This July, we’re focused on helping your clients create financial independence. How can we give them options that create supplemental retirement income and guard against inflation and future health care costs?

From riders that offer LTC benefits to permanent policies that offer cash value as supplemental retirement income, life insurance can help families prepare for the future. Our sales kit can help you find new ways to demonstrate the value of these products to your clients, especially those nearing retirement.

What’s in the Kit

Our FREE 52-page kit includes:

- 2-page LIRP sales strategy

- 10 pages of ideal client profiles & worksheets

- 6-page retirement income fact finder

- 12-page client brochure on rethinking retirement income

- 20-page producer guide on building stronger relationships with female clients

How to Use This Month’s Sales Kit

Step 1: Download & Browse the Kit

This month's kit contains several ways to evaluate your current book of business to find the right clients to approach. It has ideal client profiles and three sets of worksheets that will help you identify the needs of wealthy families, high earners, and families who need basic protection. At the end of the kit, there's also a 16-page guide and 4-page worksheet on building stronger relationships with female clients, particularly those who are interested in investing and financial planning. That worksheet will help guide the conversation once you approach your ideal clients.

Step 2: Create Your Approach

Once you've identified clients who are good candidates for a conversation about using permanent life insurance to create financial independence, decide how you want to approach them. You could call, send an email, or even send a brochure through the mail. If you call, your sales script could be as simple as, “Hi (client name), I was reviewing your file and had a few ideas on ways to help create more retirement income for you. I've helped a few other clients who were worried about things like outliving their retirement income or paying for long-term care, and I'm just wondering if you share their concerns. If so, I’m happy to explain how I helped them and what kind of options might offer your family the same protection. Do you have a few minutes to talk or Skype this week?”

Step 3: Present the Right Solutions

If you're able to set up quick meetings with a few clients, it's time to prepare your materials. You've already worked with these clients, so you have a baseline idea of their financial situation. This meeting is a good chance to ask if anything has changed since you last spoke - financial commitments, job changes, family or life changes, etc. The fact-finders in this month's sales kit will help guide this part of the conversation. Once you know more about what their goals are and how they're planning to reach them, you can use the sales ideas in the kit to present solutions like an annuity, or a new permanent policy with riders for LTC and/or critical illness.

Not sure which solutions are right for a client? We're happy to help – call us and ask to speak to a brokerage manager!

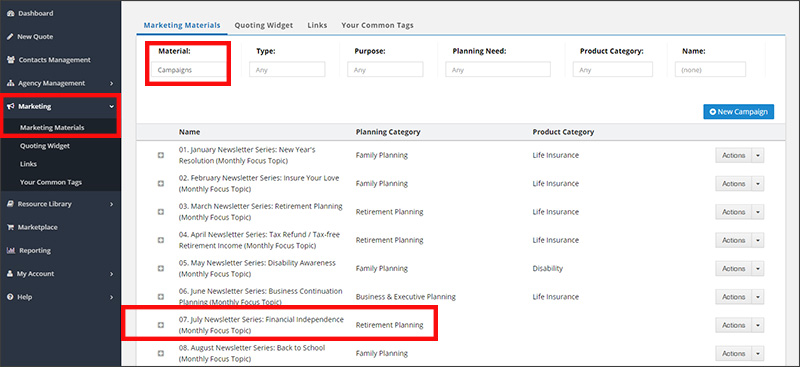

Get the KitInsureio Subscribers: Use Our Financial Independence Marketing Campaign

If you're an Insureio subscriber at the Standard or Professional level, you can also use our pre-written Financial Independence marketing campaign. The campaign includes a series of educational emails pre-scheduled for delivery throughout the month. The emails cover "big picture" topics like longevity planning, the value of permanent life insurance, and the importance of financial planning for women.

To preview the campaign:

- Click Marketing and then Marketing Materials from your left-hand navigation menu in Insureio.

- Select Campaigns from the Material dropdown menu on the top left.

- Click July Newsletter Series: Financial Independence (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To preview a template, click any of the blue links under Template. The email template will open up in a new browser tab.

Want to learn more about Insureio campaigns and how to enroll your clients? Click here to visit the Insureio Academy.

Help Your Clients Create Financial Independence with Life Insurance & Annuities