Our January 2024 sales kit will help you talk to clients about life insurance as an asset class, with benefits for themselves during retirement as well as their beneficiaries.

This month's kit contains sales ideas & conversation tips for talking to clients about cash value life insurance. In addition to explaining cash value's benefits, you'll face familiar objections from prospects relative to the cost, the complexity, and their need (or lack thereof). Both the client and consumer pieces in this kit will help you show clients the value and utility of cash value coverage for themselves as well as their beneficiaries.

What’s in the Kit

Our free 67-page kit includes:

- 4 pages of social media posts & images

- 18-page white paper on selling permanent life insurance

- 4-page agent guide on communicating the value of life insurance

- 2-page sales idea: creating a sense of urgency

- 1-page agent guide to having better conversations

- 3-page sales idea: living benefits

- 4-page article on the "rule of 7" in marketing & prospecting

- 4-page article on whole life vs. IUL and the risk/reward trade-off

- 7-page consumer guide to permanent life insurance

- 4-page client guide on the benefits of permanent life insurance

- 3-page client article: is permanent life insurance right for them?

- 8-page client guide to life insurance as an asset

- 3-page client flyer on tax benefits of cash value life insurance

How to Use This Month’s Sales Kit

Use the facts and stats in the kit to get a client or prospect's attention. The social media posts are a great start but you can also use this information in your email newsletter, client meetings, or any other way you communicate with clients. From the words to use in that conversation to methods that create a sense of urgency, the kit has tips for every part of the marketing and sales process. If you need illustrations or case design help, don't forget - we're just an email or a phone call away.

Get the KitNeed help with quotes, illustrations, or selecting the right product?

Our Brokerage Managers - Dave and David - can help. They have incredible depth and breadth in terms of product knowledge. Call 800-823-4852 and ask for a brokerage manager, or click the button below to email us!

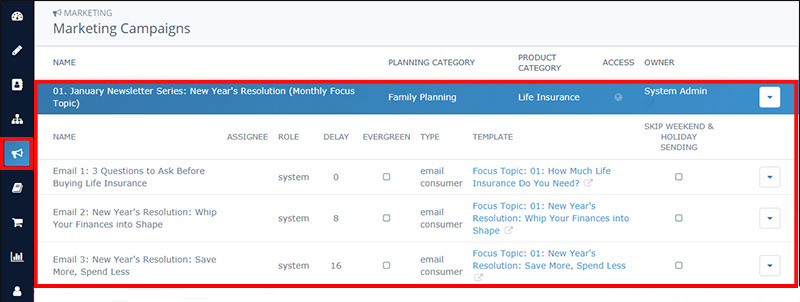

Insureio Subscribers: Use Our January Marketing Campaign

Are you an Insureio subscriber? If so, you have access to a pre-written marketing campaign for the month of January. It includes three emails for your clients and prospects, pre-scheduled for delivery throughout the month. These emails focus on general life insurance awareness, especially as it pertains to New Year's resolutions. The last two emails talk specifically about common resolutions, including saving more and spending less in 2024. As always, there's no discussion of a specific product. These are educational emails designed to raise awareness, not sell a particular carrier or product.

PRO TIP: You can also choose to use any of our one-off emails about financial New Year's resolutions written for age groups by decade. Use Insureio's reporting feature to select clients by age, and send them the appropriate email (for clients in their 20s, 30s, 40s, 50s, 60s, and 70s).

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click January Newsletter Series: New Year's Resolution (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our January 2024 Sales Kit Now!