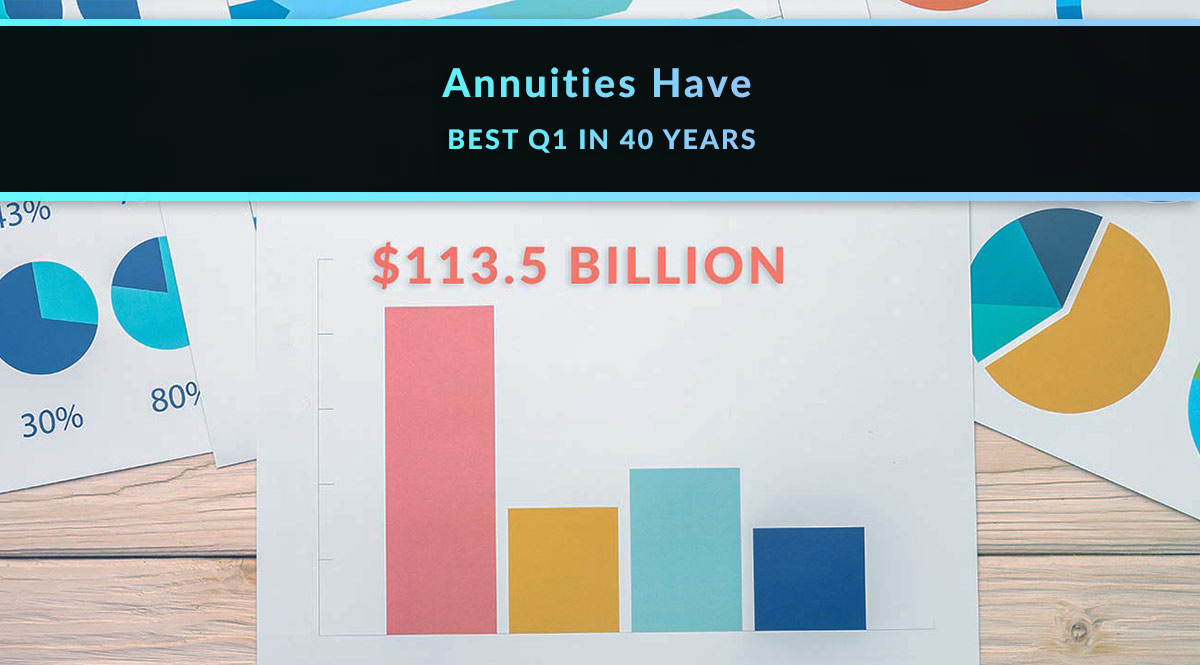

The numbers are in – and annuity sales skyrocketed in January, February, and March of 2024.

According to LIMRA, Q1 saw $113.5 billion in annuity sales, which is 21% higher than the same quarter of 2023. These results include 84% of the U.S. annuity market, and represent the highest first-quarter sales results since LIMRA began tracking annuity sales four decades ago. Here’s a closer look at sales by annuity type:

- Fixed rate deferred annuities: up 16% over Q1 2023, with $48 billion in sales.

- Fixed indexed annuities: up 27% over Q1 2023, with $29.3 billion in sales.

- Fixed immediate (income) annuities: up 19% over Q1 2023, with $4 billion in sales.

- Registered index-linked annuities: up 40% over Q1 2023, with $14.5 billion in sales.

- Traditional variable annuities: up 13% over Q1 2023, with $14.5 billion in sales.

No time to read? Watch our video overview:

What’s Driving Annuity Sales?

Two words: interest rates.

Interest rates remain high, and thanks to stubborn inflation, it’s now questionable whether the Fed will cut rates at all this year. As measured in Q1 2024, inflation rose 3.4% over the same period in 2023. (InsuranceNewsNet.com) That’s more than Fed’s stated goal of 2%, which means it’s likely to postpone any rate cuts until inflation shows signs of cooling. Market watchers originally hoped for a cut in March, which didn’t happen. Now, after the latest Fed announcement on May 1, those hopes for a rate cut have been pushed back to the fall…or to 2025. As it stands, the Fed’s current target benchmark interest rate is 5.25% – 5.5%.

While inflation hurts everyone, high interest rates help annuity shoppers. Do you have clients who are savers and want to lock in these high rates? It looks like they have more time to do so.

Sell More MYGAs with Pinney

Three Situations Where Annuities Make Sense

- To park money your clients don’t need and lock in a high interest rate. Multi-year guaranteed annuities (MYGAs) offer clients higher rates and better returns than CDs and savings accounts. Your clients don’t have to settle for the pitiful interest rates offered by big banks on their savings accounts – currently stuck at about 0.01%. MYGAs are beating CDs, too, with up to 1% more interest. As of this writing, your client could be earning 6% on a 3-year MYGA or 5.85% on a 5-year MYGA from Upstream Life. Click here to see more current rates!

- To maximize Social Security. Could your clients put off claiming Social Security for a few extra years in return for a larger check every month? Would it be easier if they had an income annuity to depend on for living expenses in the meantime? Annuities can help clients bridge the income gap between retirement or part-time work and Social Security collection. Nassau Financial even offers two annuities specifically designed to solve this problem, with two different income levels – a higher one pre-Social Security, and a lower one after your client starts receiving benefits.

- To help women plan for longer life expectancies and long-term care needs. Women can expect to live about five more years than men, on average. Only 16% of women in a recent Thrivent survey said they have an extended care plan for after their spouse passes away. Having an annuity eliminates the need for a woman to worry about outliving her money, whether she needs care or not. Creating an income stream independent of both Social Security and her 401(k) can help ease worries about future “what if”s.

Do you have clients in any of these situations?

If so, talk to them about the benefits an annuity can bring. Need help framing the conversation? Let us help! Call 800-823-4852 and ask to speak to a brokerage manager about annuities.

See today's top MYGA rates and quote annuities for your clients!