You can probably tell by now that the books we read have to do with two things: becoming better salespeople and making better use of our time. This August, we're reading a book that covers both.

You'll get a feel for the author’s premise when you look at the title of his previous book: It’s Not the Big That Eat the Small, It’s the Fast That Eat the Slow. This second book is all about becoming more productive without increasing your staff or spending money on things that don't actually help you achieve anything.

It’s about doing more with what you already have. But how?

Successful Businesses Define Their Objective

Turns out, the "less is more" thought process starts when you define your objective. Sounds easy, right? Well, maybe not. Your objective has to be a big one...and the right one.

Keep in mind that "big" and "complicated" are two different things. That's where a lot of companies go wrong. Your objective is what you want to provide or be, not how you are going to provide it or why. Successful companies are able to distinguish between these two. Jennings notes that “in productive companies, the culture is the strategy” (3). Is your objective something you and your staff can build a culture around?

That objective, Jennings says, shouldn’t change over time. Oftentimes, struggling companies will change objectives instead of changing the way they reach that objective. Instead of focusing on selling insurance, for example, a struggling agent might focus on expanding his one-man operation into a team, thinking other agents will help bring in more business. But then the objective is to find partners, not to sell insurance. It's a complete shift that affects everything about day-to-day operations.

Choose your objective wisely and commit to it.

But that raises another question...how do you know you chose the right objective?

Successful Businesses Live Their Objective

First off, your objective needs to be specific. You can’t just grab a sentence from your mission statement and use that as your strategy. As a life insurance agent, your objective isn’t “giving families peace of mind,” for example. Nope. Way too broad, Jennings would say.

Secondly, it needs to be personal. The objectives of the most successful companies Jennings studied came from transformative moments in the lives of the decision-maker. As an example, he talks about Yellow Freight and the CEO’s realization that the company’s debt load was going to put them out of business very soon. That realization prompted a huge change in objective – from freight to customer service. If they couldn’t ship faster or cheaper than their competition, they could provide better customer service.

Once you have your objective - and it's specific and meaningful - you can start implementing the tactics Jennings found among highly successful companies.

Successful Businesses Do More with Less

The success stories in this book hinge on getting rid of what you don't need. This isn't the kind of book that tells you to make a vision board, hire a consultant, or move your office to a trendy part of town. Just the opposite, in fact. This advice asks you to take stock of what you have and pare down to the essentials - then refine them.

Here’s a quick run-down of advice that caught our attention:

- Be open and honest. It sounds basic, but things like open doors and truthfulness go a long way toward establishing trust among employees and clients. This includes being honest about company policies that seemed like a good idea at the time or staff members who aren’t working out – because increasing productivity requires the ability to get rid of what’s not working, and it’s hard to do that without honesty.

- Tear down the bureaucracy. You might not think this applies to you as an insurance agent. If you’re working for a carrier, you can’t do much about their bureaucracy. If you’re running your own agency, you probably don’t have a lot of bureaucracy. The idea here, however, is that you don’t want layers of obstruction between you and what’s necessary to achieve your goal. This includes everything from multiple layers of managers to expensive office décor. How do those things help you fulfill your objective? If you can't answer that, get rid of them.

- Think hard about the people working for you. This may sound harsh, but Jennings believes that “foot draggers just go through the motions, using up oxygen, contributing nothing to company improvements” (79). Ouch. But there’s a bit of a bright side here. As one of the profiled execs notes, it’s often not fair to keep the unproductive folks with you if they’re going to be miserable when you change directions. In the book, this tough love is applied to executives and managers – not workers. If your workers aren’t being productive, that might be because you haven’t hit the next bullet point.

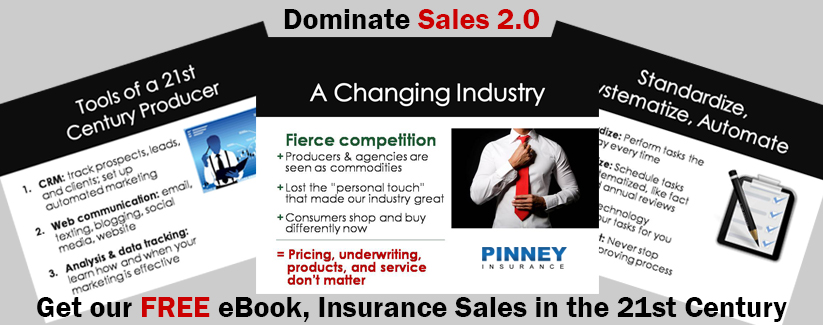

- Systematize everything. We are all about the principle of “standardize, systematize, automate.” Jennings notes that many salespeople don’t like systems because it feels like they’re being told what to do. But systematizing is a key step in getting rid of wasted time and money. You have to spend the time to figure out the fastest, most efficient, most productive way of selling life insurance – and then sell it that way every time.

- Improve constantly. Once you get your system in place, you can't sit back and relax. Financial success doesn’t mean you can stop trying to refine your process or find new ways to stay competitive. Can you reduce overhead? Can you offer even better customer service? Can you reduce sales cycle time? Most importantly, what could be improved in your process from the customer’s point of view?

This is a lot to digest, we know. But every one of these points circles back to the book’s title – Less Is More.

None of these points involve spending money or expanding.

It’s all about narrowing your focus and getting your business in the best possible shape to deliver value to your clients. Whether that’s partnering with a BGA like us to deliver more coverage options for your clients or preparing a manual to systematize follow-ups, cross-sells, and referrals, do it.

Take the time, make the commitment - and learn to do less with more.