Financial literacy among American adults isn’t good – and it’s getting worse.

No time to read? Watch our video overview:

Let’s say you needed to borrow $100 and had two loan choices: paying back $105 or paying back $100 plus 3% interest. Which would you choose? It’s probably obvious to you, but 43% of American adults couldn’t answer that question correctly. And that’s just one question on a financial literacy survey we’ll discuss in a moment.

We have multiple sources that track financial literacy:

- Milken Institute’s Financial Literary in the United States report

- Standard & Poor’s Global Financial Literacy Survey

- TIAA Institute-Global Financial Literacy Excellence Center (GFLEC) Personal Finance Index

- FINRA’s National Financial Capability Study

In addition to the ability to track financial literacy trends, we also have financial literacy programs funded by the government, non-profit companies, and for-profit companies. The problem? They’re working…but too slowly to help many of the people who need it most, as we’ll see in a moment.

That’s where you come in.

You’re in a unique position to help since prospects come to you willing to talk about their financial needs to figure out how much life insurance coverage to buy.

So let’s take a look at where we stand in terms of financial literacy, what it means for you, and specific things you can do to help.

Financial Literacy: Just the Facts

Let's back up a few years to get a benchmark for American financial literacy. As of 2015, only 57% of American adults were financially literate, according to the last S&P Global Financial Literacy Survey. More men (62%) were financially literate than women (52%). And high-income survey respondents (64%) were more financially literate than low-income respondents (47%).

Remember the question we asked at the beginning of this post (about interest on a loan)? It came from this survey. To see the other questions, click here and scroll to page 4:

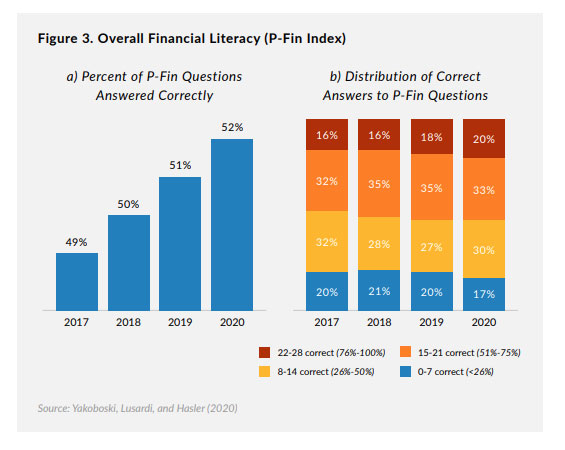

Fast-forward five years to 2021, when we got the results of the 2020 TIAA-GFLEX Personal Finance Index survey. On average, American adults answered 52% of the questions correctly. The good news? That was an increased over just 49% in 2017.

Survey results as shown in Milken Institute’s Financial Literacy in the United States report, p 10.

Unfortunately, those gains didn’t hold.

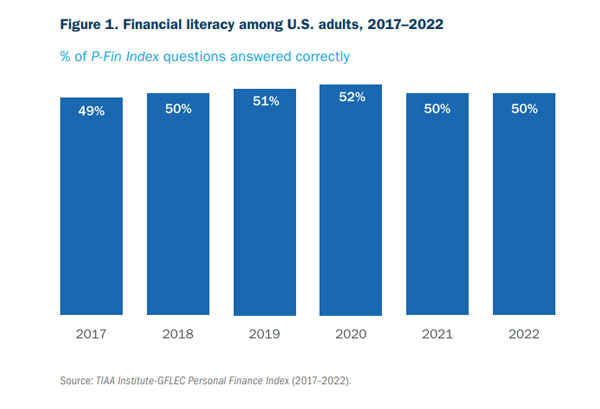

In the 2022 edition of the survey, American adults only answered 50% of the questions correctly.

Survey results as shown in TIAA Institute-GFLEC Personal Finance Index survey results 2022, p. 4.

Based on these results, it look like we’re stuck in a place where financial literacy is going to struggle to get back to that 57% mark we saw in 2015.

Financial Literacy: How We Can Help

According to the Milken report, we need to do four things to help our clients with financial literacy:

Build Knowledge

- How? Explain concepts that are hard to grasp just by reading them: inflation, stagflation, interest, compounding interest, cash value life insurance, etc. If you read Van Mueller’s newsletter, you already have a leg up on these topics.

Build Skills

- How? Show clients how to create a budget and a financial plan. This might entail using worksheets and completing them together. Plenty of our monthly sales kits include client worksheets you can do together, or let them work on it alone and review it together later.

- How? Partner with a local investment advisor and ask them for help. Can they record an on-demand webinar about investing basics for your clients…in return for referrals? Or can they come to your office to advise clients who express interest? Can they provide handouts or flyers you can give your clients?

Change Attitudes

- How? Talk with clients about their current attitudes toward saving and retirement planning. If, for example, they feel saving is a hopeless task, we need to find ways to convince them it’s not. We need examples of success at multiple income levels. What could the future hold if they’re able to create a plan and stick to it? What concrete things could they achieve that would improve their lives…and their children’s lives? You already have the answers to this in all the client success stories you’ve seen.

