This is the third in the MDRT Agency Principal Series, recorded at NAILBA 34 for agency principals and advisors. In this series, industry leaders share their perspectives on the state of the industry, with tips and takeaways to help you thrive in the changing landscape.

Panelists:

- Moderator: James Douglas Pittman, CLU, CFP, MDRT Second Vice President

- Brian Winikoff – President and CEO, Crump Life Insurance Services

- Ben Nevejans – President, LifePro Financial Services Inc.

- Victoria “Tori” Van Dusen-Roos – Principal and Head of Operations, Diversified Brokerage Services Inc.

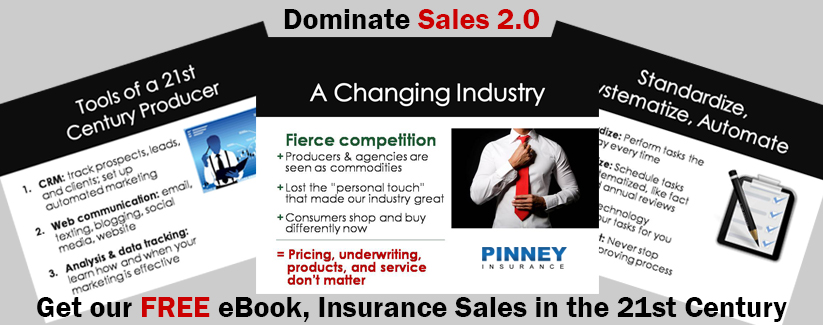

- Ryan Pinney – Vice President, Sales and Marketing, Pinney Insurance Services

- Gonzalo Garcia – Partner, AgencyONE LLC

Click the embedded podcast below to listen – or browse our show notes below.

Looking Forward: An International Perspective

Here are a few take-away points panelists brought up:

- In terms of the proposed DOL regulation we’re all paying close attention to, we need to look at how other countries have navigated through the same regulations. For example, Australia and the U.K. have both gone through this type of regulation and survived. Their careers look different, but we need to look at how they did it and attempt to be more prepared.

- Some people see the international element as a disadvantage. I look at it differently. Over the last 5-6 years, some of my best sales ideas have come from people outside the U.S. They can look at the same problem with a different perspective that we can then apply. Disability insurance is a great example. It’s a hard sell – who wants to think about being disabled? Call it income protection insurance, and suddenly you have people’s attention. There’s a tremendous amount of information that we can learn and there’s a big trend where the teacher often learns more than the student. We have the opportunity to be both the teacher and the student. I, for one, really enjoy the international element of our business.

Recruiting New Advisors & Agents: Challenges & Perspectives

Here are a few take-away points panelists brought up:

- When it comes to recruiting, we try to think like the advisor thinks. What challenges do they face? Is it their marketing? Many agents aren’t good at marketing. Many don’t embrace technology. We try to develop as many value propositions that meet those needs as we can. We’ll do the marketing for them. We’ll help them with tech – maybe manage their CRM. The advisors we work with are also entrepreneurs, and being an entrepreneur comes with a lot of challenges. Can we address those challenges and do a good job? If so, our retention is improved. We then have a personal partnership, not just a customer relationship.

- We’ve developed a strategy that works well, which is going after national accounts. We recruit thousands of producers at a time instead of one by one. We take a look at those agents and those segments we recruited. Once we find out what their needs and wants are, we deploy our relationship managers in the field to meet with them face-to-face. We ask questions like, what’s preventing them from closing sales? Then we help develop these agents. It’s a big investment, but we’re continuing to dive deeper into these relationships and foster them and make them more profitable for the producers.

- We have no interest in being really big. Instead, we focus on referrals. The agents we have, these folks are entrepreneurs – they just happen to be in the insurance and financial services industry. They want networks that will share ideas with them and run businesses or find other ways to leverage available tools and technology. We try to help them do that with meaningful service levels. We’ve lost the art of asking for referrals in this business.

We’ll bring you more from this podcast series as episodes are released. Stay tuned!