This month, we're reading The Challenger Sale by Matthew Dixon and Brent Adamson. Our July focus topic is creating financial independence, and we feel strongly that the sales techniques described in this book can help you achieve that independence by becoming a more successful salesperson.

The Challenger Sale is an easy book to read, but not necessarily an easy one to accept, let alone follow. For a lot of us, it's telling us we're doing everything wrong - never a comfortable thought.

So why are we suggesting you read it?

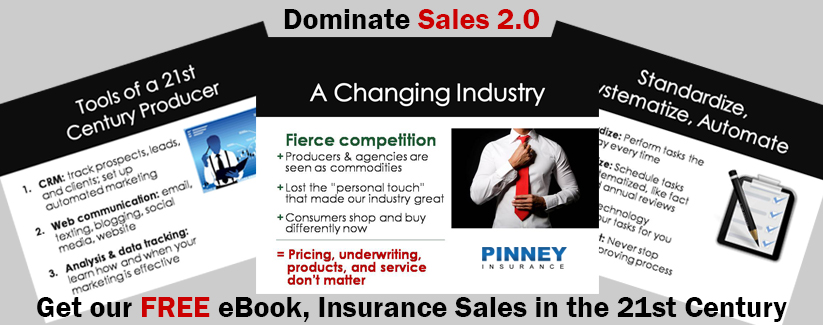

Because this book is a game-changer. It asks you to take a look at your sales methods and strategies and classify them in one of five behavioral "clusters." Then, for most of us, it explains why our particular behaviors aren't suited for making sales in today's marketplace. Bummer, right? Only if we can't adapt.

Which Type of Salesperson Are You?

The book describes five behavioral "clusters" that salespeople fall into:

- The Hard Worker: You put in serious hours on the job, making more calls and taking more meetings than anyone else.

- The Challenger: You challenge your customers using assertiveness and creative problem-solving.

- The Relationship Builder: You build strong relationships with clients and work to keep those relationships tension-free.

- The Lone Wolf: You do things your way because you're confident in your abilities.

- The Reactive Problem Solver: You make sure the sale goes through without a hitch by handling any service issues fast and well.

Keep in mind that these aren't personality types - they're the behavioral patterns that characterize the way salespeople sell. The authors came to these conclusions by studying 700 salespeople initially, and then expanding their sample size to 6,000 salespeople across 90 companies. That's a large enough group to draw some relevant conclusions.

The most surprising part of their research came when they analyzed the data to figure out which of these behavioral types is the most effective salesperson. It wasn't what everyone expected, which was The Relationship Builder. Nope. It was the one they least expected - The Challenger.

Why You Want to Be a Challenger

"But selling is all about relationships," you're probably saying. "It's always been that way and it's never going to change."

Unfortunately, it is changing.

Your Number One competitor today is your own customer and their ability to learn on their own.

The way people shop has changed, thanks to the internet, and insurance is no exception. In a world where our clients can get information about nearly anything in an instant, they no longer need to reach out to us because they're thinking about life insurance. All they need to do is Google it, and they'll have enough reading material to last a lifetime. We're not a part of the discovery process anymore (unless you're on the first page of Google's search results for life insurance, in which case, congratulations). If you have a good relationship with your clients, that's wonderful - but what are the odds a client will pick up the phone and call you instead of Googling it first? They're more likely to call you once they've come to a decision, or at least narrowed down their options.

What's the problem with that scenario?

It puts the Relationship Builder in a tough spot. What do they offer that provides value? An easy buying experience? It doesn't get much easier than buying online. A real human to answer their questions? Just about every online vendor offers an 800 number or live chat to fill that void. In the end, the Relationship Builder doesn't offer enough value to stay relevant to the consumer. In this complex sales environment, they simply aren't equipped to compete.

What matters now is what you bring to the table in terms of solving a client's problem.

That's exactly where a Challenger shines.

How to Be a Challenger

Challengers come up with new and different ideas that keep their clients and prospects coming back for more. It's not the same-old-same-old when they call a Challenger for help with a problem. The Challenger has out-of-the-box ideas that might seem weird - and he or she might be a little aggressive in explaining why they're good ideas. But that confidence and creativity are what help the Challenger stand out among a field of Relationship Builders. Clients learn something by talking to a Challenger.

Challengers also push the boundaries of perception in terms of what they can do for a client. They'll say, sure, let's get you that life insurance coverage, but you're not really going to be financially secure unless we also look at your retirement portfolio and get you some disability protection. They don't let the client put them in the "life insurance" box - they make it clear they can help with retirement planning, paying for college, estate planning, and other things the client probably hadn't even thought of yet.

If the client knows you'll have a solution to their problem - and insight they just can't get online - they're going to call you first. If they know you'll ask tough questions and bring up considerations they couldn't have thought of on their own, they're going to call you first. And whoever they talk to first is going to have a big impact on their final decision on what to buy and from whom.

What We Want to Learn from This Book

Okay, so we know we need to be Challengers and we know why - they're creative, compelling, and confident. But what, exactly, does that entail during the sales process? What are you supposed to say when you pick up the phone and a client says, "Hey, I found your website and I got a quote and I want to buy that 20-year term policy."

A Relationship Builder would probably say, "Hey, great, so glad you're taking this opportunity to protect your family. Whatever you need to get this done, I'll do it."

But we already know this isn't what a Challenger would say. That's what we want to learn here - how our exact sales process needs to change to accommodate the Challenger mindset. After all, if this book's premise is right, if you can train yourself to become a Challenger - you can change how much you sell, which changes how much you earn, which could change your entire life. Now that's financial independence.