Our July 2020 sales kit is all about financial independence. What does that mean? A long, happy retirement for your clients - free from worry about outliving their income.

Back in the day, financial independence meant getting an allowance. Then it meant getting a job and living on your own. Now? It means helping our clients navigate the seemingly endless challenges standing between them and a safe, long, happy, secure retirement. Luckily, we have one of the best possible tools in our arsenal: cash value life insurance. Cash value life insurance provides a host of benefits for retirement, from supplemental income to riders that make the death benefit available in cases of terminal or chronic illness. Plus, it gives peace of mind knowing that the death benefit will go to the kids or grandkids, income tax-free.

What’s in the Kit

Our FREE 50-page kit includes:

- 2-page sales idea: cash value life insurance in retirement planning

- 2-page case study: permanent life insurance in retirement planning

- 4-page sales idea: IUL in retirement planning

- 6-page producer marketing guide to longevity planning

- 12-page financial objectives conversation starter/discussion guide

- 2-page client flyer on managing when and how you're taxed

- 4-page article on using a diversified portfolio to help manage volatility

- 2-page article on the power of tax deferral

- 6-page consumer guide to life insurance and financial planning for women

- 4-page consumer guide to longevity planning

- 4-page consumer guide to permanent life insurance

How to Use This Month’s Sales Kit

Browse the pieces in the kit to find tidbits to use on social media, in emails, and approach letters to your prospects. For example, on page 2, you'll find a comparison chart that pits the cash value of a permanent life insurance policy against traditional sources of retirment income, like investments, and IRA (traditional and Roth), and muni bonds. That chart shows you where cash value shines - with tax-favored withdrawals, tax-deferred accumulation, no contribution limits (provided the client buys a high enough face value), and no mandatory withdrawals. Each of those facts could become teasers on your website, or in an email campaign.

Get the KitInsureio Subscribers: Use Our July Email Marketing Campaign

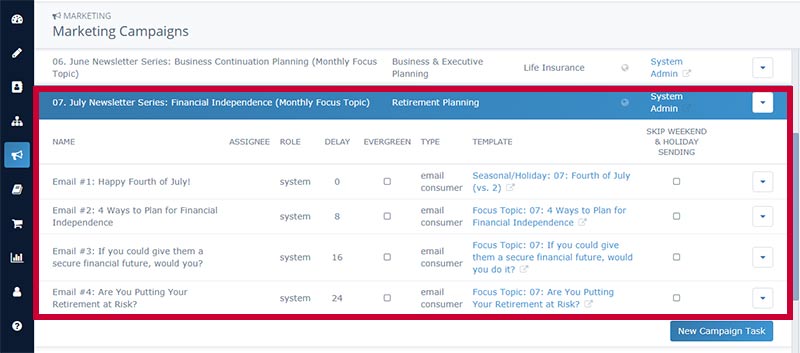

Are you an Insureio subscriber? If so, you have access to a pre-written marketing campaign for July. It includes four emails for your clients and prospects, pre-scheduled for delivery throughout the month.

These four emails focus on the basics: what life insurance protection offers, how cash value life insurance contributes to financial independence, how shared dollar life insurance can help families share the cost and the benefits of a policy, and the ways life insurance can help protect your client's retirement account. They're purely educational, and invite your recipient to learn more on the corresponding InsuranceDivision webpage, which contains a quoter and your contact info.

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click July Newsletter Series: Financial Independence (Monthly Focus Topic). You'll see the list of four pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our July 2020 Sales Kit Now!