Our December 2017 sales kit is all about asset maximization and charitable giving through life insurance. It's a great topic to bring up in December. As your clients look to wrap up their financial year, money and taxes are no doubt on their mind.

The strategies in this kit will help you talk to them about taking a more holistic look at their financial portfolio as they head into tax season. What assets are they going to need for retirement? Have they accurately assessed their retirement needs? Finally, if there are any assets left over, how can we help them get more from those assets, either for themselves or their families?

What’s in the Kit

Our FREE 50-page kit includes:

- 5 pages of consumer and producer guides to legacy maximization

- 10 pages of consumer and producer guides to pension maximization

- 6-page guide to accomplishing charitable goals using life insurance

- 20-page producer guide to Social Security planning with life insurance

- 4-page producer sales idea on municipal bond maximization

- 3-page producer sales idea on annuity maximization

How to Use This Month’s Sales Kit

Two good target markets for these strategies are grandparents, and parents with grown children. Chances are they're looking for ways to balance their financial needs in retirement with the desire to leave something behind for their loved ones. The legacy maximization strategy speaks directly to these needs.

Still looking for a niche market? State or government workers may be especially interested in pension maximization. In most cases, government employers pay pensions as single-life annuities or joint-and-survivor annuities. But which should your client chose? It may make the most financial sense to choose the single-life payout option. Afterward, they'll buy a life insurance policy that would pay a death benefit to their spouse. Why does this work? Because the single-life payout option pays more cash up front. As a result, they have more for daily living expenses plus the ability to pay for an additional life insurance policy.

Get the KitInsureio Subscribers: Use Our Asset Max Campaign

Are you an Insureio subscriber? If so, you have access to December's pre-written asset max marketing campaign. It includes educational emails pre-scheduled for delivery throughout the month. These emails highlight different assets and explain how they can sometimes fall short in terms of expected performance in a retirement plan. They also explain how to repurpose these assets using life insurance, increasing everything from available death benefit to long-term care and critical illness coverage. These emails encourage recipients to contact you with questions, but they're not selling any particular product or carrier. If you need help with case design for a client, give us a call at 800-823-4852. We're happy to help!

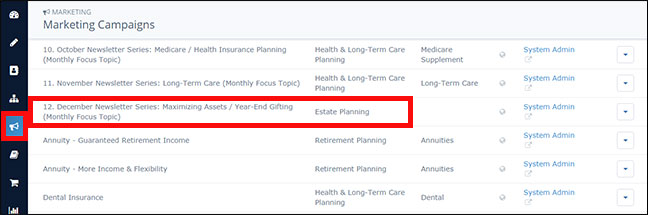

To preview the campaign:

- Click Marketing and then Marketing Campaigns from your left-hand navigation menu in Insureio.

- Scroll down and click December Newsletter Series: Maximizing Assets / Year-End Gifting (Monthly Focus Topic). You'll see the list of pre-scheduled emails. Click any of the template titles to open it up in a new browser tab for a preview

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our December 2017 Sales Kit Now!