What happens when Customer 2.0 meets Sales 2.0? How can we shorten the sales cycle and adapt to the way our customers want to do business?

Ryan Pinney recently sat down with David Saltzman of The Shift Shapers podcast to talk about technology and the disruptive shifts that have happened — and need to happen — in the insurance industry.

Playing Catch-Up with Technology

It's no secret that the insurance industry is behind the 8-ball when it comes to technology. It's easy to find segments in other industries where people have fallen behind. But in our industry, it's not just one segment that's lagging. The entire industry has fallen behind. No one has stepped up to lead the pack, creating a technology gap big enough to eliminate the competition. We've already seen what this process looks like in the music industry. Few people buy music face-to-face anymore. It's usually a digital transaction carried out on iTunes or Amazon. Someone will figure out how to disrupt the insurance industry on this level. It's just a matter of time.

How far behind is the insurance industry? About a decade behind, according to Ryan. Every iteration of technology that passes us by makes it more costly and time-consuming to catch up. It's a compounding problem that, at some point, becomes too exponentially expensive to solve. We're not quite there yet, but Ryan provided the cautionary example of Allstate. In 2003/2004, they made a decision not to get into the internet marketing space. At the time, they believed it wasn't going to be lucrative enough to justify the expense. Fast-forward a decade, and we see them buying another company (Esurance) and spending over a billion dollars to catch up.

The Growth in Online Sales

No one can afford to ignore the online marketplace anymore. Host David Saltzman brought up a very interesting point about life insurance sales in China. Over the past couple years, there's been a vast increase in the number of sales made or initiated online. But how does this trend compare in the US?

Ryan offered a few stats published by LIMRA to help illustrate the trend. Back in 2002, LIMRA's internet marketing survey showed that about 2% of all life insurance sales were made through the internet. More recent numbers indicate that more than 30% of all life insurance sales are made through the internet—and this number is probably even higher, due to reporting methods. This number only includes new business reported by either the insurance company or distribution channel as having taken place on the internet. Sales originated online but closed in person, for example, would probably lift this figure into the the 50-60% range.

Future-Proofing the Insurance Industry

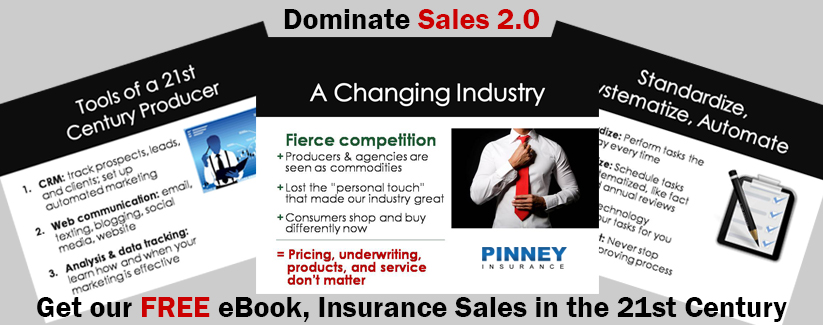

Moving forward, our industry will need to embrace and compete in the brave new world of online sales. It's important for individual agents and brokerage agencies, but it's also key to our industry's survival at large. On the micro side of things, Ryan offers his 3 must-haves for agents who want to compete:

- A tool that simplifies the application process.

- A tool that keeps track of your data.

- A tool that offers drip marketing capabilities.

On the macro scale, Ryan thinks we'll have to hold off potential industry disrupters like Costco, Google, or Facebook. We can't compete with them in terms of technology and dollar-for-dollar spending ability. Our only choice? Get better at the game before they even get into it. Now is the time to future-proof the insurance industry by bringing education and sales tools to the online arena—where our customers already live their lives.

Click here to listen to the podcast for these tidbits we didn't cover here:

- Consumer sentiment analysis: How many of your customers want to do business face-to-face versus online? The numbers might surprise you.

- Tool tips: Ryan tells you what to look for in the three must-have tools listed above.

- Marketing inspiration: How drip marketing can help you close sales with 84% of your non-buying customers (and why).