Our December 2021 sales kit hits two topics popular for end-of-year discussions with your clients: charitable giving and maximizing underperforming assets.

It happens every year - as December wraps up, we look at the past 12 months to see what we did well...and what we can do better. Then, we make plans for the next year based on our findings. That's what this month's kit is designed to help your clients do. And you can be there to help them as they look for ways to maximize tax benefits and squeeze more performance out of every asset. You don't have to be an expert. You just have to ask questions and know where to find the answers. We're here to help throughout the entire process.

As your clients go over their portfolio's 2021 performance, here's the question to ask: are there ways to make previously ignored or potentially underperforming assets do more? In most cases, the answer is yes - by reinvesting them in life insurance. Our kit has sales ideas that show you how this works with assets like Social Security payments, municipal bonds, annuities, IRAs, and more.

And as they start to think about their tax situation for 2021, remind them it's not too late to make a few strategic moves. One such move may include maximizing the charitable giving tax exclusion. For 2021, that's $15,000 per person. For clients who are married, they can double that if each spouse gives the maximum amount.

What’s in the Kit

Our FREE 69-page kit includes:

- 4-page article from Ed Slott: Year-End 2021: 5-Point Retirement Account Action Plan

- 2-page article on proposed changes to the estate and gift tax provisions

- 3-page article on further proposed tax changes

- 6-page tax guide with 2021 contribution limits, as a refresher for year-end strategies

- 8-page client guide to annual gifting exclusions for life insurance

- 4-page client guide to charitable legacies

- 7-page producer guide to charitable legacies

- 7-page client flyer on charitable giving with life insurance

- 7-page client flyer on charitable giving and tax strategies

- 15 pages of sales ideas on asset maximization (life insurance, IRA, qualified plan, muni bond, annuities and Social Security)

- 4-page client guide to lifetime giving

How to Use This Month’s Sales Kit

The first few pieces will help you understand what's at stake. We included a 5-point retirement account action plan by the excellent Ed Slott (an expert Van Mueller refers to frequently). There are also articles on proposed changes to the tax code that will affect the gift tax exclusion and estate tax in the future. Use those articles to ask clients how their strategies could change if those proposed updates become law. Later in the kit, you'll find sales ideas for a range of assets that can can be maximized, from IRAs to Social Security to muni bonds. If these assets aren't performing well (or aren't needed as sources of retirement income), you can turn them into an inheritance for your client's heirs or a gift for their favorite charity using life insurance.

Reach out to clients via phone, email, social media, letters, postcards, and any other marketing tool at your disposal. Bring up one of the facts you found in the kit and ask your clients if they'd like a year-end financial check-up to go over questions like these:

- Have they used their annual gift tax exclusion to decrease their 2021 income - and potentially reduce the tax they owe?

- Are their assets preserving and creating wealth for them as well as the next generation?

- Show clients how reinvesting unneeded assets into life insurance or an annuity provides more benefits for them (living benefits) and their heirs (tax-free death benefit). If you need help answering questions, recommending a strategy, or providing an illustration, we can help! Give us a call at 800-823-4852 - just ask to speak to a brokerage manager.

Need help with quotes, illustrations, or selecting the right product?

Our Brokerage Managers - Dave and David - can help. They have incredible depth and breadth in terms of product knowledge. Call 800-823-4852 and ask for a brokerage manager, or click the button below to email us!

Insureio Subscribers: Use Our Asset Max & Charitable Giving Email Marketing Campaign

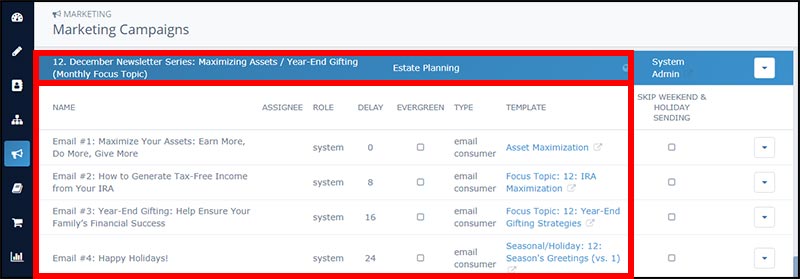

If you're an Insureio subscriber, you can access our pre-written marketing campaign for December. It includes four emails, including a holiday greeting, for your clients and prospects, pre-scheduled for delivery throughout the month.

The first three emails touch on the topics covered in the sales kit: asset maximization, how to generate tax-free income from an IRA, and using year-end gifting to help ensure your family's success. They introduce the concepts, but don't get into the specifics (such as a product recommendation). Ideally, they're just enough to pique your clients' interest and get them to call or email you to learn more.

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click December Newsletter Series: Maximizing Assets / Year-End Gifting (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our December 2021 Sales Kit Now!