This is a guest post from Sean Dudayev of Frootful Marketing. Here are his top 7 tips on Facebook ads for life insurance agents.

If there is one thing that any life insurance agent (or agency) loses sleep over, it's life insurance leads.

Agents are always looking for new or better ways to get leads and the battle never ends. In the last decade, how life insurance agents generate leads has changed substantially, and thankfully, it changed for the better. Digital marketing has created a way that agents can carve out opportunities for themselves to compete amongst the giant companies and capture their niche markets to generate business. One of the most popular and most recent trends in digital marketing has been Facebook advertising.

No time to read? Watch our video overview:

Let’s discuss tips life insurance agents can use to launch a successful advertising campaign through Facebook, but first:

Why Facebook?

While more and more businesses are starting to realize what social media can do for their business, it is still not as over-saturated as other channels (looking at you, Google Ads). There is still a ton of opportunity to drive relevant traffic or generate leads for your business through Facebook as long as you get certain elements right.

Google Ads can be quite expensive depending on your industry. If you’re a solopreneur life insurance agent, then paying $30-$40 per CLICK bidding on life insurance keywords is probably not the most optimal strategy.

The good news is that with Facebook, you should be able to achieve $10-$30 per LEAD if you do things right. The range in cost will depend on your niche, location, and success of campaign set up.

Let’s talk about a few ways to get your Facebook campaign running efficiently.

7 Tips: Facebook Ads for Life Insurance Agents

Facebook has done a great job of creating a user-friendly Business Manager back-end that allows you to set up ads through a step-by-step process. The downside of this is that newbies feel they can do it themselves because they’ve learned the tool, but the reality is the tool is only as good as the marketer behind it. So let’s discuss a few tips to help you generate life insurance leads through Facebook successfully.

1. Run Lead Gen Ads

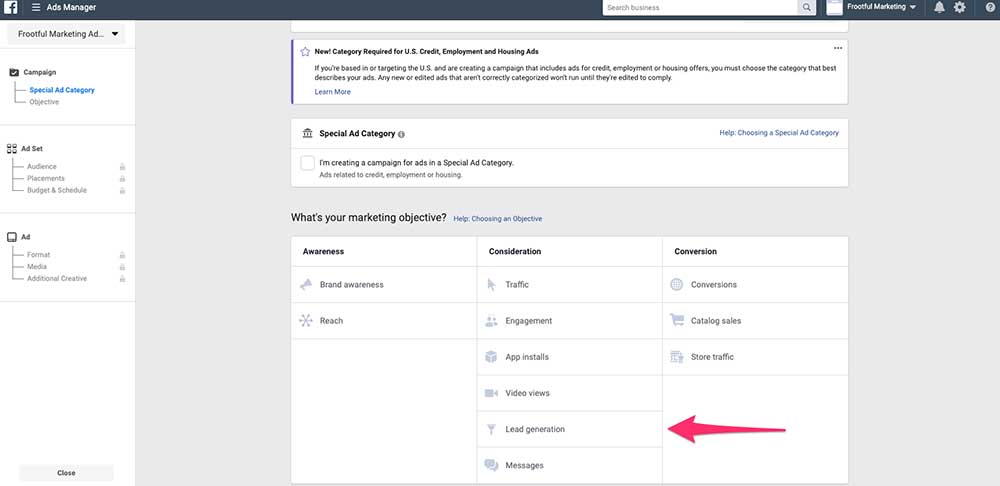

When beginning to set up your Facebook campaign, you will notice that there are multiple options for types of campaigns to run.

The one that is the most effective for life insurance leads is a "Lead Generation" campaign, rather than the more popular "Traffic" campaign. The reason for this is fairly simple. Unlike Google's paid ads, when users are on Facebook, they aren’t actively searching for your product or service, so there is no intent there. For the most part, Facebook users want to stay within their feed and continue scrolling. Running a website traffic campaign creates more resistance to click the call to action to leave the site, and adds another layer of action on your website before they can become a lead.

With Lead Generation ads, as soon as the Facebook user clicks the call to action, it will pop up a lead capture form within the Facebook interface and allow them to fill it out. The best part is that basic information like Name, Phone, and Email are populated automatically from their profile, which helps save them time on filling it out manually.

Once they hit submit, the lead will officially be captured.

During the ad setup process, you can customize the form to your liking by deciding which information to capture and any qualifying questions you may want to add.

2. Niche Down Your Targeting

If you’re setting up your first campaign, you may be excited by all the targeting options available to you. What most people do is select as many relevant targets as they can and push the launch button. This, however, is a very costly mistake. First, you end up targeting too many people, so it's hard to nail down a relevant ad and you’re stuck with something generic that may not resonate well, and in turn, not convert well. Second, if the ad by chance does begin performing well, it will be hard to nail down which audience actually responded well to your ad, so it will be hard to nail down and optimize the campaign over a longer period of time.

What you want to do is focus on just a few different products or services (one, if possible) and figure out which audience is best suited for it. If you want to try multiple audiences, set up different ad sets for certain demographics, interests, etc.

For example, if you sell final expense policies, you want to focus on targeting people over 50, or people interested in senior living and the like. However, a lot of times, the people that shop for final expense coverage can also be people that will be stuck with the funeral costs. What you want to do in this case is to create two separate ads for two different audiences and see which one has more success.

