It's back to school time! This August, we’re focused on helping your clients create college funding options with life insurance. How can we give them options that create the extra savings they need to pay for one or more kids' college tuition?

John Hancock estimates that a four-year private college education will cost $416,888 by 2034. If your clients have a new baby born in 2016, that child will turn 18 - and likely enter college - in 2034. Your clients probably aren't thinking of ways to stockpile that much money right now. Our sales kit can help you find new ways to show them how life insurance can meet multiple financial goals, including college funding.

What’s in the Kit

Our FREE 51-page kit includes:

- 5 pages of producer guides on college funding using VUL

- 10-page John Hancock producer guide to Accumulation VUL

- 1-page producer guide on building a customized family protection plan

- 2-page corresponding consumer brochure on family protection planning

- 21 pages of consumer brochures on using life insurance to help pay for college

- 8-page consumer guide on using UL to accumulate cash value

- 2-page producer guide on positioning IUL with clients

How to Use This Month’s Sales Kit

Step 1: Download the Kit

This month's kit contains planning concept information and carrier sales ideas, complete with products that can help clients accumulate cash value. There are two great reasons to use life insurance as a college funding source. First, it offers death benefit protection. No scholarship or 529 plan can offer the same peace of mind. Second, you can use life insurance cash value to pay for expenses scholarships and 529 plans won't cover. This might include a new computer, or travel expenses so your student can come home for the holidays.

Step 2: Craft an Approach

Do you have clients with young families? If their kids are age 10 or under, they probably don't realize what a big expense college will be. Your approach could be as simple as an email or phone call. Your script could be as simple as, “Hi (client name), I was reviewing your file and realized (child name) will probably need a college fund soon. I want to make sure you know about a type of life insurance that can protect your family if you were to pass away, but also build tax-free cash value for a college fund. Other clients I've helped have used their cash value to pay off debt, travel, send kids to college, or start a business. If this is something you'd like to learn more about, let's talk or Skype this week. Is there a time that works for you?”

Step 3: Present the Planning Concept

This month's sales kit has carrier materials that spell out the specific advantages of using UL and VUL for cash value accumulation. It also has a number of consumer-facing brochures you can share with clients. You'll find comparison charts to help you position universal life favorably when compared with 529 plans, custodial (UTMA/UGMA) accounts, Coverdell plans, IRAs, and mutual funds.

Need advice on specific products or carriers? Call us and ask to speak to a brokerage manager. We're happy to help.

Get the KitInsureio Subscribers: Use Our Back to School Marketing Campaign

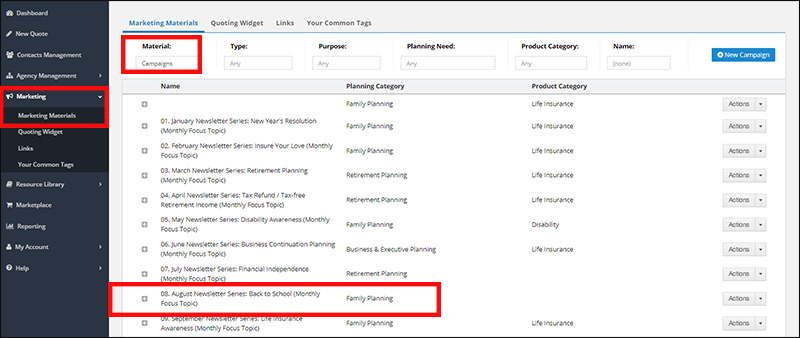

If you have an Insureio subscription (Standard or Professional), you can send clients emails about college funding using life insurance. They're all gathered for you in our pre-written Back to School marketing campaign. This series of emails is pre-scheduled for delivery throughout the month. They don't endorse a specific carrier or product. Instead, they cover "big picture" topics like cash value as a concept, and life insurance as an alternative to Coverdell accounts, 529 plans, and more.

To preview the campaign in Insureio:

- Click Marketing and Marketing Materials from your left-hand main menu.

- Find the Material dropdown menu on the top left. Change Templates to Campaigns.

- Click August Newsletter Series: Back to School (Monthly Focus Topic). To preview any of the pre-scheduled emails, click the blue links under Template. That email template will open up in a new browser tab.

Want to learn more about Insureio campaigns and how to enroll your clients? Click here to visit the Insureio Academy.

Help Your Clients Create College Funding Alternatives with Life Insurance