Our March 2024 sales kit will help you talk about the ways life insurance can create a more financially secure retirement.

Retirement planning can be scary - it involves thinking about things like longevity, taxes, stock market volatility...and then finding ways to deal with all these things. If a client has been avoiding these topics, you can help them think through the possibilities and create a plan that de-mystifies the financial future. Emphasize the feeling of being in control, because that's the emotional benefit of taking on a project like retirement planning. Ask: Would you like to feel confident, having a plan you'll create with a trustworthy partner who can show you the best options to overcome those obstacles you fear?

What’s in the Kit

Our free 84-page kit includes:

- 3 pages of social media posts & images

- 4-page sales idea on the value of tax-free income in retirement

- 2-page sales idea on life insurance as supplementary retirement income

- 4-page producer guide to help answer common client questions

- 12-page client guide on adding flexibility to a retirement portfolio with whole life insurance

- 2-page flyer on bridging the Social Security income gap

- 1-page flyer with important links and concepts for people in or nearing retirement

- 1-page flyer with important links and concepts for pre-retirement clients

- 16-page client guide on taming a bear market in retirement

- 2-page client flyer on bear markets in retirement

- 4-page client sample illustration to show how accessing cash value can help your portfolio recover during a market dip

- 6-page guide to retirement risks & how life insurance can help

- 2-page client flyer on how to handle inflation in retirement planning

- 2-page client flyer on the importance of tax planning for retirement

- 6-page market volatility case study

- 3-page case study on retirement planning (15 years out from retirement)

- 12-page client guide on keeping your retirement plan on track

How to Use This Month’s Sales Kit

To prospect using this month's kit, use the included social media images & text. Supplement those with your own experiences regarding retirement planning. How did you feel before you started? What gave you the impetus to start? How did you feel once you had a plan and started working toward your goal? You're not just the trusted advisor in this situation. You're someone who has probably felt a lot of the same emotions as your clients & prospects. If you got through it, so can they.

You can use the sample questions, facts, and stats in the kit with prospects and existing clients. Here are just a few examples:

- Ask questions about taxes: How long can current tax rates hold up in the ongoing economic uncertainty? Are tax rates likely to be affected by things like an aging population, the increasing national deficit, and increasing obligations on programs like Social Security and Medicare?

- Ask questions about market volatility: What do you think will happen to the value of your 401(k) or IRA if you need to retire during a market downturn? Do you have an alternate source of retirement income that is not directly impacted by changes in the financial markets?

- Ask questions about your client's budget for retirement: Did you know that the average monthly Social Security payment is $1,520 per month...but average monthly expenses for people 65 and older is $3,965? Did you know that your anticipated buying power isn't going to be what you expect, thanks to inflation? Did you know a whole life policy can provide supplemental retirement income in the form of tax-advantaged withdrawals and tax-favored policy loans?

Remember: If you need illustrations or case design help as you start working with a prospect, don't forget - we're just an email or a phone call away!

Get the KitNeed help with quotes, illustrations, or selecting the right product?

Our Brokerage Managers - Dave and David - can help. They have incredible depth and breadth in terms of product knowledge. Call 800-823-4852 and ask for a brokerage manager, or click the button below to email us!

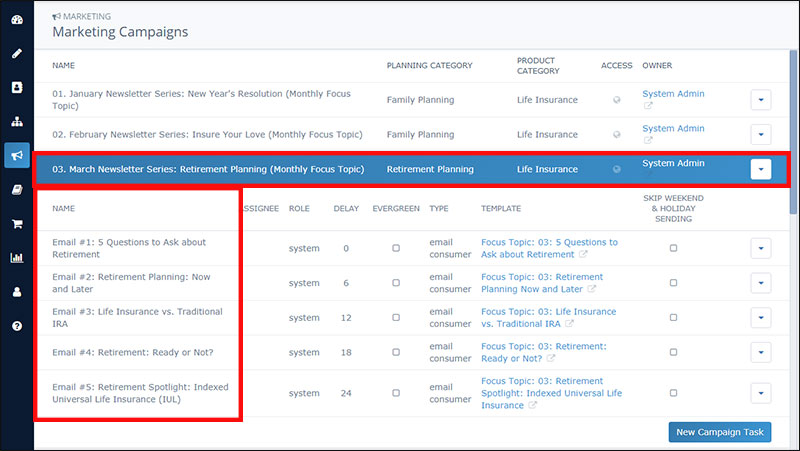

Insureio Subscribers: Use Our March Marketing Campaign

Are you an Insureio subscriber? If so, you have access to a pre-written marketing campaign for the month of March. It includes five emails for your prospects, pre-scheduled for delivery throughout the month. These emails focus on general topics in retirement planning, including the differences between cash value life insurance and traditional retirement vehicles, like an IRA or 401(k). As always, these informational emails don't mention individual carriers or their products by name. They're designed to educate your clients first, so they understand the concepts you'll be talking about when it comes time for a meeting or sales call.

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click March Newsletter Series: Retirement Planning (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our March 2024 Sales Kit Now!