Why is PR still important in the days of social media selling?

Public relations (PR) is about more than just driving traffic to your website, although that’s an excellent side benefit. It’s about credibility. When a prospect finds you – on LinkedIn, on Instagram, or even on TikTok – chances are they’re going to Google you. What do you want them to find? Ideally, you want them to find evidence of media coverage where you’re consulted or profiled as an expert. That coverage functions alongside social proof (positive reviews) to give a full picture of you to a prospect.

No time to read? Watch our video overview:

Okay, so we know PR can be as valuable as social proof. But how do you get it? What if you’re a one-person agency with no previous media experience? And how do you maximize it when you do get it? Let’s find out.

Tip #1: Identify your target audience

You probably already have this nailed – who is your ideal customer? What market niche do you serve? Which type of client do you serve best?

You want to make sure the media coverage you get will attract these types of prospects. To do that, imagine you’re speaking directly to your ideal client.

Not sure how to identify your ideal client? Check out our post (and free template!) on how to create and implement a buyer persona.

Tip #2: Identify what your target audience is interested in

Now that you know who you’re speaking to, you need to find a subject they’re interested in. Not every business owner, for instance, wants or needs to hear about employee stock option plans. If your ideal client is a single mother in her 30s, she may be more interested in college planning with life insurance than long-term care.

What's the best way to find out?

Ask! Run a poll on social media and provide a short list of topics, asking which they’re most interested in. If you get a couple good contenders, pick several subtopics or approaches and post about them on social. Now check your responses and analytics. Which topic got the most engagement? When you get proof that your audience is interested, you have a solid topic that you can pitch to a media outlet.

Tip #3: Identify where your target audience consumes content

But what media outlets should you consider? Where do you start if you’ve never approached one before? Don’t worry – there are two easy steps to figure this out.

- Ask your best clients. You can either do this casually or with intention, depending on your comfort level. If you want to do it casually, take a moment during the small talk that opens or closes a client meeting to ask them for recommendations for podcasts or magazines or news sources. Say you’re looking to add some new content to your rotation and see what they recommend. If you want to do this intentionally, tell them you’re looking for media opportunities and since they represent your ideal client, you’d love to know where they get their financial news.

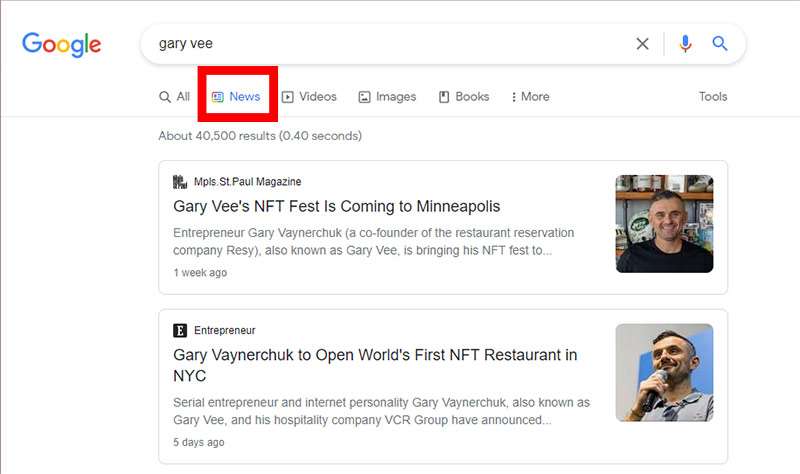

- Use Google. As with anything, Google probably has the answer if you know how to ask the right questions. Do a search for competitors or well-known industry figures and see where they’ve been getting coverage recently. The best way to go about this is to use Google News…

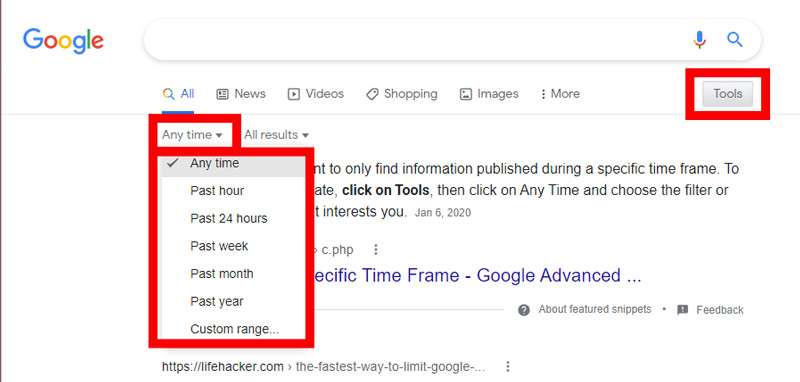

…or limit your Google results by time to make sure you’re getting current results. To do that, click Tools and use the Any time dropdown menu. Past month and past year are good options to try.