- How? Ask clients whether they’ve had talks with their loved ones about death and dying. Most likely, the answer is no. But until we can help them overcome their fear or reticence, any plans they make for long-term care are less likely to stick. The best way to do this is to share stories: what happens when families ignore these hard conversations? What happens when they tackle them head on?

Change Behavior

- How? Check in with clients more regularly and ask about their progress. Be supportive if they’ve started new behavior patterns, like saving a percentage of each paycheck. If they haven’t, offer helpful tips on how to start – apps that make it automatic, for example.

How to Start the Conversation with Prospects

When you make contact with a prospect, your first instinct is probably to close the sale. However, that’s also the best time to find out for yourself just how financially literate your new prospect is. Are they even shopping for the right product to meet their needs? Do they know what else is out there to help them with other financial problems?

Idea #1: Add a Quick Financial Literacy Survey to Your Marketing Funnel

As part of your introduction to a new prospect, you could use a very brief (2-4 question) survey to get a feel for where they are financially. These shouldn’t be “math” questions about calculating interest or anything off-putting like that. Instead, ask them to prioritize topics or select topics they feel more or less confident about. This helps you figure out what stage of life they’re in (financially speaking). After all, if your client is struggling with debt, inviting them to a webinar on investing for beginners isn’t a good fit.

Here are a few sample survey questions:

Which of the following financial tasks do you feel most confident about?

Making a budget and sticking to it | Saving for unforeseen expenses, like car or home repairs | Investing for retirement | Planning for retirement expenses like healthcare and long-term care

Which do you feel least confident about?

Making a budget and sticking to it | Saving for unforeseen expenses, like car or home repairs | Investing for retirement | Planning for retirement expenses like healthcare and long-term care

What is your biggest financial worry at the moment?

Not being able to work because of a disability | Not ever being able to retire | Paying my bills every month | Running out of money in retirement | Losing money when the stock market has a downturn

If there were an additional financial topic I could help you with, what would you be most interested in?

Getting out of debt | Creating a financial cushion | Starting to invest | Retirement planning

Based on their responses, you could add them to targeted educational campaigns that include text messages, emails, webinar invitations, and more.

Idea #2: Ask a Few Key Questions During Your Calls

If you do business in person or don’t want to deal with an online survey, ask these questions over the phone or during your appointment. You can make the questions more open-ended and conversational. If your client gets stuck or doesn’t know what to say, you have the multiple-choice answers handy to help prompt a response.

Why Us? Why Now?

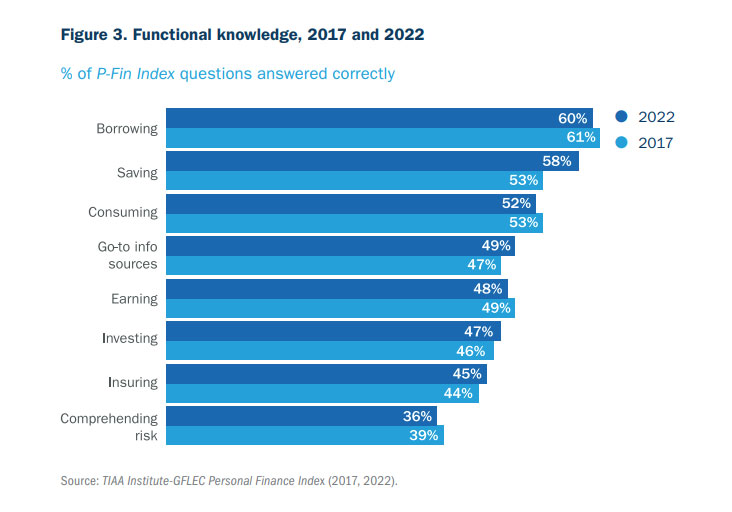

Selling insurance means covering a lot of the same ground as these financial literacy surveys. Here’s how the topics covered in the 2022 TIAA-GFLEC survey line up with topics you probably already talk about with clients:

- Sell permanent life insurance? You probably talk to clients about what a cash value account is, and how it has some similarities to a savings account. Saving is a topic only 58% of Americans could answer a survey question about correctly, according to the 2022 TIAA-GFLEC survey.

- Sell IUL? You need to cover the topic of risk with clients, and what they stand to gain or lose by choosing IUL over a product with a guaranteed rate of interest. The concept of risk is one of the least understood, in terms of basic financial literacy. Only 26% of American adults answered the question about risk correctly on the 2022 TIAA-GFLEC survey.

- Talking about policy loans? You’re covering borrowing, a subject only 60% of American adults could correctly answer a survey question about.

- Talking about the value of compounding interest in a cash value account? Compounding interest is a component of investing, a topic only 47% of people could answer correctly on the survey.

By taking a little more time to explore these topics with prospects, you’re making them better prepared to face their financial future. You’re also giving them the opportunity to become long-term clients with a deep, long-lasting relationship sparked by your thoroughness and dedication.

That’s our quick look at financial literacy and how insurance agents can help!

Do you already cover general financial literacy topics with your prospects and clients? Do these survey results match up with what you've seen in your own client base? Tell us in the comments!