1 in 4 of today's 20-year-olds will become disabled before they retire.

More than 25% of workers in their 20s will be disabled before reaching retirement, according to the Social Security Administration (SSA). But if you read that statistic to a client, chances are they'll think, That won't happen to me. But what if the weather report said there was a 30% chance of rain? They might carry an umbrella. What if they were told there's a 30% chance of winning the next Powerball draw? They'd probably buy a ticket. Disability insurance shouldn't be any different. It's our goal to give you the resources to help your clients understand why DI is so powerful - and why they need to protect their income now.

Our Disability Insurance Resources

Even if you've never sold DI before, we'll give you the tools you need to get started. If you're not familiar with the market yet, there are some strong offerings on the market, although availability will vary by state. Some carriers offer simplified financial requirements or allow for minimal medical underwriting, while others emphasize quality benefits or low rates. If you're new to DI, the best thing to do is email us or give us a call at 800-823-4852. We'll match your client's budget and financial goals with a top-rated carrier and policy. Here are some of our disability income carriers:

- Assurity

- Lloyds of London

- MetLife

- Principal Life

- Standard

- United of Omaha

Let us know how we can help your clients protect their most valuable asset - their income.

Disability Insurance for Individuals

Starting the DI conversation is often as simple as explaining to a client (a) how likely they are to need it, and (b) how little they may actually receive from other expected sources of coverage. We've got the facts and stats you need to present a compelling case. Let's get started:

We insure our cars. We insure our homes, whether we own or rent. We insure our pets, our possessions, and our lives. But what about the income that makes every purchase possible? That's what disability insurance really is - it's income insurance. If you can help a client understand that what they're doing is insuring their paycheck, the conversation will take a different turn.

Let's say your client is lucky and has a group LTD policy covering her income. Ask her to check the “fine print” in her benefits booklet - she may be surprised by what's inside. In many cases, her policy will pay 60% of her pay up to $5,000 monthly, after a 90-day waiting period. Here are just a few of the problems with this sample policy:

- If your client's earnings are over $100k, she'll hit her monthly benefit ceiling before getting the full 60% of her pay.

- A 90-day waiting period is a big problem if your client's savings can only stretch for 60 days.

- Getting 60% of a paycheck may sound good - until your client realizes that's actually a 40% pay cut.

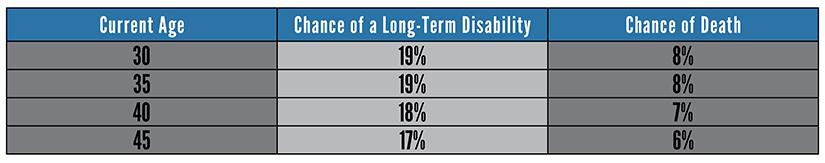

But now let's say your client still isn't convinced. Let's say he understands the importance of protecting his paycheck, but he still doesn't think a disability is ever going to happen to him. The statistics are on your side. Take a look at the likelihood of a long-term disability vs. death for a range of ages below:

Probability of a Long-Term Disability vs. Death

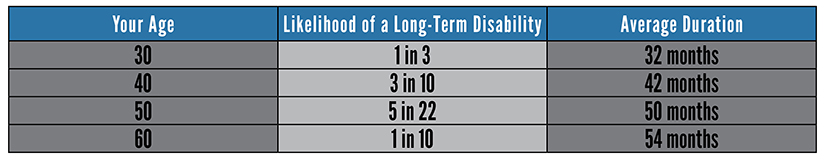

Average Long-Term Disability Duration

Okay, so now you're convinced your client that (a) they need income protection, and (b) a disability is more likely than they think. Now is the time when we hear many clients say, "But if I'm disabled, I'll get Social Security."

Yes, they might.

But how much?

Social Security benefits are limited. For example, in early 2019, Social Security paid an average monthly benefit of about $1,234 for disability. That's barely above the 2018 poverty level. Could you live on that much? Could your client? What if their disability lasted for 32, 42, 50, or 54 months, as in the chart above?

If the answer is no, disability insurance will give your client the peace of mind they need should a short- or long-term disability affect their lives.

