What percentage of your clients are millennials? We’re guessing it’s pretty small. But that’s going to change, whether you like it or not. Let’s look at the facts:

- Baby Boomers will age and pass on. Their kids — millennials — are going to inherit the wealth you helped their parents grow and protect.

- Millennials are the largest demographic in the country—more than 1/3 of the total population.

- Millennials spend $1 trillion per year.

- Many millennials don’t have a financial advisor.

- 70% of millennials don’t know how to save for retirement.

If someone told you there was an untapped market that encompassed 33% of the population and spent a trillion dollars per year, 70% of whom needed your help, what would you do?

You’d hit the phones, right?

But that’s not going to work this time, because of all the things millennials do with their phones, talking on them is only their sixth-highest priority, according to a 2015 Vanity Fair survey. The strategies that worked with their parents and grandparents aren’t going to give you a foothold here. So what can you do? Let’s take a look at your best options.

Hang Out Where They Hang Out

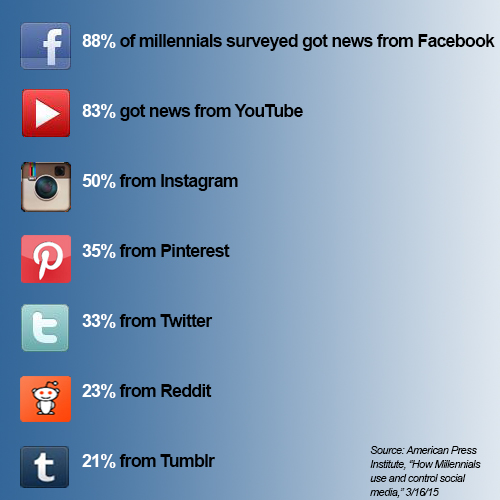

Millennials get their news online, period. Based on a March 2015 survey by the American Press Institute, here’s where they go to get that news:

What are they doing on these networks? Browsing headlines, looking at pictures, and seeing what their friends and family are up to. They get product recommendations from these friends and family members, as well as from online reviewers. If you’re not in the places they’re looking for that advice, they won’t know to come to you for help.

This gives you two tasks. The first is simply having a website or blog. This gets you on the map, and able to be found by Google in their search results.

The second task is to use the sites they use. Whether you actively post or not is up to you. If you don't post, you should check in periodically to keep tabs on headlines and trending topics so you know what they’re talking about and thinking about. If you've ever wondered what you should post on your blog or website, these trending topics can give you some ideas. From tech to the environment to celebrity news, marketing to millennials is going to involve making connections between life insurance and the subjects they're interested in.

Give Them Cool Stuff - for Free

5 out of 6 millennials connect with companies on social media networks.

Millennials are big researchers. In fact, 33% of them like researching more than they like buying, according to The Intelligence Group. This is one of the biggest challenges in marketing to them. They have unlimited access to knowledge, and a wide social universe from which to get recommendations. What's worse, they don't see the typical salesperson as providing value. The marketing funnel as we know it just doesn't work on them - they prefer to be in control of any brand experience they have.

One way to offer them the control they want? Give them the material they need to do their homework - and let them do it.

Brand all your materials, so any PDFs they take away from your site have your logo, contact info, photo, and links to more content with further information if they need it. You can bundle your most popular blog posts into an eBook, offer worksheets, case studies, product descriptions, and more. Whatever materials you produce, keep the tone light and conversational so the "homework" feel vanishes, and they feel more like they're discovering a great financial opportunity.

Don't Market to Them

More than 85% of millennials own smartphones - and touch their smartphones 45 times a day.

Millennials can sniff out advertising a mile away, and they don't want to be a part of it unless it's a brand they believe in. If you aren't a brand they believe in (yet), what are your options? You have to talk about "what's in it for me" - WIIFM. Don't ask for twelve different pieces of information about them in order to run a quote. Don't make it about you, how long you've been in business, or how much your other clients like you. Don't tell them they're making a mistake by not buying a policy. None of these tidbits answers the question of what's in it for them.

Instead, tell them how they can use the cash value of a permanent life insurance policy to do...just about anything. Tell them they can pull from their benefits if they get really sick and need help paying for health care. Tell them that socking money away in an IUL policy offers a guaranteed rate of return and zero downside exposure.