Our November 2019 sales kit is all about long-term care - with an emphasis on life insurance products that offer LTC riders.

November is Long-Term Care Awareness Month - but we know that stand-alone long-term care policies are a hard sell. That's why we're focusing on two aspects of the long-term care conversation: (1) raising awareness about the need for a plan, and (2) using LTC riders on a life insurance policy as an alternative to a stand-alone policy. As stand-alone LTC pricing steadily increases, your clients may feel better about the locked-in pricing they get from a permanent life insurance policy with living benefits instead.

What’s in the Kit

Our FREE 74-page kit includes:

- 12 pages of pre-written social media materials, courtesy of OneAmerica

- 1-page infographic with stats you can share on social media & in your newsletter

- 5-page guide on starting the LTC conversation with clients

- 18-page booklet on the "aging at home" strategy using LTC products

- 3-page guide to tax implications for living benefits

- 4 pages of client profiles

- 12-page guide on the difference between 7702B and 101(g) riders

- 4-page guide on LTC coverage and affluent clients

- 5-page guide on creating a care program based on how LTC benefits are paid

- 8-page consumer guide on alternatives to traditional LTC policies

How to Use This Month’s Sales Kit

Make it easy for your clients to learn more about long-term care:

- Use the pre-made social media materials to spread the word. The pre-written social media materials in this month's kit include downloadable images, links to articles, and a calendar that shows you what to post when. Use these sound bites to get your clients familiar with the kinds of questions that come up when you talk about long-term care, like: "Did you miss a spot? Is long-term care in your retirement strategy?"

- Use the stats throughout the kit in your email newsletter and/or email blasts. It's a good idea to contact everyone in your book of business about long-term care (filtering out those who already bought a stand-alone policy or life insurance with an LTC rider). Good places to grab stats include the infographic in this month's kit, as well as the pieces on starting a conversation and aging at home with long-term care protection. In this email, include a call to action so your clients know they should call or email you for more information or to set up a meeting.

- Know which options to present, along with their strengths and weaknesses. When a client asks for more information, you want to be prepared. But you also don't want to overwhelm the client in this first discussion/meeting. First, outline the options they have, including the advantages and disadvantages of each: self-insuring, buying a stand-alone LTC policy, or opting for a life insurance policy with an LTC rider.

- Self-insuring. Make sure your clients know just how dangerous this choice could be. The rising costs of long-term care combined with inflation and increased longevity mean their dollars won't buy as much as they expect them to. According to the Employee Benefit Research Institute, out-of-pocket healthcare costs will average $296,000 - $399,000 through the course of retirement for the average 65-year-old couple. Are they prepared to downgrade their standard of living in order to pay for care out of their existing retirement savings?

- Stand-alone LTC policy. These used to be the only option for LTC benefits; however, insurers are pulling back from these policies because of the ballooning costs of care. The benefits may not be as comprehensive as they used to be, and premiums are rising. While these are worth using as a comparison point, the most affordable option may be the one presented below.

- Life insurance with an LTC rider. This category includes two distinct types of policies: hybrid products, which are typically funded with a single payment, and permanent life insurance policies with a rider designed to pay for long-term care expenses. The good news about these policies is they answer the dreaded question, "What happens if I never need long-term care?" If that's the case, the full amount of the death benefit goes to their beneficiaries, making this an effective and affordable option that works for many clients.

- Let us get you the answers and quotes you need. Do your clients have questions you can't answer? Do you need an illustration? We can help. Call us at 800-823-4852 and ask to speak to a brokerage manager.

Insureio Subscribers: Use Our Long-Term Care Email Marketing Campaign

If you're an Insureio subscriber, you can access our pre-written marketing campaign for November. It includes four educational emails for clients and prospects pre-scheduled for delivery throughout the month. The emails in this campaign explain what long-term care is, what long-term care policies provide, and how important it is to make a plan. They're designed to introduce concepts rather than sell a policy - there's no hard sell, and no specific carriers mentioned. They're designed to educate your prospect or client so they know what's at stake before you have a conversation with them.

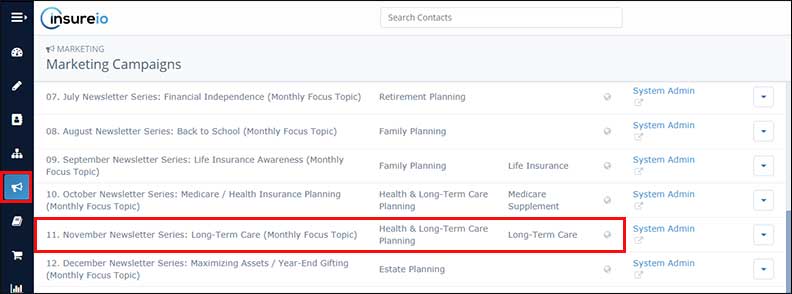

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click November Newsletter Series: Long-Term Care (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our November 2019 Sales Kit Now!