Creating a great customer experience is as important to your business as finding new leads. From quote to application to policy review, this process should be your bedrock – build it once, improve it as best you can, and let it earn you referrals and repeat business for as long as you own your business.

Step 1: Make your marketing about them, not you.

Your client’s experience with you begins long before they’re a client.

It begins when they discover you. That could be through a web search, Facebook post, or other marketing effort you’ve made. Whether they move forward depends on two things: (a) how they feel about the information you’ve laid out, and (b) how they feel about you. Even if most of your prospects are shopping for price, which you can’t control, there are many other parts of the process you can control to improve your conversion rate.

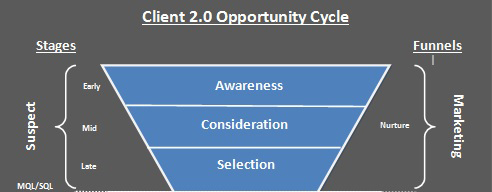

Map your sales funnel

Whether you realize it or not, you have a sales funnel. It begins with your marketing and prospecting efforts, both active and passive. As clients deepen their interactions with you, they move down the sales funnel, in stages that range from awareness to consideration to selection. Here’s a visual representation of this part of the sales funnel:

Every new client's experience begins with their entry point to your funnel. This is where you make your first impression – and you know what they say about first impressions. To evaluate yours, make a list of all the entry points to your sales funnel. These include:

- Stand-alone quoters

- Landing pages

- Website

- eBooks and downloadable guides

- Social media profiles

- Slide decks

- Business card

- Print ads in local magazines or newspapers

Now look at the images and messages you present at each entry point. The goal is to create a unified message and brand image. By unified, we mean that the main idea is the same, even if the exact wording is different. Your messaging should tell the client two things: (a) what’s in it for them? and (b) how do they move forward?

We’ve talked about this point before, but we’re bringing it up again because it’s crucial to your success. A prospect who’s not sure they need life insurance won’t be swayed by your number of years in the business. They’ll only be swayed when you convince them that the benefits of life insurance are worth the time and cost it takes to get it.

When you create your master list of funnel entry points, be sure the messaging fits the specific needs and personality of each platform. This may require you to write several tailored versions of your message. For example, your Twitter bio can only be 160 characters, while your website’s home page has much more space. In terms of mood and tone, you can be more informal on social media than on a business card or print ad. Spend a few minutes thinking about who you're hoping to reach on each platform, and tailor your message accordingly. Store this document somewhere you can access it from any device, such as Evernote or Google Drive. Now you can be sure you have a consistent, client-focused message across all platforms.

Extra credit: Standardize your profile photos, headers, logo, and background images for consistent visual branding. Need a guide to the various image sizes on social platforms? We like Sprout Social’s – it’s continuously updated.

If you serve a niche

Every rule has an exception, right? If you serve a niche market, you may want to craft a message that's partly about you. Your expertise is a valuable marketing tool. In this case, it may be effective to tell the consumer why you’re the right choice – but only because your experience is directly related to their circumstances. For example, if you specialize in insuring prospects with diabetes, your value proposition to the client may be something like, “Think you can't get life insurance because you have diabetes? I specialize in finding coverage for clients with well-controlled Type 2 diabetes diagnosed after age 40.” That value proposition does speak to your experience, but it also tells the client you understand their problem in a way another agent might not.

Step 2: Use drop-ticket processing.

I can’t wait to do my life insurance application...said no prospect ever.

Like income tax, the application process isn’t something your average prospect looks forward to. It has the potential to be time-consuming, confusing, and scary – especially if they have an impairment that could affect their rates or coverage opportunities. Then there’s the waiting...and the underwriting, which is often full of jargon they don’t understand. The whole thing is easier to avoid, which is why you may lose touch with some prospects after they reach out initially.

How do you keep the process streamlined and remove these obstacles for them?

You use drop-ticket processing.

