This July, we're talking about independence - financial independence, that is.

Financial independence is the ultimate goal for many of our clients. That's why we're focused on permanent life insurance this month. It's an often-overlooked tool that can meet short- and long-term financial needs, especially during retirement. Best of all, the money your clients invest into their policy is still available to them in a number of ways: as an income tax-free death benefit, through cash surrender value, via a loan or withdrawal, as well as through accelerated/living benefits. By focusing on its versatility, you can show clients how valuable cash value life insurance can be.

What’s in the Kit

In this month's kit, we have 40 pages of resources to help you reach out to clients and prospects. You can also use the facts, stats, and selling points found throughout the kit on social media.

Our FREE 40-page kit includes:

- 4-page producer guide on using life insurance as "smart money"

- 7-page producer guide on supplementing retirement income with life insurance

- 6-page producer guide on protecting your clients' assets in retirement

- 2-page sales idea on using IUL in combination with term life

- 1-page sales idea on the flexibility of guaranteed universal life

- 4-page consumer guide on the financial benefits of permanent life insurance

- 5-page consumer guide on supplementing retirement income with life insurance

- 3-page consumer guide on the value of permanent life insurance

- 2-page consumer guide on the benefits of a tax-deferred annuity

How to Use This Month’s Sales Kit

The first five pieces in the kit are all producer guides and sales ideas for you. These guides cover a variety of topics, from accumulation to protection. Browse them to see if you're overlooking any selling points when you talk to prospects about permanent life insurance. These guides are also great places to go for inspiration if you're creating your own marketing pieces.

The remaining pieces in the kit are intended for clients. If you're new to selling permanent life insurance, let these pieces give you a nothing-but-the-basics picture of a permanent policy's selling points. If you're already well-versed in cash value life insurance's sales features, pull stats, facts, and quotes from these guides to use in conversation with clients or on social media. Need help with an illustration or product? We're just an email or phone call away. Our brokerage directors are happy to help with case design if needed.

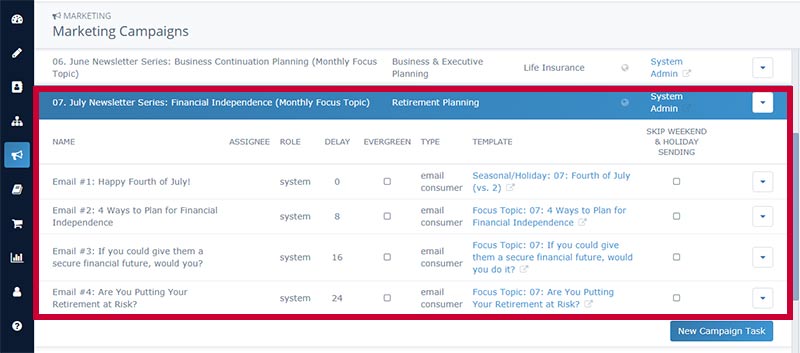

Insureio Subscribers: Use Our Financial Independence Email Campaign

Are you an Insureio subscriber? If so, you can access July's pre-built email marketing campaign. It includes four emails that will be automatically delivered throughout the month. The emails introduce concepts that help clients achieve financial independence, from permanent life insurance and its useful cash value to the long-term security of an annuity. Each page links to corresponding content on your Insurance Division site, so your prospect can learn more at their own pace. Each Insurance Division page has a quoter and your contact info, so when they're ready to take the next step, they'll have multiple ways to do so.

To preview the campaign:

- Click Marketing and then Marketing Campaigns from your left-hand navigation menu in Insureio.

- Scroll down and click July Newsletter Series: Financial Independence (Monthly Focus Topic). You'll see the list of four pre-scheduled emails. Click any title to preview the template in a new browser tab.

Want to learn more about Insureio marketing campaigns, including how to enroll your clients and prospects? Click here for a complete tutorial in the Insureio Academy.

Download Our July 2019 Sales Kit Now!