If you’re like most agents, you want creative ways to find new leads. You could always buy leads, but if you want to supplement paid leads with organic ones, this post is for you. Think of each of the lead sources described below as a stream of income. The more well-rounded you are in terms of lead sources, the more future-proof — and profitable — your client base will be.

The best way to use this post is to bookmark it, read it, think about it, and come back to it over time. The right lead sources for you will depend on your agency’s needs, budget, and your personality. You’ll get the most bang for your buck when you commit to one or two of the strategies below and give it time to mature. In other words, these aren’t get-rich-quick schemes. They’re long-term strategies to build your brand, your reputation, and your client base.

Strategies for Traditional and Hybrid Agents

We’ve talked before about the different types of agents we work with. Some prefer to meet clients face-to-face. They like doing business the traditional way, and their strength is in that one-on-one connection. If this sounds like you, the methods below can all work for you. If you’re a hybrid agent who meets some clients face-to-face but also generates online leads, you can use the strategies below, too.

1. Referrals

This is the golden ticket – a stamp of approval from a happy client that nets you a brand-new prospect. Chances are you already get a few referrals without doing a thing. But if you want to make referrals a full-on revenue stream for you, you need a standardized, systematized way of handling them. Often, it’s as simple as adding a request for a referral to your existing process whenever a client’s policy is placed in force.

The best referrals come when you give your client something (or someone) specific to look for in their circle of friends, relatives, and co-workers. By asking if they know anyone with a particular job, health issue, or planning need, you’re making it easy for them to identify someone. Even better, they know you have experience in that area and can refer you with confidence.

Here are two ideas for turning referrals into a revenue stream:

- Just getting started: Send a letter or email to your clients once their new policy is in force. Ask them to give that letter to friends or family members who need coverage. This request will be in the top half of the letter. The bottom half should introduce you. Include a photo, contact info, and a brief, sincere reason why the recipient should contact you. Use your client’s name, like in this example sentence: “I just helped John Doe protect his family with a new term life policy. He wants you to know I’m here to help if you want to do the same.”

- Swing for the fences: Ask your clients to write a quick note, make a sketch, or film a quick video on their cell phone. The purpose? To have them show how they feel knowing their coverage is in place. Get a copy of what they produce. Next, create a unique letter or email for your client to give to people they’d like to refer. Keep the intro short, written from your client’s point of view. Something like this: “I just got life insurance coverage for my family. It’s not something we normally talk about, but since you have a family too, I thought you might be interested. My agent can help.” Next, include a copy of the client’s note or sketch, or provide a screenshot and URL for their video (upload it as a private video on YouTube first). Afterward, include a short message from you, the agent, introducing yourself, as described above.

2. Speaking Engagements

Many agents overlook speaking engagements because they don’t know how to get them. Most are small and informal, not much different than talking to a client. Although most gigs don’t pay, it’s a form of prospecting that can reward you big-time if you create a rapport with the audience.

To get started, you’ll need a simple demo video. No fancy equipment needed here—just start with a cell phone camera. Create a short (<1 min) video where you answer a common client question, or introduce yourself and your expertise. Later, you can update your demo with clips from other events. Right now, you’re just showing you’re knowledgeable and comfortable speaking.

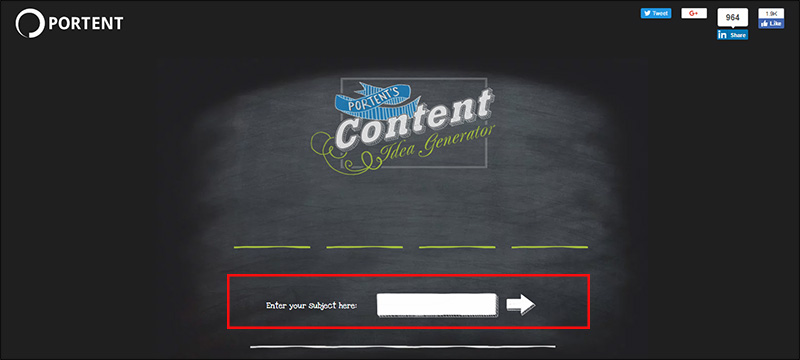

Before you pitch anyone, remember that it will be easier to get booked if your topic excites the audience. I know, we’re in insurance…not the most exciting field, right? So tie your topic to current events to amp up the interest factor. For example, what estate planning mistakes trip up everyone from celebrities to sports stars? What are the 5 most common retirement planning mistakes you see? Which financial advice gurus have it right…or wrong? Need more help? Try the headline generators from HubSpot, SEOPressor, or Portent (shown below).

