Our January 2020 sales kit hits a great topic for addressing New Year's resolutions: life insurance as an asset class.

Did your clients resolve to do better at saving for retirement? If so, do they also realize life insurance is an asset that can help? If not, this is the time to show them how cash value life insurance can supplement their retirement as well as provide valuable living benefits.

If you have clients who need coverage, want to save more than their yearly max for a 401(k), and also want to access cash penalty-free before age 59½, this may be a good strategy. Cash value life insurance can give them a way to sock away extra cash once they've maxed out their 401(k) or IRA contributions. After the first 7-10 years, they can take a loan to buy a business or a vacation home. Or they can keep accumulating until early retirement and then begin taking distributions. That strategy works especially well if their need for life insurance decreases as kids leave home and the mortgage is paid off.

What’s in the Kit

Our FREE 61-page kit includes:

- 15-page agent marketing brochure

- 4-page agent guide

- 1-page fact finder

- 3-page case study

- 12-page discussion guide

- 1-page worksheet

- 8-page consumer guide to leaving a financial legacy

- 3-page sales idea

- 8-page consumer guide on the little-known benefits of life insurance

- 2-page consumer flyer

- 2-page consumer infographic

How to Use This Month’s Sales Kit

Use the producer guides to refresh your memory about the specific benefits of life insurance as an asset class: extra cash prior to retirement, supplemental retirement funds, and living benefits. Then, look at the included 12-page client discussion guide to get a feel for how a conversation about this advanced financial strategy would go.

Next, prospect within your book of business. Do you have clients with a term policy whose income level suggests they may benefit from converting to a cash value policy? Do you have clients with a whole life policy who could be benefiting from the market-based gains of an IUL policy? Plan on educating them over time about the benefits of life insurance as an asset class. That education could happen during meetings, video calls, or through a drip email campaign - it's up to you.

Get the KitInsureio Subscribers: Use Our New Year's Email Marketing Campaign

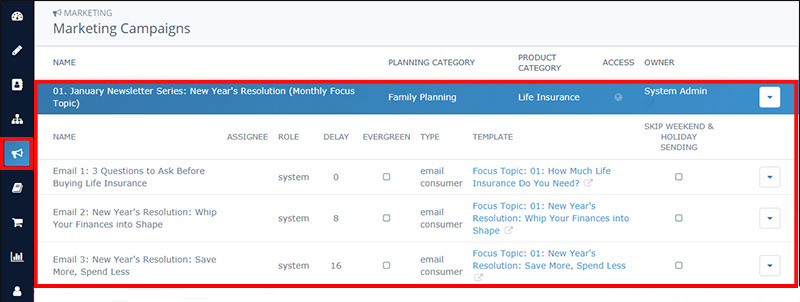

Are you an Insureio subscriber? If so, you have access to a pre-written marketing campaign for January. It includes three emails for your clients and prospects, pre-scheduled for delivery throughout the month.

These three emails focus on general life insurance awareness, especially as it pertains to New Year's resolutions. The last two emails talk specifically about common resolutions, including becoming more financially savvy and saving more/spending less in the new year.

PRO TIP: Don't want to use the entire campaign? No problem. There are one-off emails about financial New Year's resolutions written for age groups by decade: for clients in their 20s, 30s 40s, 50s, 60s, and 70s.

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click January Newsletter Series: New Year's Resolution (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our January 2020 Sales Kit Now!