Choosing the right life insurance policy is essential in ensuring your family's financial security and achieving long-term financial goals. Two primary types of life insurance—term and permanent—each have distinct features, advantages, and considerations. Understanding the differences between them can help you determine the best fit for your unique needs and circumstances.

What is Term Life Insurance?

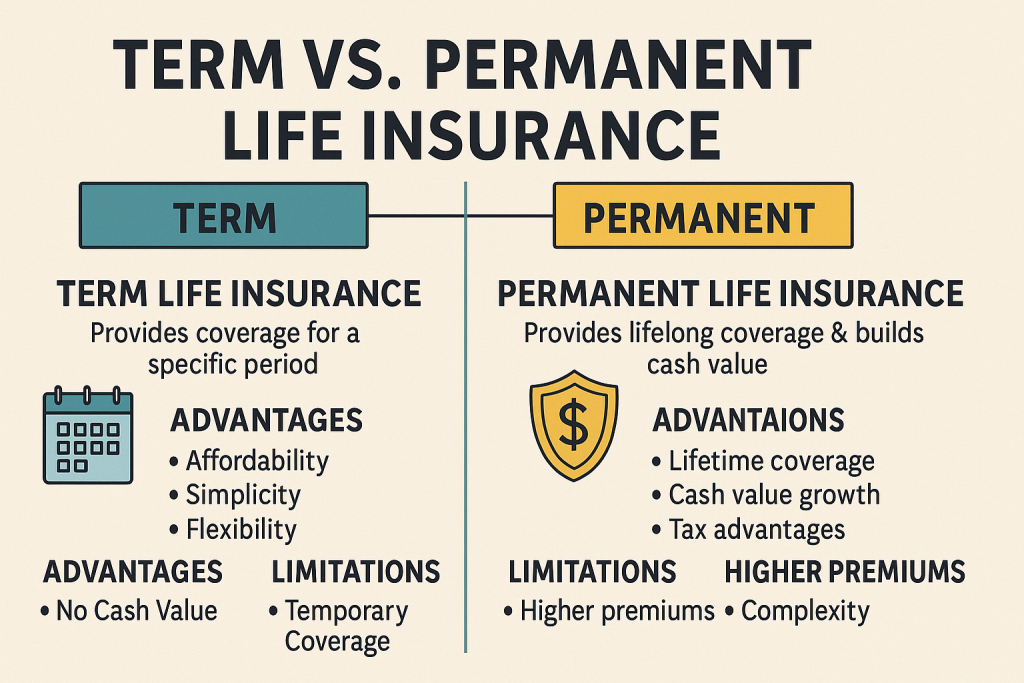

Term life insurance provides coverage for a specific period—typically 10, 20, or 30 years. If the policyholder passes away within the term, beneficiaries receive the death benefit. If the policyholder outlives the term, the coverage ends without payout unless renewed.

Advantages of Term Life Insurance

- Affordability: Term policies generally offer lower premiums compared to permanent policies.

- Simplicity: Straightforward coverage with clear terms.

- Flexibility: Ideal for temporary financial responsibilities, like mortgage payments or educational expenses.

Limitations of Term Life Insurance

- No Cash Value: Unlike permanent insurance, term policies do not build any cash value.

- Temporary Coverage: Protection ends when the policy expires, requiring renewal or new coverage, typically at higher rates due to increased age.

What is Permanent Life Insurance?

Permanent life insurance provides lifelong coverage, with premiums paid consistently. These policies offer a death benefit and build cash value over time, providing financial resources you can access during your lifetime.

Types of Permanent Life Insurance

- Whole Life Insurance: Offers fixed premiums, a guaranteed death benefit, and cash value accumulation.

- Universal Life Insurance: Provides flexible premiums and death benefits, allowing adjustments as financial circumstances change.

Advantages of Permanent Life Insurance

- Lifetime Coverage: Provides ongoing protection throughout the policyholder's life.

- Cash Value Growth: Accumulates cash value that can be borrowed against or withdrawn for various financial needs.

- Tax Advantages: Cash value growth is tax-deferred, and death benefits are typically tax-free to beneficiaries.

Limitations of Permanent Life Insurance

- Higher Premiums: Typically more expensive than term life insurance.

- Complexity: Policies have more components and require a greater understanding of financial management.

Which One is Right for You?

Consider Term Life Insurance if You:

- Need affordable, temporary coverage.

- Have significant financial responsibilities for a specific time (e.g., mortgage, children's education).

- Want straightforward, uncomplicated coverage.

Consider Permanent Life Insurance if You:

- Desire lifelong protection and estate planning benefits.

- Wish to build tax-deferred cash value as part of your financial plan.

- Have a higher budget for long-term financial security and investment purposes.

Making an Informed Decision

Choosing between term and permanent life insurance involves evaluating your financial goals, budget, age, and long-term needs. Working with a knowledgeable insurance professional can help you navigate these considerations, ensuring your chosen policy aligns perfectly with your individual circumstances.

Get Expert Help

Pinney Insurance offers expert guidance to help you select the right life insurance solution. Reach out today for a personalized consultation to secure your family's financial future.