Disability Insurance for Business Owners

If your client owns a business, it's even more important for you to talk with them about disability insurance. There are several different ways DI can protect the future of their business:

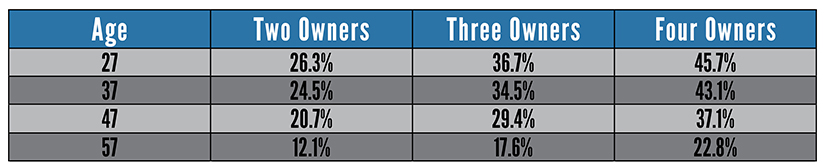

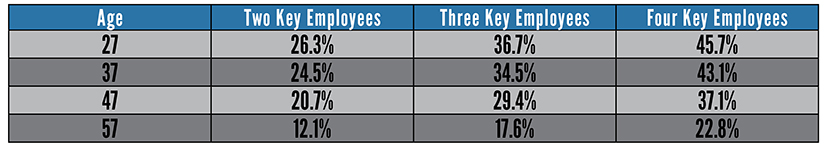

Sometimes it's not your client's disability that needs to be guarded against - it's the potential disability of their business partner. What are the odds that a business partner will become disabled for a significant amount of time (12 months or longer)? Check out this table:

Likelihood of a Business Partner's Disability

What would happen if one owner couldn't return to work? How long could the business afford to pay the disabled owner? At what point would the remaining owner(s) want to buy out the disabled owner? Where would the money come from? Without business disability insurance, there are four main options:

- Current earnings – Can the business afford it with reduced earnings and increased expense?

- Create a sinking fund – Is there enough time to accumulate the funds?

- Obtain loans – Who would loan that business money if revenues are down and expenses are up?

- Sell assets – But isn’t this liquidating the very business your client is trying to save?

Disability buy-sell insurance allows the owners to pass the determination of complete disability and the buy-out funding to a third party. It allows them to concentrate on keeping the business going without the services of the disabled partner. The advantages of using disability buy-out insurance to fund the buy-sell agreement are clear: It assures adequate funding for the disabled owner’s interest. It avoids a hit to working capital and the credit position of the business. It reduces the pressure to liquidate business assets to fund the buy-sell obligation. Perhaps most important, it can cover a funding need that arises just days after the creation of the buy-sell agreement.

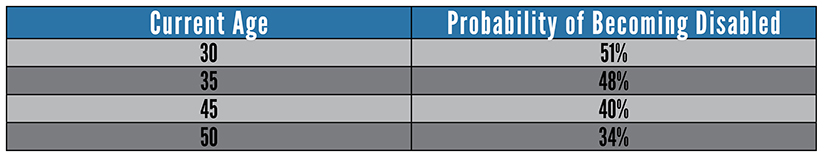

Your client worked hard to make his business successful. But what would happen to that business if your client were to become disabled? His income may be insured, but what about his business expenses? Who will pay them? First, let's take a look at the odds of such a disability happening:

Chances of a Disability Lasting Three Months or More before Age 65

Overhead expense disability insurance assures the owner of a business that the business will still be there when he is ready to come back after recovering from his disability by paying for some or all of these ongoing expenses:

- Rent or mortgage

- Property taxes

- Insurance premiums

- Equipment leases

- Accounting fees

- Collection expenses

- Utilities: phone, electricity

- Other fixed business expenses

- Salaries for current employees

But how would this policy work in real life? Let's say Dr. Anne Example owns her own dental practice. She has a disability buy-out policy that will transfer ownership of the practice to her two employees. The policy will buy out her interest after one year of disability. After speaking with her financial advisor, Dr. Example realized that she couldn’t afford to keep the practice running and meet her business expenses for an entire year without help. Her adviser recommended a business overhead disability policy that would pay benefits for 12 months, to coordinate with the waiting period under her buy-sell policy and assure herself that her practice will go on without her.

What about key person disability? Just as with the death of a key employee, there are potentially severe consequences to the business and to the employee, of that employee becoming permanently disabled.

- The business could purchase and be the beneficiary of a disability income policy to help off-set the extra expense of replacing the disabled employee and paying continuing compensation during the disability period.

- Executive benefits insurance plans provide enhanced income protection for executives and key employees who suffer long term disabilities. Executive benefits plans offer an economical and flexible way for employers to provide sufficient coverage for their valued employees.