3. Take Time on Your Ad

When trying to generate life insurance leads, speed is always of the essence, but you can’t allow it to make you cut corners during the creative process. Most of the time, people are quick to throw up a stock photo and some text around it and just hit the launch button. What you want to do instead is allocate some time and create multiple versions of the ad, then pick your winners - or rather, allow the data to do that for you.

There are a few elements that make a good Facebook ad. Here are some best practices when creating a good Facebook ad for life insurance leads.

Best Practice #1: Add Text to Images

Sneak in the text where you can - Facebook doesn’t allow the image of your ad to have more than 20% text. Rather than not including text at all, you want to use the real estate of the image to include an enticing message. Going back to the Final Expense example, you can add text to the image that provides a thought-provoking point. Something like “Who is Paying for Your Funeral?” or “Don’t Stiff Your Kids (or Spouse) With the Bill.”

You can use a tool like Canva to design these ads.

Best Practice #2: Teach Them Something

One of the best ways to get someone’s attention or to occupy real estate in their mind is to teach them something. People usually always remember where they learned something and are quick to tell others about it. Another good practice in an ad is to use the text or heading area to demonstrate a fact or provide a resourceful piece of information. This can be something like a statistic, or perhaps insider industry info on a company/product that they may not be aware of.

Here is an example: “Did You Know You Can Get Life Insurance Without a Medical Exam?”

Best Practice #3: Numbers Speak Louder Than Words

With insurance products, if there is anything that works better than words, it's numbers. Illustrating how many customers you’ve helped, how much money one can save, or a sample quote can work wonders on conversions. Test multiple options based on your audience and see what works best for you.

4. Ask Qualifying Questions

One of the things that you want to make sure you do is ask qualifying questions in your lead form. While getting a volume of leads is good, you also want to make sure you’re not wasting your time calling what most agents refer to as “duds,” or bad leads.

The way to do this is to ask one or two qualifying questions on top of the pre-populated basic contact information. This can be asking about the desired coverage amount or coverage reason. Facebook also allows you to select the type of question, for which I recommend a simple multiple-choice.

This will allow you to filter out the mindless scrollers on Facebook, of which there are plenty in my experience. Because there is no user intent, users often won’t recall interacting with your ad at all, and because of its pre-populated info, it's easy to enter the funnel if there are no qualifying questions. Focus on quality over quantity, and add qualifying questions. This may hurt your cost per lead, but it will impact positively on your cost per acquisition - which is the only number that matters when it comes to lead generation for your business.

5. Integrate with Your CRM

The one drawback of Facebook’s user interface when it comes to lead generation ads is that there is no notification when you get leads, and you have to go into the Ads Manager in order to retrieve them. When you do, you have to set the date and download a CSV file full of the leads, and only then do you have the info on hand. If you have a CRM, you will have to manually input the info before you put them into your CRM funnel.

The best way to avoid this is to use a tool like Zapier to help integrate your Facebook campaign with your CRM. If your CRM doesn’t work with Zapier, then you will want to use Zapier to integrate your Facebook campaign with your email account, and then push the leads from your email inbox directly to the CRM.

With most leads (and Facebook leads in particular), timing is everything. You want to contact the leads as soon as possible in order to increase the chance of converting that lead to a client. Integrating them with the CRM will allow you to reach out as soon as the lead comes in.

6. Split Test Everything

Going back to an earlier point on targeting and creating multiple ad sets, with Facebook, you want to split test as much as you can in order to grind down to the most effective strategy.

Split testing is also known as A/B testing, where you change one variable at a time to see how it influences ad conversion and engagement.

The trick is to only test one thing at a time and pick the winner, then test another factor, and rinse and repeat until you’ve got the best version of your campaign performance.

With your ad you can test:

- Ad Text

- Ad Image

- Ad Type

- Call to Action Text

- Lead Form

Make sure to only test one variable at a time.

As a little freebie for reading this far, historically, “learn more” has been the highest converting call to action text.

As mentioned earlier, you also want to test different audiences, but make sure that your ads are perfectly identical in order to make sure there is nothing else at play other than the type of person you are targeting.

7. Always Optimize

The one thing organic (SEO) and paid strategies have in common is that they should both provide an increasing ROI over time. The biggest mistake a lot of entrepreneurs make when setting up their campaign is the “set it and forget it” approach. This is a good way to burn through a lot of your budget and get nowhere. Many of the people who say Facebook Ads “don’t work” take this very approach to set up campaigns.

It's very rare that your first campaign will be your best effort. Unless you have experience in setting up dozens of campaigns across the same industry and the same niche, in most cases, there will be a lot of room for improvement. This is why it is absolutely important that you try and optimize every aspect of your campaign.

This includes things like tracking your engagement rate, link clicks, and clicks resulting in leads. Monitor the way your ads are performing and the result of every split test you run. After you reach enough people, it will be fairly obvious to see which test is performing better, and then it will be time to swap it out and test it against another variable.

Launch Your First Campaign

The key to a successful campaign is constant monitoring, tweaking, and optimization. Every month your CPL or CPA should decrease and provide a better ROI on your efforts. Observe the data, perfect your campaign, and drive the leads to yourself that you want to see. It all starts with hitting the launch button!

About the Author

Sean Dudayev is the founder of Frootful Marketing. After starting his own life insurance agency and successfully generating leads through digital efforts, he decided to take what he learned and help other entrepreneurs scale their businesses.