…or limit your Google results by time to make sure you’re getting current results. To do that, click Tools and use the Any time dropdown menu. Past month and past year are good options to try.

Tip #4: Identify your hooks

Okay, now you know who you’re talking to, which outlets you want to be featured in, and have a rough idea of what you want to talk about. But a rough idea isn’t going to cut it – you need a hook that’s going to appeal to the gatekeeper of a media outlet.

There are two parts to your hook. The first part is the hook for your insurance-related story. The second part of your hook answers the question: why you? And neither one of them are as hard as you might think they are.

- Part 1 – Your Insurance Hook. You need a fascinating fact, new statistic, or timely topic to frame your insurance news. News outlets are looking for fresh, relevant stories – the fact that business owners need life insurance, for example, isn’t fresh. You may need to do some Googling to find a new study, survey, fact, or tidbit about financial habits or mistakes that apply to your target audience. Or is there a holiday coming up that you can use to present statistics in a new way? For example, around Mother’s Day, media outlets want stories about motherhood – so what can you dig up about moms and life insurance? What might the audience not be aware of? That’s your hook.

- Part 2 – Your Personal Hook. This is less important than your insurance hook, but it can really help seal the deal if you have one. This hook answers the question: why you? Why are you the one to bring this story to their attention? Or what about you might make you interesting to that media outlet’s audience? Sometimes this is an award or recognition you’ve earned. Sometimes this is a fascinating first job you held that has nothing to do with life insurance. Figure out what it is about you that, when you tell people, makes them say, “Tell me more!” That’s your personal hook.

Tip #5: Create a solid pitch

You’ll almost always deliver your pitch via email. Most media outlets have a “contact” or “submissions” link on their websites with instructions for sending a pitch. This should always be less than 1 page long, following a formula like this:

- Start with your insurance hook.

- Flesh out the topic in a few more sentences.

- Introduce yourself and explain why you’re the right person to cover this story.

- Add a bit more detail about the story: what sources you’re using, what topics you’ll cover, what the audience can take away.

- Thank them for their time and say you look forward to hearing back from them.

Tip #6: Leverage your connections

What if you want to pitch a media outlet that doesn’t have instructions for how to submit…or they do, but say they’re currently closed to submissions? You have two options. You can move on and find another outlet, the easiest solution for the time being. Or you can think about who in your professional or personal network may be able to help you get a foot in the door at that magazine or TV show. Did you work with someone in a previous job who went on to be interviewed by Forbes magazine? Are you close enough with that person to reach out and ask if they could refer you to a contact there? The answer won’t always be “yes.”

You do not – repeat do not – want to ask people you barely know to help you achieve something.

For example, let's say you notice that a connection on LinkedIn has been featured in Business Insider and you want to be there, too. Make sure you build a relationship before asking them to connect you with the person who interviewed them. Interact with that person, get to know them, and add value to the relationship by offering help or advice when possible.

In the long run, building relationships isn’t about seeing who can help you. It’s about helping other people and learning from them. Then, if and when the time comes where they can lend you a hand, they’ll be happy to do it.

Tip #7: Share your success

When you land an interview or magazine feature, do your part to promote it.

But make sure you do that the right way.

On the day your media drops, don’t just post a link to it and tell your social followers to check it out. Sure, you’ve done all this work to include a hook so you know it’s interesting to them. But you have to reiterate that hook or pull an interesting tidbit out from the interview when you share it. Why should they stop what they’re doing and read, listen, or watch? Lead with that, and you’ll drive more traffic to your new PR win.

There are our 7 PR tips for life insurance agents!

What's your process for getting media coverage? We'd love to hear your success stories.