Once you have a demo and an angle, you can find speaking engagements a few ways:

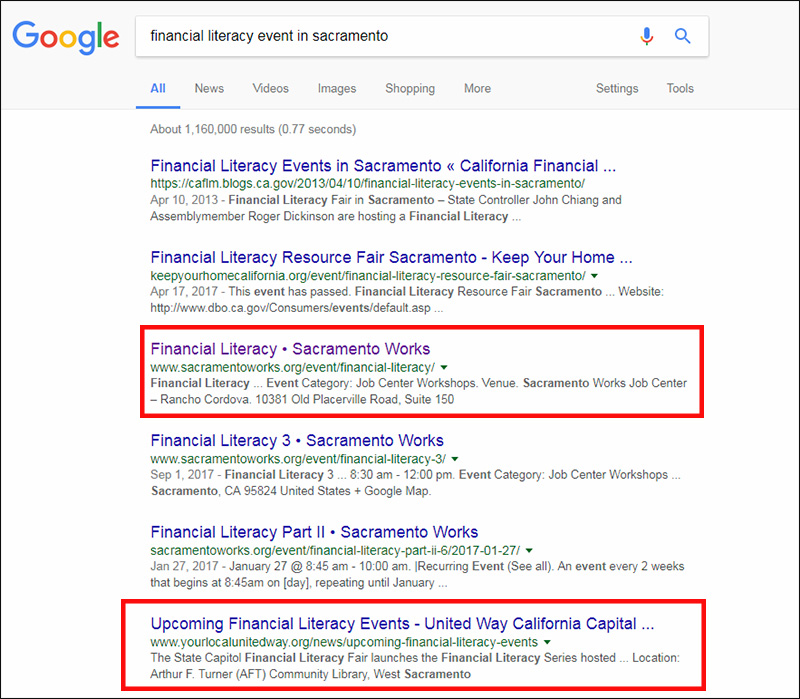

- Local events. Your chamber of commerce, service clubs (Kiwanis, Rotary, etc.), newspaper, public library, churches, and nearby colleges & universities are good sources of community calendars and events. Or Google “financial literacy event in [your state or city]” or “[city/state] [profession] conference.” Contact the event planner and ask (briefly) if they’re accepting new speakers, then tell them what you’d speak on. If asked, provide more detail about your professional experience and presentation topic, as well as your demo video.

- Conferences. Once you have a good demo video and some speaking experience, you can aim a little higher. The basic procedure is the same – you find relevant events your target market is interested in, contact the event coordinators, and make your pitch. By this point, you should be experienced enough to craft a custom pitch/topic for each event. If you’re a hybrid agent, be sure to put your speaking resume, clips, and testimonials on a page on your website specifically aimed at event planners and promoters.

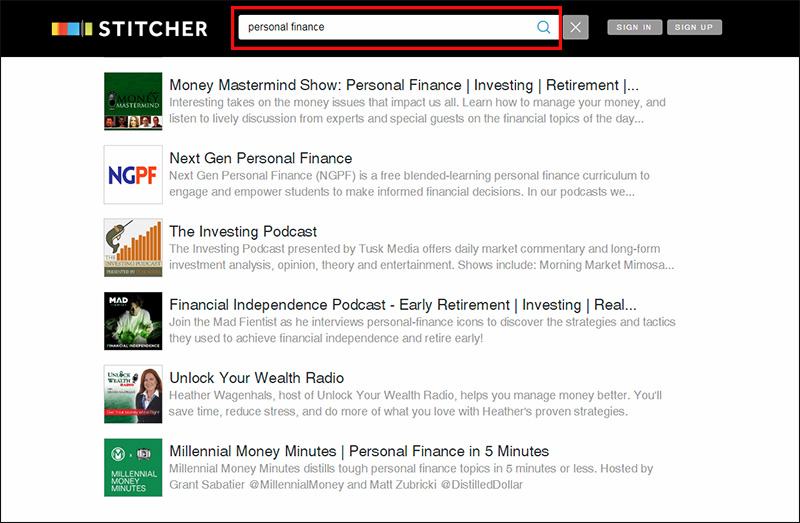

- Podcasts. Think of podcasts as a new version of old-fashioned radio shows. An interview here is a form of a speaking engagement. The two biggest podcast repositories are Stitcher and iTunes/Apple’s Podcasts app. Use the search function to find podcasts related to personal finance or your niche.