Experts vs. generalists

If your first instinct when you think about drop-ticket processing is, “No way, I want to help my client through the process every step of the way,” think of it like this. What happens when a patient checks into a hospital? That patient may see a neurologist, an orthopedic surgeon, and a physical therapist to treat a single condition. Each doctor is an expert in his or her field. Just because the neurologist doesn’t take the patient to physical therapy doesn’t mean the neurologist didn’t provide a crucial part of patient care.

In this case, you’re the expert at selling. But you’re not necessarily an expert in application submission or individual carrier requirements. For example, how many times have you had to go back to a client and ask a question that got missed on the application the first time? Or request more information for the carrier? Or print another carrier form after you downloaded the wrong one? These types of follow-ups create disruption in your client’s life. That’s not the experience you want them to have.

If you can avoid damaging the client experience by outsourcing part of the process, that's a smart decision. If your client asks why they need to talk to someone else, position your drop-ticket app submission team as the expert in life insurance applications. You're more than welcome to become a Pinney partner and work with us - but if you choose to look elsewhere, the concept remains the same. You're looking for an expert in the life insurance application and submission process. Don't worry about being out of the loop for part of your client's experience. Any good drop-ticket team will keep you updated without you having to ask. Plus, we'll show you how to keep tabs on the client experience in the next step.

Step 3: Request feedback.

Once you’ve improved your sales funnel and smoothed out the application process, you’re done, right?

Almost.

