This is the second in the MDRT Agency Principal Series, recorded at NAILBA 34 for agency principals and advisors. In this series, industry leaders share their perspectives on the state of the industry, with tips and takeaways to help you thrive in the changing landscape.

Panelists:

- Moderator: James Douglas Pittman, CLU, CFP, MDRT Second Vice President

- Brian Winikoff – President and CEO, Crump Life Insurance Services

- Ben Nevejans – President, LifePro Financial Services Inc.

- Victoria “Tori” Van Dusen-Roos – Principal and Head of Operations, Diversified Brokerage Services Inc.

- Ryan Pinney – Vice President, Sales and Marketing, Pinney Insurance Services

- Gonzalo Garcia – Partner, AgencyONE LLC

Click the embedded podcast below to listen – or browse our show notes below.

Trends Affecting Agent Productivity

Here are a few take-away points panelists brought up:

- One issue affecting productivity is a lack of training. It’s interesting because I don’t think our products are all that complicated. I think we make them more complicated than they need to be due to compliance and our terminology. Consumers’ eyes glaze over because they don’t understand what we’re saying. The soft skills that were available 20-30 years ago in our industry have been lost. We’re trying to replace them with technology, which is good, but you still need somebody with good soft skills at the point of purchase, someone who can make that connection. In every direct marketing instance, we still talk to the consumer – this is still the most effective way to do it, and it all comes down to training. It’s harder and harder to find a qualified sales force. We’re dealing with the contraction of our market space. There are fewer advisors in the traditional distribution modules. We see more and more advisors being part-time, or working in banks, credit unions, and wirehouses. As agencies and principals of agencies, we need to come up with a plan to train and grow an agent field force. Even if that force isn’t out in the field, making traditional face-to-face visits. We still need the same soft skills and presentation abilities in a call center, for example.

- We need to do better at leveraging resources from carriers and third-party institutions that provide training and development, either via webinars or in-person training for advisors or networks of advisors. Those resources are available. Our first inclination is to build a network like this ourselves, but then we face questions like, how do we do it? The more you explore, the more you’ll find there are more than enough 3rd parties who provide this kind of training. Spend time walking through the vendor hall. New entrants with lots of interesting ideas that could be helpful for your business – should be aware of at least. Try to stay ahead of the curve.

The Need for Process

Here are a few take-away points panelists brought up:

- Producers have so much coming at them all the time. Salespeople by nature I think are a little distractable. Fundamentally, they aren’t trained to drive sales in a systematic way. The art of prospecting and cold-calling like previous generations have done has been lost. Instead, it’s easy to grab a cell phone or iPad and get distracted. There’s really a need to focus.

- There are 2-3 different types of advisors: (1) really good marketers, (2) good closers who can make the sale and explain the need, and (3) a hybrid – there are fewer of these now, who know how to market and sell. Most producers seem to fall into the latter category – they’re salespeople, not marketers. How do you help a person who doesn’t know how to market or prospect? Cold-calling often isn’t even possible anymore, with the Do Not Call List. How do you help an advisor who wants to grow their business in this environment? One way is finding a classic BGA with scale – having a certain scale allows you to do things like create a lead-gen program for advisors. Consistently, what do advisors want? Leads. It’s their #1 request by a margin of 2-to-1. 75% to 80% say they want more leads. But how many of us are good at generating leads? Many BGAs aren’t good at it or equipped to do it. Someone is going to come in and fill that gap.

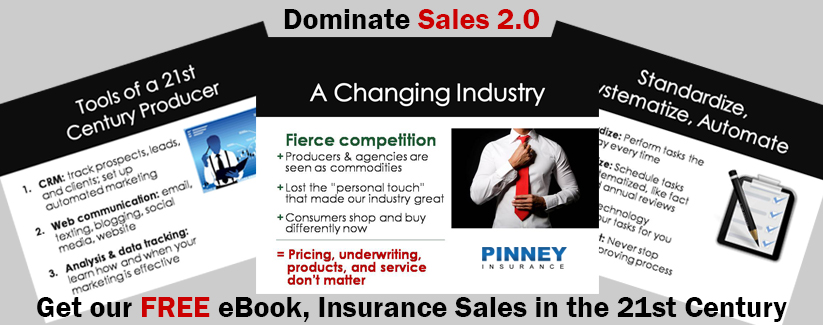

- Most successful producers have a process. They know what they’re good at. They have a prospecting process, one for processing business, one for growing relationships. The old process involved aligning with a big carrier who would give you a territory, and then you’d make outbound calls and meet with people. If you worked hard and stuck with it, you could be successful. But that model doesn’t work anymore. You can’t get in as many doors; the tickets are smaller. You need a different process, but there isn’t a great roadmap for that. Companies haven’t pivoted and provided new training programs. It’s up to advisors to figure out what works for them to leverage help from the BGAs and other organizations. As an agent, you have to figure that out and get good at it.

- Advisors today can choose to be a transactional advisor servicing a temporary need with term insurance. They might be sitting down with an iPad platform that can take them from start to finish, reading a script that helps them take a client through a story that ends with a product selection that’s suitable for that client. It can work if they’re willing to embrace it and learn.

The Future of the Industry

Here are a few take-away points panelists brought up:

- This is a noble profession for a million reasons. But today’s college graduates don’t say, “I want to sell insurance.” Texas Tech, for example, has a great program for both undergrad and Master’s degrees, for people who will get into our business. We need to do more of that. If we keep aging and no one else comes behind us, who’s left? We need to focus on where we’re going to get the talent.

- I think it starts with our carriers. They need to forge the way to change, especially in how we talk about life insurance. Just look at the difference in vocabulary between how consumers talk and how we talk. Take “death benefit” – the consumer is thinking, “How morbid – you’re going to benefit me when I die?” We need to change the vernacular of our industry. It’s not easy, but the people who are manufacturing our products need to help.

We’ll bring you more from this podcast series as episodes are released. Stay tuned!