- Think outside the box. Whether you’re a fan of social media or not, you can use it as a search engine. Search Twitter for hashtags like #callforspeakers, #conferencespeaker, and #conference. Check Meetup.com and Eventbrite.com. Or scope out other agents’ LinkedIn profiles to see where they’ve spoken. Your client list may also be able to help, if you let them know you’re available to speak to large and small groups.

3. Public Relations

What the heck is public relations, anyway? It’s how you interact with journalists, bloggers, and the news media, both online and off. Good PR can result in being interviewed by journalists for magazines, radio shows, blogs, or even TV shows. There are a few free tools you can use to generate free PR for your agency. Yes, free—all it takes is a little time.

Here are 3 ways to increase your visibility with PR:

- Websites connecting journalists with sources. You might remember HARO (Help a Reporter Out), which was sold to Cision, a PR software company. The good news is the founder of HARO has started a new organization, HERO - Help Every Reporter Out. You can sign up to be a source for journalists here and share your expertise with their readers. There are also paid services you can use to get connected with journalists. They're not cheap (often $150+/month), but if you're looking to become known as an expert or want quotes and clips for your website, this is one way to get them. Sites like this include JustReachOut, Muck Rack, SourceBottle, and Qwoted.

- Social media. Once again, the hashtag is your friend. Twitter is the platform of choice for journalists requesting information. Search for #PRrequest, #journorequest, #bloggerrequest, and #HelpAReporter. If you use a social media manager like Hootsuite, create a stream for each hashtag and check them a couple times daily.

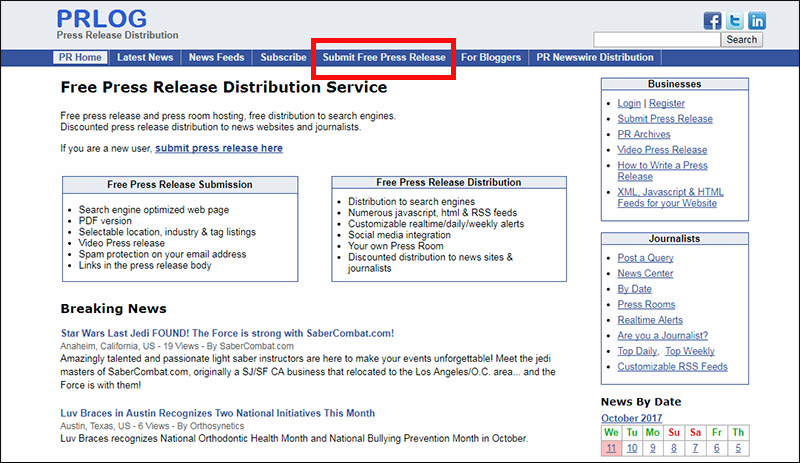

- Press releases. Yes, you can publish your own press releases for free – but only if you have real news to share. If you’re speaking somewhere, that’s a great reason. If you’re participating in a national campaign (Life Insurance Awareness Month or Insure Your Love, for example), that’s a great reason. Try Free-Press-Release, Newswire Today, OnlinePRMedia, and PRLog.

4. Traditional Advertising

Paying to advertise in newspapers, magazines, direct mail, TV, and radio can still work as a lead source, if that’s the type of media your prospects pay attention to. Do you serve the senior market? Daily newspapers in your city may be a good bet. Do you serve a niche? Trade or special-interest publications have dedicated readerships already invested in that topic. Local TV and radio stations can also help you drum up more in-person business. There are also options like phone book ads, billboards, bus bench ads, and more.

One big problem with traditional advertising is tracking its ROI. You could start asking every client who calls or drops by how they found you, but there are other ways to track ROI without putting a client on the spot.

Here are two ways to track ROI in traditional advertising:

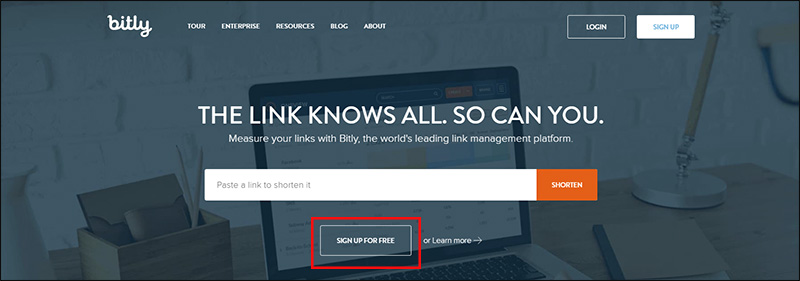

- Provide unique URLs. Even old-school marketing techniques can drive traffic to your website. To help track ROI, use different URLs in different ads. Google Analytics can then tell you how many visitors came to each page on your site. This is as easy as creating a new page for each ad you run. For example, you might use MyHomePage.com for a billboard, and MyHomePage.com/bonus when offering a free download or consultation in a local radio ad. You might also want to use a link shortener so prospects don’t have to remember a long URL. Bitly and Goo.gl are both good options here.

