Our April 2023 sales kit will help you start a conversation about income taxes - a timely topic this month.

Whether your clients got a tax refund this year or not, they're probably interested in ways to lower their tax obligation in the future. Who doesn't want to keep more of their hard-earned money? The good news is you can take this month's focus topic and choose whether to keep it simple or go into greater depth. Looking for a simple approach? Ask whether your prospect got a tax refund, and if so, show them how affordable it can be to buy a new life insurance policy. Looking for more depth? Talk to clients about tax strategies that will really add up during retirement, like living benefits, cash value withdrawals, and using the guaranteed income of an annuity to help offset unexpected expenses during retirement.

What’s in the Kit

Our free 54-page kit includes:

- 4 pages of images & post text for social media

- 4-page guide to using your clients' tax returns to grow your business

- 4-page conversation guide on the tax benefits of annuities

- 2-page quick tax reference

- 12-page 2022 and 2023 tax guide

- 1-page list of 2023 retirement plan contribution limits

- 4-page article on growing your business by working with CPAs

- 12-page consumer guide on key tax-planning strategies

- 6-page consumer article on tax changes in 2023

- 3-page consumer guide on the tax advantages of life insurance

How to Use This Month’s Sales Kit

Cast a broad net by asking prospects if they got a tax refund this year (or anticipate getting one). Wondering how many people, on average, get refunds? As of October 2022, the IRS had issued refunds to 108.6 million taxpayers, for a whopping total of $345 billion. If you do that math, that creates an average of $3,175 per taxpayer. (Source: eFile) Now, ask those prospects: why they wouldn't spend this to safeguard their family's financial future?

To start a deeper conversation, you can ask clients and prospects about their retirement plans. Have they factored in how tax planning could help them live better during retirement? For example, the conversation starter in this kit will help you talk to clients about annuities and their role in income tax planning.

Get the KitNeed help with quotes, illustrations, or selecting the right product?

Our Brokerage Managers - Dave, Joshua, and David - can help. They have incredible depth and breadth in terms of product knowledge. Call 800-823-4852 and ask for a brokerage manager, or click the button below to email us!

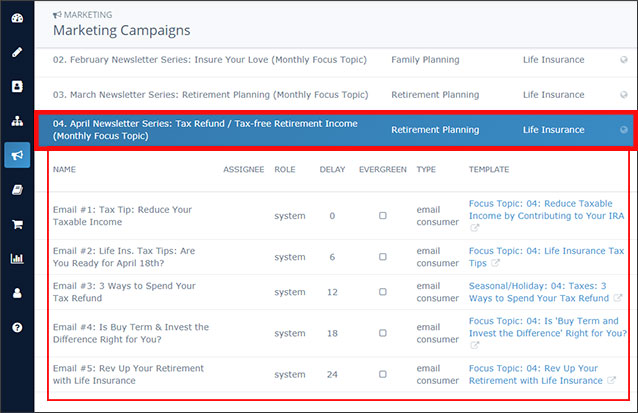

Insureio Subscribers: Use Our April Marketing Campaign

Are you an Insureio subscriber? If so, you have access to our pre-written marketing campaign for April. It includes five emails for your clients and prospects, pre-scheduled for delivery throughout the month. These five emails focus on general tax planning topics, including how to reduce taxable income by contributing to an IRA, using a life insurance refund to buy life insurance, and how an insurance-based retirement plan uses tax-deferred growth to sock away more money than you can with a 401(k) or IRA alone.

To preview the campaign:

- From your left-hand nav menu in Insureio, hover over Marketing and then click Marketing Campaigns.

- Scroll down and click April Newsletter Series: Tax Refund / Tax-free Retirement Income (Monthly Focus Topic). You'll see the list of pre-scheduled emails. To see what a template looks like, click any of the blue template title links. The template will open up in a new browser tab.

Want to learn more about Insureio marketing campaigns and how to enroll your clients and prospects? Click here to visit the tutorial in the Insureio Academy.

Download Our April 2023 Sales Kit Now!