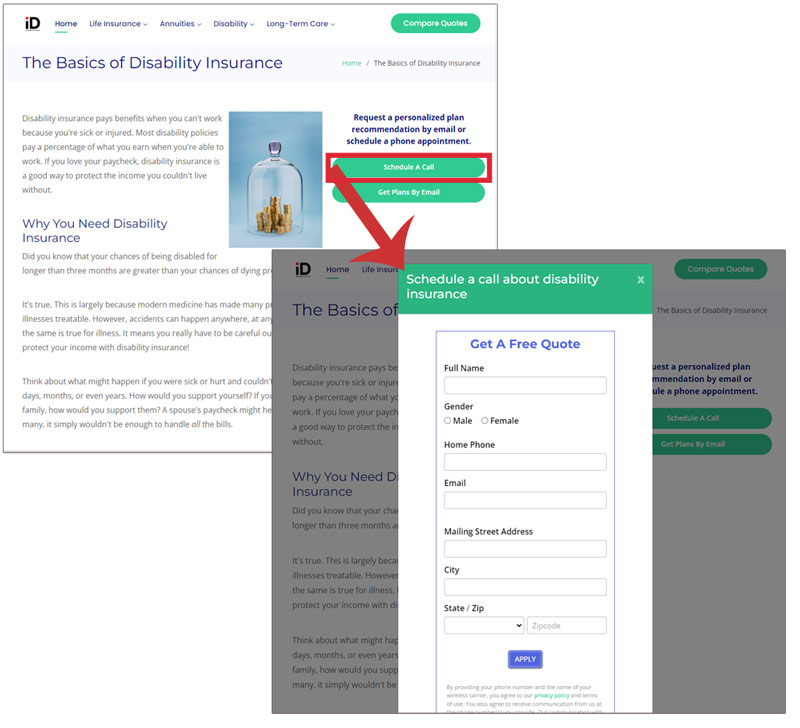

BONUS: If you subscribe to the Insureio marketing package, you also get access to InsuranceDivision.com, a pre-built white-labeled marketing website. There are already content pages written on disability insurance, Medicare supplement insurance, annuities, and critical illness insurance. Each page has a lead capture form - you don’t have to reinvent the wheel and create these things yourself!

Step 4: Repurpose Funnels as Needed

Depending on how you construct your funnels, you could use them for multiple purposes. In addition to engaging and educating new prospects, you could also:

- Put cold leads into one of these campaigns to re-engage them.

- Re-use emails/texts on ancillary products like disability, critical illness, or annuities with your ideal clients, who probably haven’t seen this material before.

That’s our look at how to serve a niche without turning others away!

Do you use automation for email and text messaging in your practice? Where do you see it working best? Tell us in the comments!