- Provide unique phone numbers. If you’re starting small with one ad, you can set up a corresponding Google Voice number, and forward calls to that number to your office or cell phone. Google Voice will also email you transcripts of voicemail messages, super handy for after-hours calls. Similarly, there are paid call tracking services like Grasshopper that provide you with different phone numbers and a virtual phone system that can route all incoming client calls to your preferred phone number.

5. Partnerships

Partnerships with other local professionals is a great way to get new leads. You do the work once, and let the referrals trickle in for months and years afterward. It can take some time reach out, build relationships, and choose the right partners. But once you do, you have both a constant source of referrals and a partner you can call with questions if your clients ask a question you can’t answer.

There are certain life events during which prospects are more likely to think about insurance. When a prospect works with a lawyer to create their will, for example, they’re clearly planning ahead. If you and that lawyer were partners, you could each present clients with a list of partners who can handle related issues. This can also be as hands-off as leaving business cards or flyers with a partner.

Here are a few ideas for partnerships:

- Lawyers. When people need a lawyer to make a major life change, their insurance needs probably change, too. Because lawyers specialize, there’s room to partner with a family law attorney, an estate/wills/probate attorney, a business attorney, and more.

- Real estate agents. Buying a home requires clients to get their finances in order. They’re already thinking about money and the future, so why not see if they’re interested in protecting that future with life insurance?

- Daycare providers. Life insurance protects families…and who’s more invested in family than the parent of a young child?

- Professional organizations. Remember that list of places to look for local speaking engagements? Those organizations might also have lists of local professionals for members who need services. If you develop a relationship with a group, you can ask if they have a list like this you can join.

- Accountants. If your niche is business insurance and succession planning, see if you can partner with a local accountant or CPA. You may be able to leave cards and brochures with them, or request that your contact information be included with any new client welcome kit they provide.

6. Write for Publications Your Clients Read

You may have enough insider knowledge to write an article for National Underwriter Property & Casualty, but only your peers will see it. If you want leads, go where your prospects go. Which magazines do they read? Are there local publications that reach an audience you want to work with?

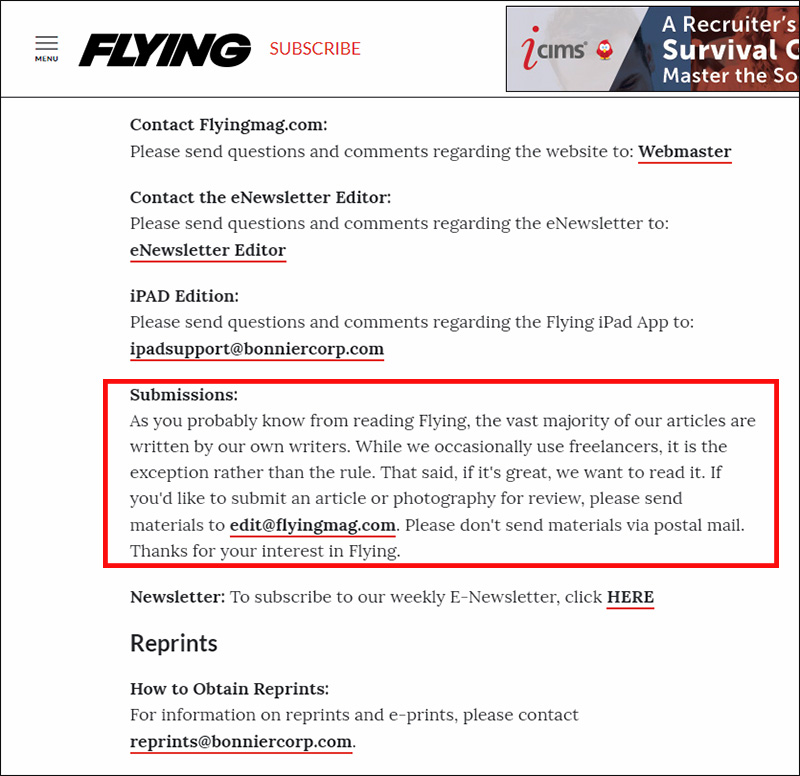

This approach works especially well if you have a niche. Do you help business owners set up their succession plan? Many metro areas have business-specific magazines (we have the Sacramento Business Journal, for example). Do you specialize in high-risk clients, like smokers or aviators? Search for niche publications they’re likely to read, like Pipes and Tobaccos or Flying.

