If you’ve ever been jealous of how easy it is to sell a physical product online, don’t be – here are 4 eCommerce sales tactics you can use to sell insurance.

No time to read? Watch our video overview:

Of the 100 biggest companies in the world, Amazon has the third highest market value - $916.1 billion. It’s the most-used shopping app in the country, with 150 million+ people who use the mobile app monthly. Its nearest competitor, Walmart, has roughly 76 million mobile app monthly users. (Source: Oberlo)

It’s safe to say Amazon knows a little something about how to sell a consumer a product.

Every part of Amazon’s sales process and sales pages has been refined with data from hundreds of millions of purchases. So why not take advantage of what they’ve learned? Here are a few sales tactics Amazon uses that we can tweak and use on life insurance websites.

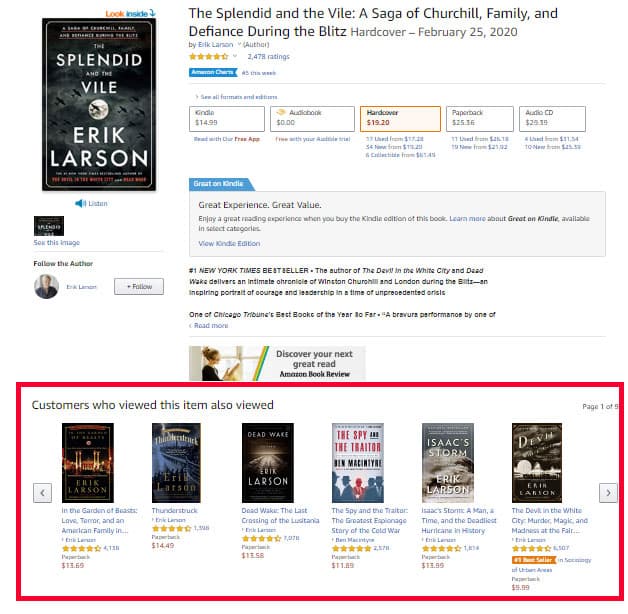

eCommerce Sales Tactic #1: Customers Also Viewed

Amazon loves to show you products that other people looking at the item in question also viewed or bought. This helps both parties. It helps Amazon make more money by selling you another product. But it also helps the consumer because some products inspire the need for complementary products, or simply pair well with others.

We can apply that same logic.

The difference? While Amazon’s recommendations are dynamic and generated by AI and huge amounts of data, ours will be static and consistent. They provide a valuable nudge to consumers to let them know what other people are also buying.

So how do you add “also viewed” products to a sales page when you don’t sell physical goods?

Take a look at your product and sales pages. Find a space below your “get quote” or “apply now” button. Add a row of content that’s similar to Amazon’s also-viewed. Give it a title like “Clients who buy term life insurance also buy” or “Insurance shoppers also viewed”.

Then add headlines, images, brief descriptions, and links to other types of policies or product categories you sell. You can begin to up-sell disability income insurance, long-term care insurance, and retirement solutions like annuities this way.

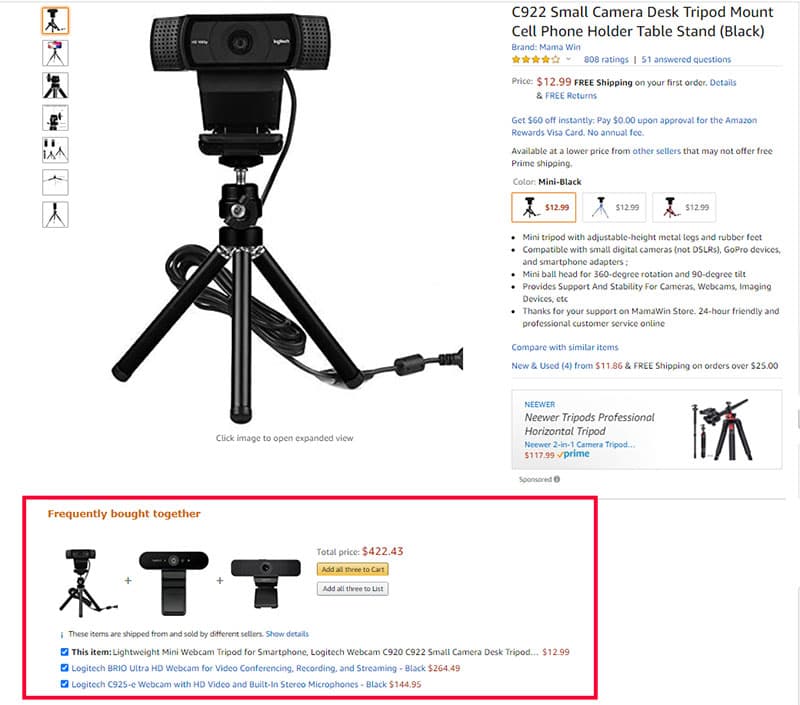

eCommerce Sales Tactic #2: Frequently Bought Together

This is similar to also-boughts, but it’s more closely linked to the actual product your client is looking at. On Amazon, for example, if you’re buying a microphone, their “frequently bought together” recommendations will include accessories like a microphone stand or pop filter. These are products intended to make what I’m buying perform even better.

