This is the fifth and final episode in the MDRT Agency Principal Series, recorded at NAILBA 34 for agency principals and advisors. In this series, industry leaders share their perspectives on the state of the industry, with tips and takeaways to help you thrive in the changing landscape.

Panelists:

- Moderator: James Douglas Pittman, CLU, CFP, MDRT Second Vice President

- Brian Winikoff – President and CEO, Crump Life Insurance Services

- Ben Nevejans – President, LifePro Financial Services Inc.

- Victoria “Tori” Van Dusen-Roos – Principal and Head of Operations, Diversified Brokerage Services Inc.

- Ryan Pinney – Vice President, Sales and Marketing, Pinney Insurance Services

- Gonzalo Garcia – Partner, AgencyONE LLC

Click the embedded podcast below to listen – or browse our show notes below.

Commoditization of Insurance Agents & Insurance Products

Here are a few take-away points panelists brought up:

- On the notion of advisors and commoditization – I think it’s the opposite right now. I don’t see commoditization in the industry. There’s more product out there than ever before and more differences in those products than ever before. The people selling them are providing holistic advice – that’s the direction the industry is going. Look back 2-3 decades when you had armies of people selling 1-2 products 1-2 ways, differentiating with their relationships and their personality. Now we have more products, but the challenge is understanding how to talk about those products in a solution-oriented way and providing value as a financial advisor in the process. If you rewind to 2004-2006, when a lot of business being written was replacement business with GUL, that was a fairly commodity-oriented product. Term life insurance is a commodity-oriented product, but most of the premium in the industry is not term insurance – it’s not GUL, either. Understanding where IUL fits in the spectrum of risk/reward is a value-add conversation to have, not a commodity-oriented conversation.

- Commoditization of service and products only happens if you let it. You have to demonstrate the enhanced value that these products and your services have by pointing out the differences in the products we have today, whether it’s product type or the tremendous riders we have available, and maybe even pointing out some of the flaws in these products.

- Where we see the commoditization happening is in the producer. Many BGAs and producers lead with the same type of conversation. In the BGA world, it’s "We have great commissions, superior underwriting, the best products, and excellent service." But if that’s what we’re leading with, there’s not a person sitting at this table that couldn’t say the exact same thing. So we commoditize ourselves by the way we describe what we do and what we offer. From the consumer’s perspective, what’s the difference between Agent A and Agent B, or even Carrier A and Carrier B? An analogy I like is that commodities aren’t necessarily a bad thing – think of soda in the checkout line. It's $1.70 for a 20-oz soda, but you could also walk back one aisle and get a 2-liter bottle for $0.99. The commodity is in the convenience. Commodity applies to convenience, need, and desire. Some consumers know what they want to buy and they go straight for it. But a lot of people don’t do that. They’re browsing and not sure what they want. We have consumers who shop in different ways. So how is the typical advisor differentiating themselves and explaining what they do?

How Do Agencies and Advisors Differentiate Themselves with a Value Proposition?

Here are a few take-away points panelists brought up:

- You need to convey your value proposition in a well-thought-out way and have everyone be on the same page in your organization. That’s as true for the person answering the phone as it is for the president. Everyone needs to be speaking the same language as far as what your value proposition is.

- We play in a lot of different markets and the value proposition in one line of business is different than another. There are two important points here, though. The first is to know what you’re good at. Understand what makes you different in whatever market you’re in. The second, and the most important, is to listen to your clients and see what they need, whether it’s an institution or an individual. Talk to them. Ask, “What are you looking for? What do you need?” Does their need match up with what you’re good at? If not, refer them out and disengage. If so, you can then explain why you’re a good fit. That’s how we look at it.

- You have to be willing to walk away from business if it’s not a good fit for your model. We want to be helping each other grow in that relationship.

- A lot of people in our industry are scared to walk away from business. What they don’t understand is that by taking everything, they’re actually fragmenting their own business model and making it more difficult for them to be successful. We don't always do that. Sometimes you get caught up in wanting to make the sale and it’s tough to walk away, but it’s important.

- You have to be able to deliver. If you look in the trade publications, we’ve all got ads in there. They promise the world, but those organizations that actually deliver are the ones retaining that business and those advisors. They can do business with whoever they want. If you’re not doing a good job for them, they figure it out pretty quickly.

- You have to be present. You have to stay engaged. Some of the people in this business get distracted, just like everyone else. These producers have lots of demands put on them by their clients, by the advisors that are referring clients to them. They need answers, support, and action.

- It's about saying please and thank you. Show up on time. Do what you say you’re going to do and finish what you started. It’s not that hard. You just have to build that kind of culture in your organization. It's not fun to invite producers to take their business somewhere else, but why do it every year?

- If you have trouble creating your value proposition, seek out help. We use consultants every day. You can learn so much about yourself, your organization, and how to be a better agent.

- Have a mastermind, mentor, or study group. Within the group, you can share information, technology, and insights. I do this with several of the people on this panel. We're friendly competitors – we compete, but not really. It’s a huge market, and the people who seem to be growing and prospering now are the ones who have a mindset that's open to collaboration. They want to mentor and be mentored. Put that into your unique value proposition. Our agency is part of a study group made up of a dozen agencies, leveraging each other’s techniques and tools because it helps us all be better.

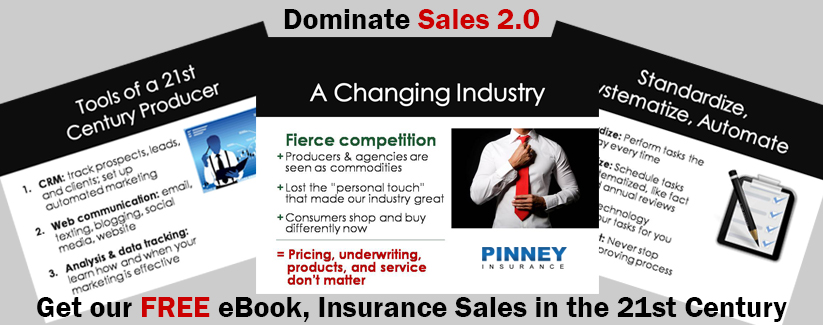

That’s the final episode in this series – we hope you learned a lot from our panelists! You can read more about our sales strategies in the eBook below, Insurance Sales in the 21st Century.