If you’re not sure what to write, browse the magazine’s website to get a feel for their readers. Then imagine someone who fits that description walked into your office. What would you say to them if they asked for life insurance coverage? Which issues should they consider? What will underwriting be most concerned with? If they’re already covered, can you help them save with a new policy?

Most publications offer submission guidelines via their website. Check these before pitching or submitting. If you can’t find submission guidelines, check the FAQs and Contact Us page. In the case of Flying magazine, shown below, their contact page contains the info you need. TIP: When you see a publication that discourages sending an article you’ve written yourself, pitch yourself as an interview subject!

7. Books

A book is the new business card. Imagine having copies of your book in the lobby of your office. Or bringing copies to sell at a trade show or local event. A book instantly signifies authority—you literally wrote the book on your subject. If you’re at all interested in speaking gigs, a book can help convince an event planner that you’d be a valuable addition to their lineup.

It’s not just big-name financial gurus like Dave Ramsey and Suze Orman who wrote books. You may be familiar with Jeff Rose (GoodFinancialCents.com). He has a book geared towards consumers called Soldier of Finance. You might also be familiar with Seth Godin and Guy Kawasaki, both of whom went from blogs to books to big-name influencers.

But I can’t write a book, you say.

You totally can. You so totally can.

Here are a couple easy ways to do it:

- Blog your book. Break down the topic you want to write about into 10-15 chapters. Write the first draft of each chapter as a blog post. Include a chapter for frequently asked questions, and there’s your book!

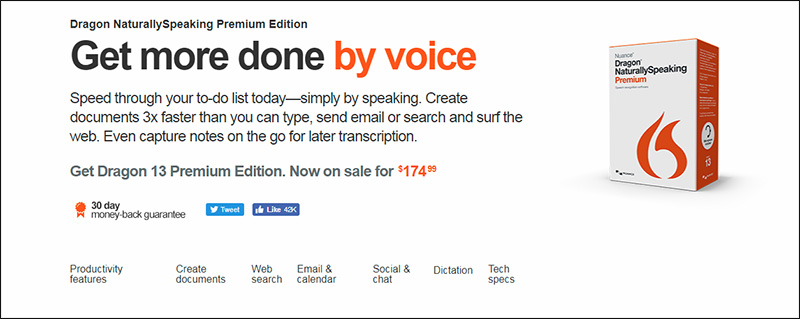

- Dictate your book. Hate the idea of writing? Try a combination of voice recording, dictation, and/or transcription. Record voice notes on your phone – pretend you’re talking to a client who knows nothing about life insurance, and start from the beginning. Next, you can either send those digital files to a transcription service, or load them on your computer and use dictation software like Dragon to transcribe them. Dragon software isn’t cheap ($99+), but if you get the hang of dictation, everything you type now could soon be handled with a headset and your voice.

- Create a workbook. Intimidated by the idea of writing a whole book? Try creating a workbook instead. A workbook could include forms, questionnaires, lists where clients jot down their financial accounts and data, financial calculator worksheets, and more. You can include lists of resources and to-dos, as well as the forms listed above. Of course, don’t forget to add calls to action that explain how you can help secure their financial future.

- Hire a ghostwriter. If you like the idea of having a book as a marketing tool but don’t have time to write one, a ghostwriter can take your notes and prepare a finished manuscript for you. It won’t be totally hands-off, however; you’ll still need to provide notes and interview time so they can get a feel for your style.

Once you have a manuscript, you have a world of options. If you get to this point and want more advice, let us know. You can self-publish easily these days, or hire freelancers to spiff up your manuscript, format it, design a cover, and get it published for you, all in digital, paperback, and audio formats.

Phew! That’s our look at 7 ways to get new leads for traditional and hybrid agents.

There’s a lot of information here, so please bookmark this page and come back to it over time. Think about the strategies that reflect your strengths. Are you great with people? Try looking for a speaking engagement. Are you more comfortable with the written word? Then start looking for publications that your niche target market reads. As always, feel free to ask questions in the comments below.