What do we have that makes a policy perform even better? Riders.

To introduce the concept of riders, treat it like a “frequently bought together” section of your sales or info page. Create the same kind of content you did for also-viewed items, but include brief descriptions of riders that can make their policy even more valuable.

You don’t want to get too specific here – we’re not trying to create specific content about the actual riders available for a specific carrier’s policies. We’re just trying to use patterns your prospects already know to get them to ask you about riders. Pick 2-5 types of riders and create basic descriptions that pique their curiosity.

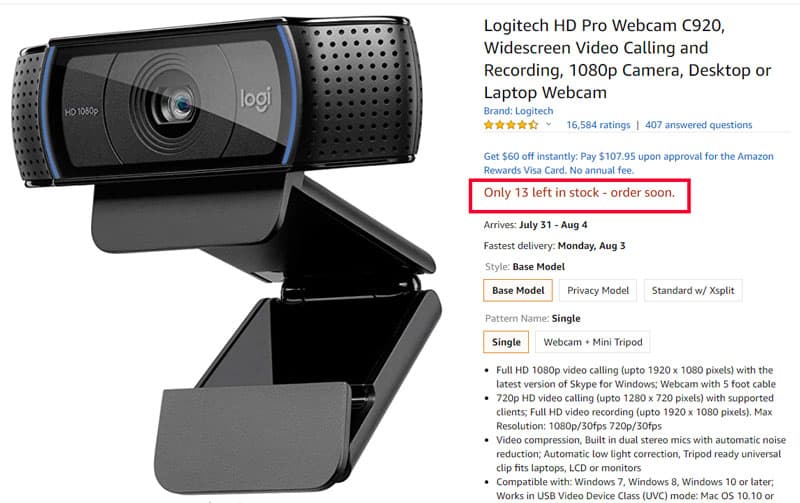

eCommerce Sales Tactic #3: Scarcity

Another thing Amazon loves to do? Tell you there’s only one left of what you want to buy. Doesn’t that scarcity make you want to click the “Add to Cart” button?

While we can’t do that with life insurance, we can try to inspire a similar feeling that acting now is in the client’s best interest. Are there any price hikes in the economic forecast? Right now, there are. Whiel life insurance prices have been at historic lows for years now, that’s likely to change because of COVID-19. Insurers simply can’t afford to keep selling simplified issue policies at those low prices. It’s very likely that in the near future, opting to skip an exam will mean paying more for a policy.

You can use this information to let your client know why it’s important to buy now.

Add a note to your sales page near the “apply now” or “get a quote” button that historic low prices and streamlined application processes may change soon because of issues caused by COVID-19. You might also include a pop-up tool tip or link to a blog post where you explain more about why this price increase is likely to happen.

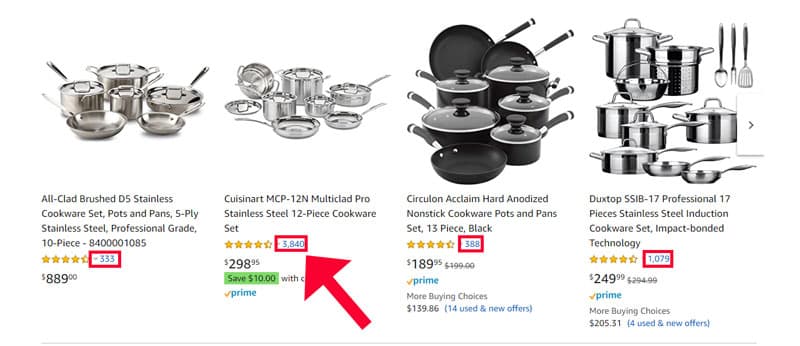

eCommerce Sales Tactic #4: Ratings and feedback

Consumers love to see what other people think before they buy. How often have *you* been swayed by the thousands of positive reviews for a product on Amazon? Or have you chosen not to buy because of a few negative reviews that struck a chord with you?

We can do that, too:

- All the carriers have ratings from financial institutions. Create a reference page on your site that lists this information, then link to it from your sales and info pages. For extra credit, display these ratings in your quote results.

- Post review snippets from your clients that explain why you and your agency are great to work with.

- Get testimonial quotes from clients that explain why they’re glad they bought life insurance.

That’s our quick look at 4 eCommerce sales tactics you can use to sell insurance!

Which of these methods appeal most to you? Are you already using any of them? Do these tactics help persuade you to buy stuff you find at online retailers?