Get the Kit

Our FREE 27-page tax strategies sales kit includes:

-

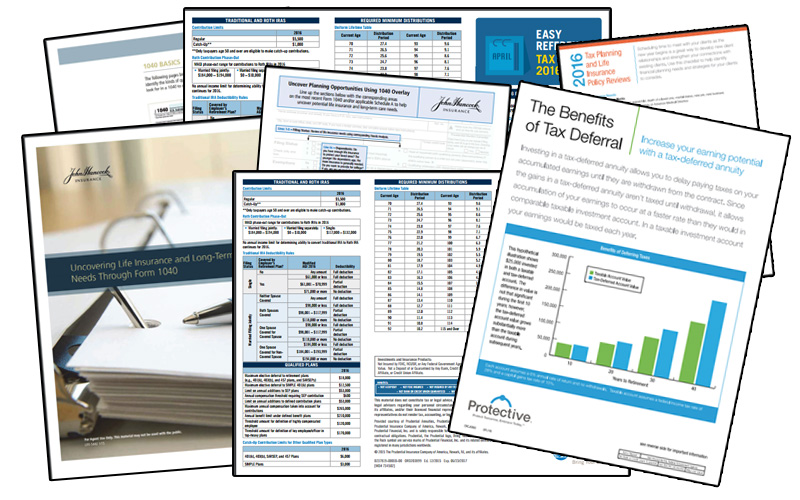

12-page guide to uncovering life & LTC needs through a 1040 tax form

-

6-page 1040 overlay guide and worksheet

-

2-page easy reference tax guide for 2016

-

2-page tax planning & life insurance policy review checklist

-

3-page guide on the benefits & power of tax deferral

Your client's tax return can tell you a lot about their financial needs - are you taking advance of tax season to get in touch and offer to help? Comparing a client's 2014 and 2015 returns can also tell you a lot about financial changes they're undergoing, whether it's a gain or drop in income, addition of new family members, or the additional financial obligation of caring for a dependent parent.

If your client owns a business, you can also learn a lot about it here. The more profitable the business, the more it needs to be protected against the chance of your client's disability or death. Another key finding from your client's 1040 is the amount they may have invested for retirement. Their 1040 will show you how much they received in dividends, taxable interest, and tax-exempt interest. If those sections are blank, it's a good conversation starter - you can ask about other methods your client may be using to sock money away for retirement.

Get the KitIn 2015, more than 109 million Americans received tax refunds. According to IRS.gov, the average amount refunded was $2,797.

Your clients may be more eager to talk about money, tax strategies, and financial solutions now, while taxes are fresh in their mind. If they just got a refund, you may be able to point out how easily they could afford life insurance. If they didn't, that may indicate employment or money troubles. In that case, it may be even more important to be sure their family earnings are protected.

Get the Kit

Get the Kit