In October, we brought you the story of Goose and Maverick – two agents working as a team to close $100,000 in life insurance sales in a single month. Well, just like the movie Top Gun, we’ve got one agent flying solo now...and shooting for a brand-new record. Here’s how Seth Gray reinvented the “Danger Zone.”

Seth Gray - “Goose”

Background: Prior sales experience, including 5 years with a major bank

Insurance experience: Transitioned to life insurance sales from LTC

Tools

- Insureio

- Application fulfillment partners - Pinney Insurance's A-Team

Insureio is an insurance-specific CRM offering lead, policy, and contact management. For busy agents who need to maximize their time, Insureio offers time-saving features like click-to-call (a big office favorite here) and a dashboard display highlighting daily tasks and opportunities. As Seth says, “It’s a user-friendly system. Everything is easy to use and easy to find.”

Lead Sources, Procedure, Common Objections

Seth’s routine hasn’t changed much since our first post – in other words, if you’ve got a system that works, stick with it! That post has all the details about Seth’s lead sources, procedure, and tips for overcoming common objections.

Results

Seth joined Pinney Insurance in April of 2016. He was licensed in June.

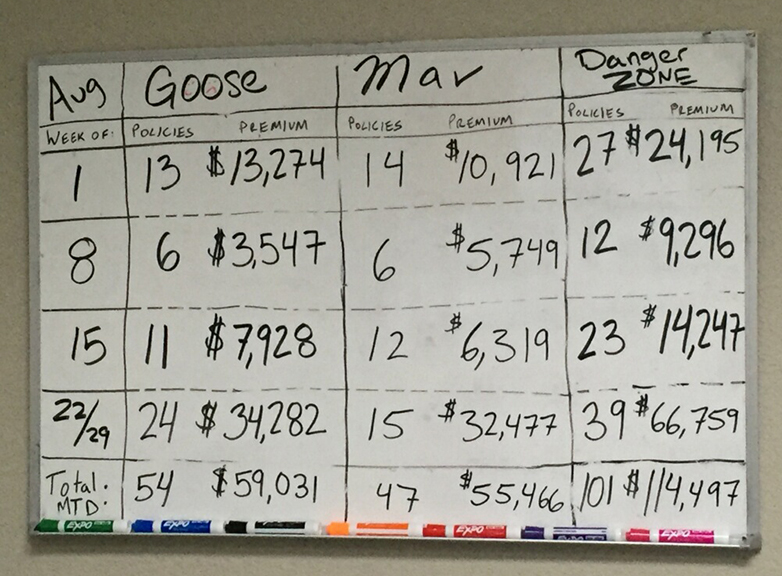

In August, he and Amanda closed $100,000 in life insurance sales in a single month. To achieve that goal, he personally closed $59,031 in premium that month.

- Applications submitted: 101 (54 from Goose)

- Total premium: $114,497 ($59,031 from Goose)

In October, he started with the same goal: at least $50,000 in premium.

He blew that away by week 3.

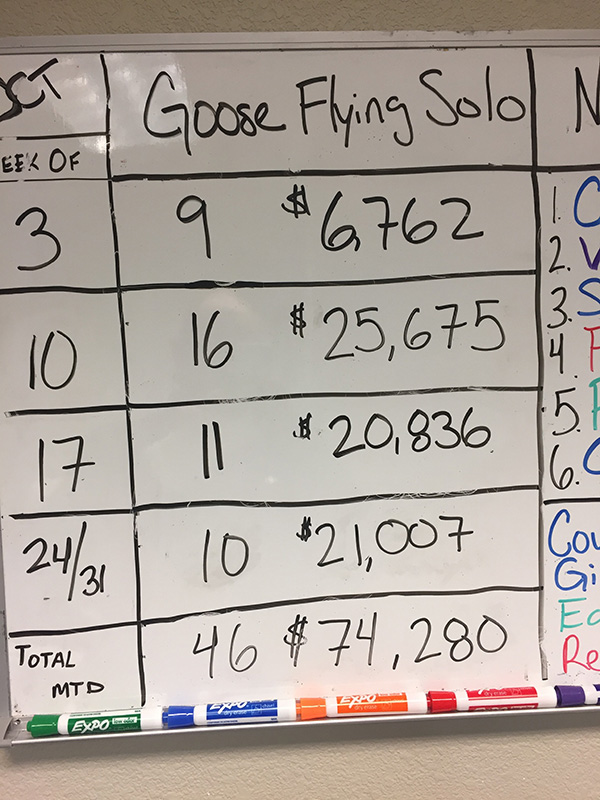

In the end, Seth closed the month with $74,280 in premium.

- Applications submitted: 46

- Total premium: $74,280

Compare those numbers to the previous month. He sold 15% fewer policies than in October, but he booked 26% more premium. Way to go, Goose!

