Would you tell your doctor if you ate a whole pizza by yourself on a Friday night? How about if you successfully trained for and completed a half-marathon? Would you also give that data to your health insurance or life insurance provider if it meant you could save money?

Turns out, more people are ready to say yes. Fitness tracking data could be the next revolution in the way we not only price but sell life insurance.

Fitness Tracking Goes Mainstream

We’re talking about this because of the growing popularity of fitness tracking. As of late 2015, Forrester Research reports that 1 in 6 online adults own either a dedicated fitness tracker (such as a Fitbit or Jawbone) or use a similar app on a smartwatch or smartphone. Tracking exercise goals and posting times, routes, and results on social media is huge in the running and biking communities, for example.

If people are increasingly willing to share their results with family, friends, co-workers, and total strangers on the internet, it’s not a big jump to share it with doctors and insurers.

The 2016 LIMRA Insurance Barometer study found that 30% of consumers would share their fitness tracking data with a life insurer. The good news is that this 30% segment doesn’t currently use a fitness tracker. Among shoppers who do already use these devices, 65% would share their data with a life insurance provider.

But how, exactly, could this data affect the life insurance industry?

For starters, we’d be able to personalize rates based on the consumer’s smart choices. Instead of being lumped into an underwriting category, for example, policies might start out with one rate and decrease by a certain percentage with healthy living, as supported by uploads from a fitness tracker. Life insurance could become a truly customized product.

If that sounds farfetched, it’s already happening in a different insurance sector.

Cars Can Get Connected, Too

Car manufacturers are already using technology to monitor a car’s vital signs the same way fitness trackers monitor your vital signs. All Tesla vehicles are connected to the manufacturer via the Internet, for example. The car’s data can be retrieved to help determine the cause of an accident.

The intent of such tracking isn’t to pinpoint bad drivers, however. The intent is to identify malfunctioning parts that might endanger the driver or others on the road. As a secondary goal, it might help alert drivers to patterns of risky driving behavior, like stomping on the brake. UP to 90% of cars will likely have this kind of “black box” data and internet connectivity by 2020, according to Verisk Analytics.

With trackable data automatically streaming from new vehicles, it would be easy for automobile manufacturers to get into the insurance business. Or, more accurately, to seek out partnerships with insurers willing to rate based on data.

Auto insurance company Progressive already offers a discount for safe drivers through their Snapshot program. In the program, a specialized device records your VIN, how you drive, the number of miles you drive per day, and how often you drive during the statistically dangerous hours of 12 – 4 a.m. As far back as 2009, GM’s financial arm, GMAC, offered drivers a discount on their insurance if they used OnStar. The fewer miles they drove, as tracked by OnStar, the bigger their discount.

If it works for cars, can it work for life insurance?

In a way, it already is.

Sharing Means Saving

John Hancock’s Vitality program is a great example of the way fitness tracking data fits into life insurance. It starts once the policy is issued, so nothing about the current issue process is different from what you’re used to.

Once a client signs up, they take a quick online health survey. This helps them identify and set goals. They then earn points for healthy habits, like regular doctor’s appointments and buying healthy food at the grocery store. To help them track progress, they get a free Fitbit. The more points they earn, the more they save – up to 15% on their life insurance premiums. Even better, they can also earn travel and shopping rewards. In this case, sharing their data earns them valuable discounts, making the exchange worthwhile.

We’ve already had great feedback from a client who’s used the program – you can read his letter here.

Sharing Also Means Building a Relationship

Let’s go back to the 2016 Insurance Barometer Survey and take a second look at these findings. We know data is the next frontier in technology. We know consumers are tracking their own data and are increasingly willing to share it.

But why?

The survey asked. Respondents said their #1 reason for sharing was saving money. Those savings might come in the form of actual policy discounts, or the kinds of freebies and discounts the Vitality program is using. Some respondents who said they wouldn’t share data were worried about privacy. Others just aren’t very active and would prefer their insurer didn’t know that.

But there’s one more piece of interesting information, and it has to do specifically with millennials. Take a look at their reasons for sharing fitness tracking data:

These figures represent the 51% of millennials who wear a fitness tracker and would share results with their life insurance company. Take a look at the two right-hand columns. 33% of those who would share data want to interact and build a long-term relationship with their insurance company.

That means millennials do see life insurance as a valuable investment – and a long-term one. Now it's up to us to build and nurture those relationships.

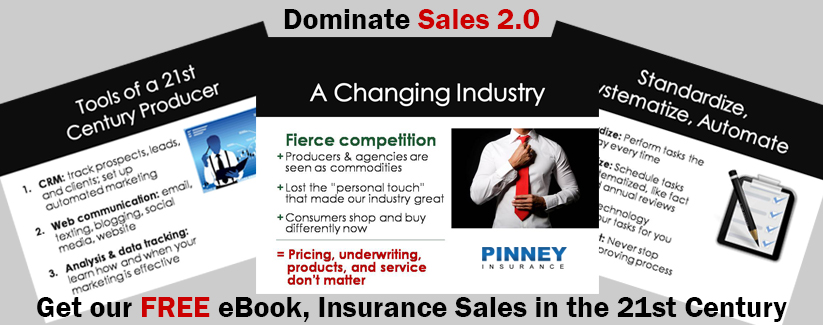

Find out more about what it takes to become a 21st Century Producer in our free eBook: