Our April 2018 sales kit is all about strategies for tax savings and tax-free income. If your clients have already done their taxes, ask them to bring you a copy of their 1040. If they haven't, you can provide a few tips on tax-advantaged financial vehicles like annuities and life insurance.

What’s in the Kit

In this month's kit, we have 48 pages of resources to help you talk to your clients about their retirement needs, and ways to maximize their tax savings. The cornerstone of this strategy is the 1040 overlay. Using your client's completed 1040 form, you can immediately spot ways for them to get more for their money. For example, on line 20b, you can see how much Social Security income your client had in 2017. Social Security income counts toward their adjusted gross income (AGI). One way you can help them lower their overall AGI is by repositioning assets or contributing to an annuity or variable life insurance policy. Earnings from these financial vehicles that aren't withdrawn don't count toward the AGI. A lower AGI means less taxation on their Social Security benefits.

Our FREE 50-page kit includes:

- 6-page 1040 overlay guide

- 12-page tax table guide for tax years 2017 and 2018

- 9-page guide to business tax highlights

- 5-page guide to estate and gift tax provisions

- 6-page guide to state corporate tax rates

- 2-page conversation starter guide

- 4-page client brochure on tax-efficient retirement strategies

- 4 pages of client brochures on the benefits of a tax-deferred annuity

How to Use This Month’s Sales Kit

This month's kit contains a full page of conversation starters. Ask your clients these leading questions to get them thinking about tax strategies. You can also ask if they're interested in a free consultation. All they'd need to do is send you a copy of their completed 2017 1040 tax form. Using the 1040 overlay guide in this kit, you can point out areas for potential future savings or planning needs. The overlay form shows you exactly which lines to pay attention to on the tax return.

This is also a good opportunity to talk about annuities. Tax-deferred accounts like annuities help your clients grow their savings faster. Instead of getting taxed every year on capital gains and dividends, they don't pay tax on their account's earnings until the payout phase of the annuity. As a result, compound interest works its magic on larger and larger amounts of money each year. Over time, your clients will accumulate more than they would in a non-tax-deferred product.

Get the KitInsureio Subscribers: Use Our Tax Strategies Campaign

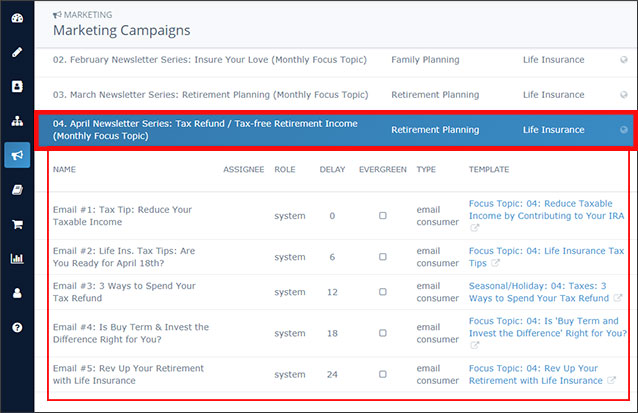

All Insureio subscribers have access to our pre-written marketing campaigns. April's campaign for tax savings and strategies includes five pre-written educational emails, already scheduled for delivery throughout the month. All you have to do is enroll your clients or prospects, and they'll get each email in the series automatically. These emails aren't your typical sales email. They're not a hard sell--in fact, they don't mention a particular product or carrier. All they do is provide the basic concepts they need to understand how tax-advantaged products like annuities and permanent life insurance work. They're a great way to lay the foundation for a future conversation.

To preview the campaign:

- Click Marketing and then Marketing Campaigns from your left-hand navigation menu in Insureio.

- Scroll down and click April Newsletter Series: Tax Refund / Tax-free Retirement Income (Monthly Focus Topic). You'll see the list of five pre-scheduled emails. Click any email title to preview the template in a new browser tab.

Want to learn more about Insureio marketing campaigns, including how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our April 2018 Sales Kit Now!