In the next part of the post, we’ll look at how Seth transitioned from working in a team to working alone. We'll also dig deeper into the mindset needed to set your new personal best in sales.

Setting Records while Flying Solo

For Seth, there’s no difference in the mindset required to set records as part of a team versus setting them alone. You use the same skills and have the same motivation – and those things won’t change because they’re internal, not external.

“I thought of it more as a competition - I always wanted to be number one. I still want to be the number one agent.”

So what’s the main difference in his routine now? He’s not sharing an office. If you’re on the phone for 6 hours a day, you know what a big change this is.

Previously, he and Amanda had to pay attention to each other’s schedule. If Amanda was about to dive into a call, Seth would catch up on email. Now, he doesn’t have to worry about putting the phone down for 30 minutes. It’s added a bit of productivity to his day – and it shows.

The Daily Routine

On average, Seth spends 75% - 80% of his time on the phone. If he reaches 5-6 clients per day, that adds up to 6-7 hours of phone time per day. On a day where he doesn’t get a hold of many people, that might dip to 50%.

Take some down time. It’s hard when you’re on the phone for that long. You just need a few minutes to zone out.

When you’re spending that long on the phone, it’s natural for focus to waver as the day goes on. Seth’s advice? “Take some down time. It’s hard when you’re on the phone for that long. You just need a few minutes to zone out.”

If you’re struggling to stay focused toward the end of the day, start planning scheduled breaks. Get up and take a walk, grab a beverage, or just zone out by watching a quick YouTube video. Use an analog or digital timer if you need a concrete reminder to get back to work.

So what’s a top seller doing when he’s not on the phone? He’s running quotes, checking email for missing info sent in by clients, answering questions, and sending apps to the rare client who wants to see it before filling it out.

Setting Goals

“My goal is always $50K, every month. If you do $50K, you’re solid. More than that is gravy.”

You might be surprised to learn that the $70,000 mark wasn’t Seth’s original goal.

He starts every month with a goal of $50,000 and notches his goal upward if he hits the mark early.

In October, the goal took shape as his sales climbed steadily upward. When he met his $50K goal, he created a stretch goal of $60K. But as he began closing in on $60K two-thirds of the way through the month, it looked like that goal would need to be re-set, too—and it did.

He blew by $60K during the last week of the month, and set an ambitious stretch goal of $75K.

Set a new goal so you have a reason to keep pushing.

Raising your sales goal is a great way to stay challenged. If you meet your goal in two weeks, what’s motivating you for the rest of the month? Set a new goal so you have a reason to keep pushing. Even if it’s a small goal that you’re likely to reach (an additional $5K, for example), reaching two goals can boost your confidence and give you valuable data when it comes time to set your next big goal. You’ll get a strong sense for how much you can achieve, and how much you should push yourself.

As for Seth, he ended the month of October just shy of $75,000, by about $800. Considering how close he came, we wouldn’t be surprised to see this goal checked off very soon.

Making the Sale

We’ve covered Seth’s routine and how to set goals. Now, let’s take a look at how he approaches each sale, from initial contact to follow-up.

Pre-Call Research

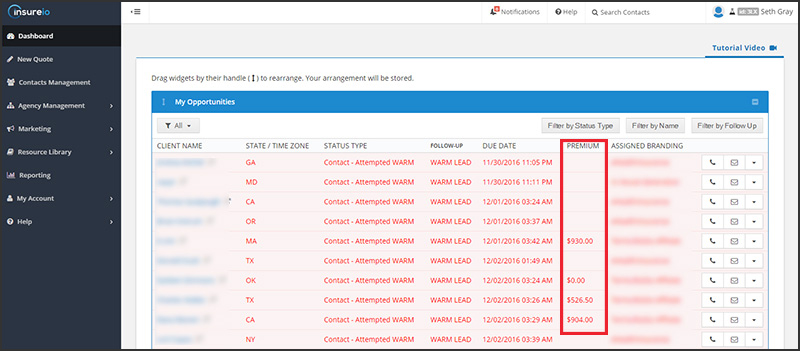

Seth’s leads are posted straight to our CRM, Insureio. As we described in the previous post, all he has to do is log in to view the new leads available on the dashboard.

The dashboard provides information including the client name, state/time zone, status and brand associated with that client, and the premium associated with that client (if known).

“I can tell where a lead is coming from in Insureio. Based on that lead source, I have a good idea what the client is looking for.”

Here’s what Seth’s dashboard looks like, with the at-a-glance premium column marked in red:

There are three things Seth looks at before picking up the phone:

- Is the policy for a small face value? If so, the client likely needs a simplified issue or final expense policy. It's also possible they simply can’t afford a larger policy.