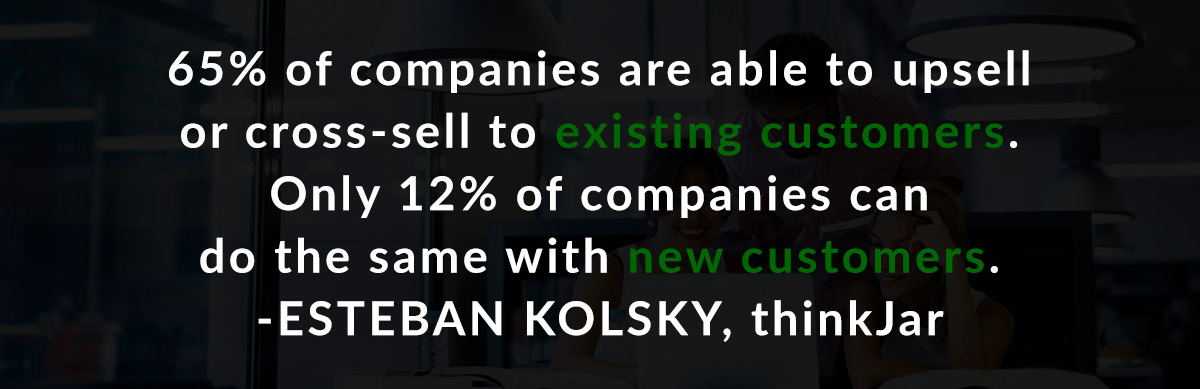

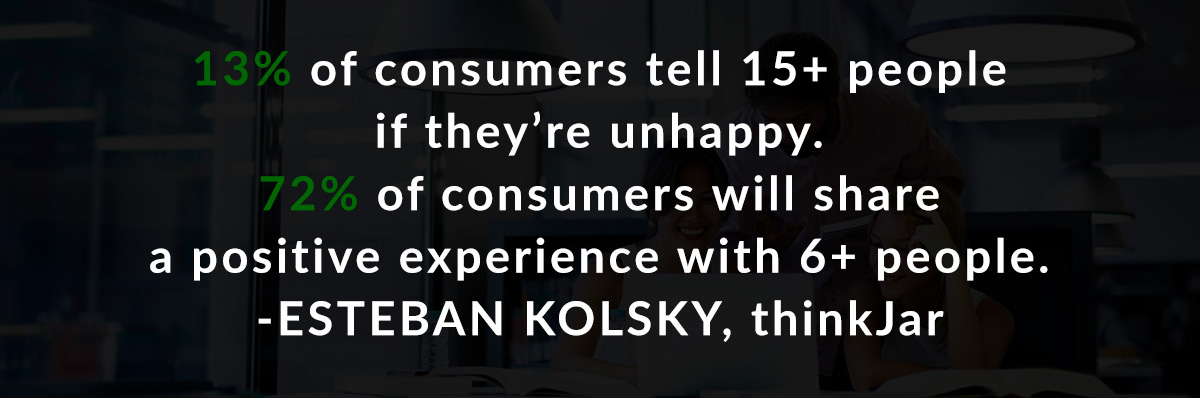

Your client has a policy and you got paid, but there’s always more you can do. It's probably hard for you to remember what it’s like to go through the application process for the first time, so why not ask your clients for feedback? According to customer strategy expert Esteban Kolsky (a former Gartner analyst), only 1 out 26 unhappy customers will complain. What about the other 25? What if their complaints are things we can address? Even happy clients often have suggestions or insights we can use to improve our processes.

To ask for feedback, send a simple survey to clients after their polices are in force. It’s really easy to do this in Insureio, our CRM of choice – and a subject for a future blog post. If you aren’t using a CRM or email marketing software, you can email a survey link directly to your client.

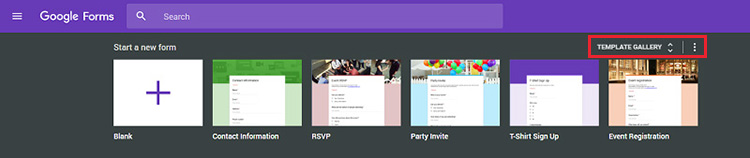

Create a Survey with Google Forms

Google Forms are free to use, with a pre-designed Customer Feedback template.

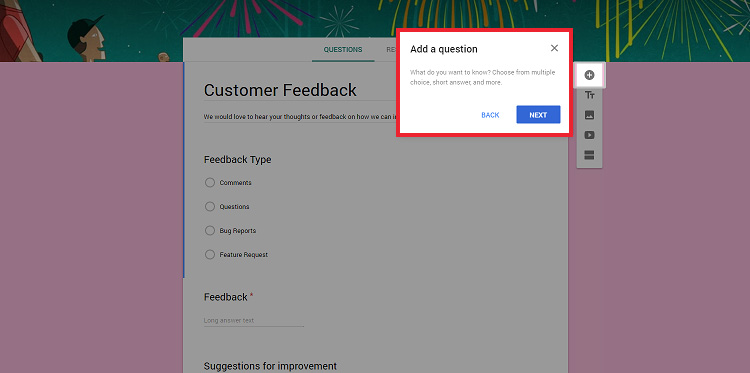

When you click a template, you can change the colors, background image, and more. You can add pictures or a YouTube video, as well as include multiple choice, short answer, and quiz-style questions. You can even add a confirmation message and collect your recipient’s email address. Here's what the form builder looks like:

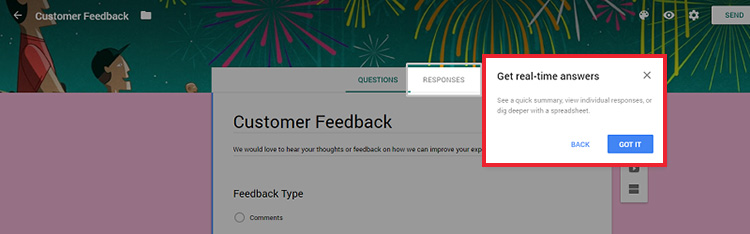

When you’re done building your form, just email the form’s URL to your clients. Once you send your survey, click the Responses tab to see real-time results.

So what should you ask in your survey?

The goal is to ask a mix of open-ended questions and yes-and-no or multiple-choice questions. The easiest open-ended questions to ask are:

- What do you wish you had known before applying for life insurance?

- Is there any part of the process that surprised you?

- What could I have done to make this process easier for you?

In terms of multiple-choice questions, you could ask things like:

- How much did you know about life insurance before applying? (a lot, a little, nothing)

- During the application process, did you receive updates in a timely manner? (yes, could have been better, no)

- Did you feel like it was easy to contact me or my staff with questions? (yes, could have been better, no)

These tips are just the beginning of what you can do to create a great customer experience. There’s a lot we can’t control due to the carriers, products, and pricing. But what you can control is your client’s first impression and how they feel during the process.