Our April 2024 sales kit will help you talk to clients about everyone's favorite subject: income taxes...and how to minimize them as much as possible.

No one likes to think about taxes. Almost no one likes to talk about taxes. But everyone likes to save money, so it's one of the topics we really need to cover with our clients. You can help them in multiple ways: by looking at their 1040 form and identifying planning opportunities, or by bringing up those planning opportunities during an annual review. This year, tax day is on Monday, April 15. Use the soundbites in this month's kit to chime in with the news stories and social media posts already inundating your clients with tax day questions, horror stories, and - hopefully - opportunities.

What’s in the Kit

Our free 91-page kit includes:

- 4 pages of pre-written social media posts (images + text)

- 15-page guide to uncovering life & LTC needs through a client's 1040 form

- 13-page tax guide with 2023 and 2024 income and payroll tax rates

- 2-page sales idea: tax provisions set to expire on January 1, 2026

- 26-page guide to the taxation of life insurance

- 2-page guide to the tax status of common assets (IRA, equities, annuities, etc.)

- 3-page case study on using life insurance to protect against tax rate fluctuations

- 2-page client worksheet for tracking how and when you're taxed

- 12-page client guide to tax diversification in retirement planning

- 4-page client guide to tax advantages that are scheduled to sunset on January 1, 2026

- 2-page guide to identify financial opportunities using your 1040

- 4-page client guide to pre-funding retirement taxes with permanent life insurance

How to Use This Month’s Sales Kit

As always, start by posting the social media images and text provided. We recommend you read through the kit and pull out questions, facts, or strategies to share with your clients. How you get the message out is your call: a webinar, emails, one-on-one meetings, or additional social media posts, for example. Remember the "7 Touches of Marketing" theory, which says that your target audience probably needs to hear a message at least 7 times for it to sink in. Those 7 touches don't have to come from the same medium - in fact, it's probably better if they don't. But if you provide them with social posts, several emails, calls, ads, a webinar, or any combination of those, chances are your message will begin to stick.

You can use the sample questions, facts, and stats in the kit with prospects and existing clients. Here are just a few questions you may want to ask:

- Do you have enough life insurance coverage? Ask about the ages of their dependents claimed on their 1040 form. Does their coverage last at least until the youngest dependent turns 18? Do they want to help any of those kids with college funding? Do any of those children have special needs that requires extra planning?

- What investments and retirement accounts do you currently have? Do you see any tax-exempt interest earned on their 1040 form? This comes from tax-advantaged investments, which may make this client a good candidate for a balanced portfolio strategy using permanent life insurance. If you see taxable interest, on the other hand, that probably means your client has significant funds in CDs or savings accounts. Talk to them about their goals for this money - could it earn more interest in a MYGA?

- Are you currently taking distributions from a pension or annuity? Ask whether they're taking these distributions because they need them or because they're required as RMDs. If they don't need that money to live on, you can talk to them about strategies to convert that cash into something with less of a tax burden for their heirs.

Need help with quotes, illustrations, or selecting the right product?

Our Brokerage Managers - Dave and David - can help. They have incredible depth and breadth in terms of product knowledge. Call 800-823-4852 and ask for a brokerage manager, or click the button below to email us!

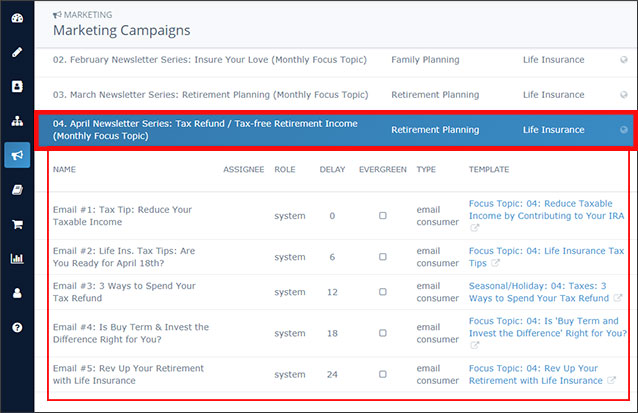

Insureio Subscribers: Use Our April Marketing Campaign

Are you an Insureio subscriber? If so, you have access to a pre-written marketing campaign for the month of April. It includes five emails for your prospects, pre-scheduled for delivery throughout the month. These emails focus on general topics related to income tax, from tax-day readiness to future planning strategies to reduce tax in retirement. As always, these informational emails don't mention individual carriers or their products by name. They're designed to educate your clients first, so they understand the concepts you'll be talking about when it comes time for a meeting or sales call.

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click April Newsletter Series: Tax Refund / Tax-free Retirement Income (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our April 2024 Sales Kit Now!