- Did the lead come from our high-risk affiliate? If so, there will probably be some hurdles to jump through with the client’s health. Insureio’s integrated XRAE-powered health screening tool makes this easier.

- What information posted to Insureio with the client’s request for a quote? Depending on the lead source, he’ll have different levels of information available before making a call. While some leads come in with a lot of client data, some come in with virtually nothing. In these cases, he might only see a name, phone number, and state – but even these details are often inaccurate. This happens when the default setting in the lead source’s quoter or lead capture form is pre-set to a particular birth year, gender, or state. Clients requesting quotes don’t always modify this information.

PRO TIP: Use the Insureio quoting widget on your website(s) and landing page(s) to avoid this problem. It doesn’t set default data entries in order to improve lead quality.

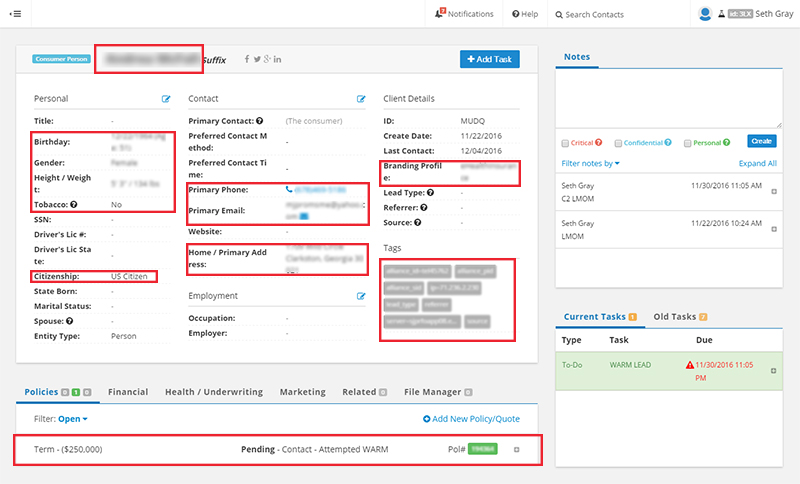

Here’s an example of what Seth sees when a lead posts with good information.

He’ll get a name, contact info, DOB, gender, height/weight, the face amount quoted, and the branding profile the lead has posted to, all marked in red below:

Now that he has a snapshot of the client’s details, it’s time to call.

Making the Call

On average, Seth spends 15-20 minutes on the phone with a client. If the client has a lot of questions, the call time could be pushed to 30 minutes. That’s about how long it takes to walk a client through the fact-finder in Insureio, including the health and lifestyle questions. The more time Seth spends with a client, the more they're invested. About 75% of the clients he takes through the fact-finding process end up submitting an application.

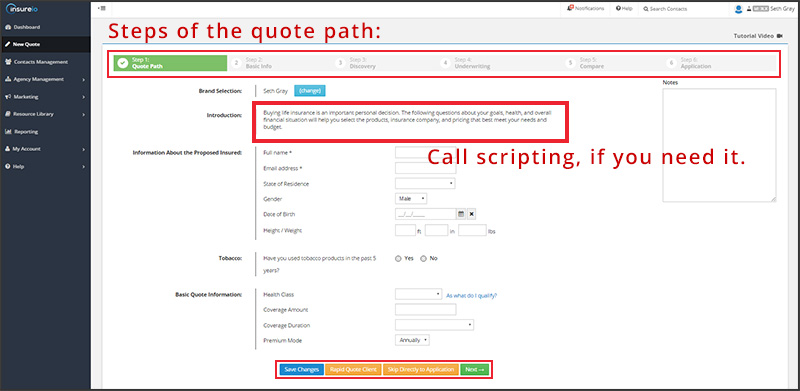

The quote path in Insureio is laid out in a way that’s easy to navigate, with call scripting in place if you need it.

Here’s what that looks like in the system:

We covered Seth and Amanda’s on-call strategies in October’s post.

Need a recap? Click here to review their strategies for:

- Figuring out how much coverage a client needs

- Common objections & how to deal with them

Follow-Up

Seth has a great routine for making follow-up calls to ensure no cases fall through the cracks.

“Typically, I call all the people I quoted but didn’t submit an app for on Friday of that week. If they’re serious about buying, I usually get a hold of them or they call me right back. If I don’t get a hold of them, I’ll try and set a time next week to talk to them. On those Friday calls, about 50% of them will submit an app.”

The great thing about this strategy? Not only does it provide structure for the week, but it’s also a great way to finish strong in term of your sales goal. Over time, you’ll develop a sense for how many of these calls are likely to end with a completed application. It can help push you over the top if you’re close to your goal!

Not all follow-ups end in a sale, though. What happens then? If it’s a big case, Seth will follow up 10-15 times before closing the client’s file. If it’s a smaller case, he’ll call several times before closing their file.

Letting Technology Do the Work

One of the benefits of using a CRM with automated marketing capabilities is the ability to let the system work leads you’d be otherwise unable to reach.

Here are two great examples.

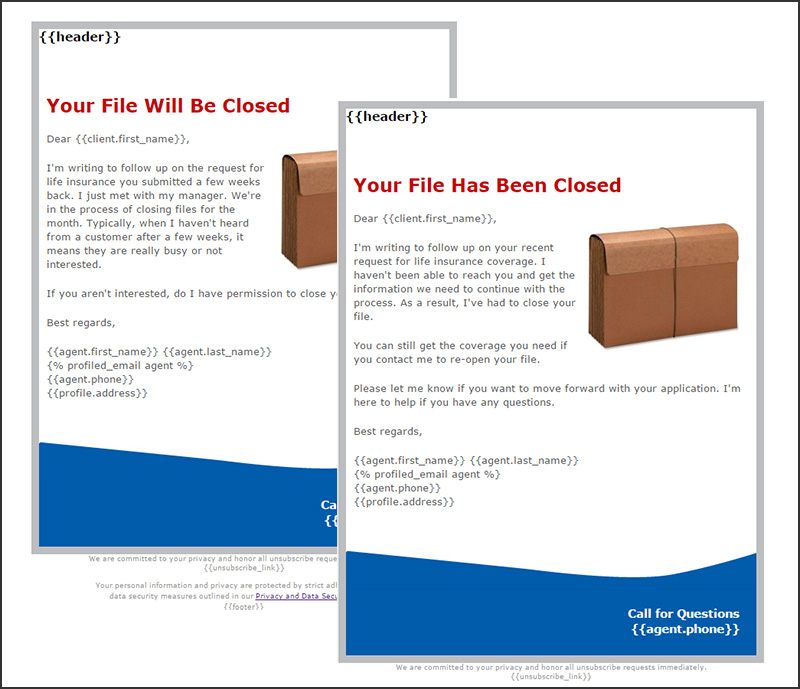

- Example 1: When Seth closes a client’s file, Insureio will email the client several times. They’ll receive an email asking if it’s okay to close their file, and another letting them know the file has been closed. These emails remind the client how important life insurance coverage is, and that they can always start the process again when they have more time.Insureio’s email templates automatically pull in the appropriate branding and agent contact information for each client. You can create templates with custom messaging and trigger them with status changes, such as changing a lead’s status from “contact attempted” to “withdrawn.”

Seth likes this feature because it reminds the client about the need for coverage without him having to take the time to make another call. He can move on to new leads, and let the automated emails try to turn a cold lead back into a warm lead.

- Example 2: Occasionally Seth gets a lead who’s been quoted but, whether by design or accident, has submitted a wrong or disconnected phone number. Sometimes, these leads do post with a correct email address, though. In that case, the system will automatically send emails to those clients when Seth closes their file, as described above.

“The system will reach out to them for you, even if you can’t get them by phone. The system can actually bring you new leads this way.”

Advice to New Agents

If you’re just starting out – or committing to hit even bigger life insurance sales goals in 2017 – here’s what Seth has to say:

- “It’s absolutely possible to hit goals like $50K or $70K per month. I didn’t start selling insurance until five months ago. I started with zero knowledge of life insurance, but in this case, the product sells itself.”

- “You know if you can sell. You know if this is a job you can do well. Someone can teach you the product, but if you don’t have the desire to learn and succeed, no one can teach you to sell.”

- “You have to put in the work. Consistently selling policies is what will get you there. If you sell 10 per week, you’ll hit a big one eventually and that will carry you toward your goal.”

- “Submit 8-12 apps per week and you’ll get your numbers bumped up to where you need to be.”

- “Don’t let a slow start discourage you. For the past few months, my first week has been slow. In November, my week 1 total was 9 policies for a total of $8,951. My week 2 total was 13 policies for $20,337.”

- “If a client asks you something you don’t know, that’s okay. Instead of making it seem like you don’t know the answer, say something like, ‘Let me confirm that for you before we move on. I don’t want to give you the wrong information.’ Then get a hold of someone who can give you that answer.”

- “Ask questions and learn by doing. Having a good support system is key. If I don’t know, I can find out.”

So what’s next for Goose?

He wants a $100,000 month. If it happens, we'll do a follow-up to explain how he did it. Stay tuned!

Ready to close $70,000 in life insurance sales and join Seth in the Danger Zone?

Now’s the time to set your goals and create a workflow that will get you where you want to be. Seth’s tips are just the beginning. As he said, having a good support system is key - and we're here to be that support system for you. We’ll give you the system and tools you need to grow your business. From marketing tips to workflow optimization, you can learn how to use technology to better serve your clients. Click the button below to learn more about our 2-day Advanced Sales Academy.