Odds of a Key Employee Being Disabled for 12 Months or Longer before Age 65

Andrew Carnegie once said:

”You can take away my money and my factories. As long as you leave me my people, I will be where I was within two years.”

Businesses rely on their key employees to keep the business running smoothly. What would happen to the business if a key executive couldn't return to work? How long could the business pay the disabled key employee or owner? Where would the money come from to replace the key executive? The advantages of using disability income to protect a business from the loss of a key executive due to illness or injury are clear. It is also clear that a business should include disability income for its key executives as part of a tax-wise total compensation plan.

Advanced Sales Made Simple

Need a little extra help presenting a DI case? At Pinney, we want to make every sale and process simple for you and your clients. That’s why we create our “Advanced Sales Made Simple” series of tools, resources, guides, and planning concepts. In the series below, we'll take you through the four steps to get started selling DI.

Take a look:

This section will go over some essential statistics and key terms to help you better understand the basic premise for disability planning and the importance of income protection.

Most disabilities intrude silently and can last for several months or years. The chances of enduring a permanent or temporary disability before retirement age are much greater than the chances of dying, much greater than the chances of your house burning down, and much greater than the chances of totaling your car. Meanwhile, your health and ability to earn an income are your greatest assets. Auto and homeowners insurance may be mandatory if you have a car and a house, but consider protecting your greatest asset–your income.

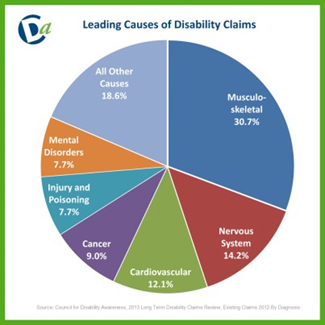

It is nearly impossible to predict what type of affliction may be coming. Many people assume that accidents are the most likely source of disability. While it is true that accidents are a very common cause of disability claims, there are many more silent illnesses that can wreak havoc on your day-today lifestyle, ultimately affecting your ability to continue working. Musculoskeletal conditions account for nearly one-third of all claims in America, followed by mental and nervous disorders.

Every 7 seconds. The rate at which disabilities occur is astounding. Not all disabilities can be prevented, but many people have taken the proper steps to ensure that their families will be financially protected. However, two-thirds of Americans do not have any private resources to keep their income flowing in the event of a disability. Individual disability income is just one way to make sure you are prepared in a serious time of need.

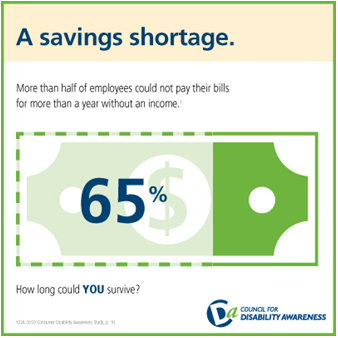

There is a shortage. Your savings account is the most logical place to look for money when enduring a disability. However, there may be several problems with this plan. First, most people do not have enough cash to keep them afloat through a long-term disability. More than half of employees could not pay their bills for more than a year without an income. Secondly, those who can use their savings will lose out on years of compounding investment interest—money that was earmarked for retirement.

Most people can't rely on just one resource. Not every solution is available to every person. In our experience, these are the seven most common sources of disability income for young people. It's best to be prepared with a game plan in case your potential disability income sources are reduced…or depleted.

Savings will often be the first line of defense against the financial wake of a disability. This may work in a short-term disability scenario, but you can run into problems when you are faced with a chronic condition like arthritis, cancer, or stroke. If you do have a well-funded retirement account then make sure you consider the financial repercussions of using your retirement resources.

Savings will often be the first line of defense against the financial wake of a disability. This may work in a short-term disability scenario, but you can run into problems when you are faced with a chronic condition like arthritis, cancer, or stroke. If you do have a well-funded retirement account then make sure you consider the financial repercussions of using your retirement resources.- Loans can be tempting when you are unable to work. This can create conflict if friends and family are your primary support system. Bank loans will want to be sure to receive the repayment of that loan, plus interest, at a later date. Furthermore, the bank may be unwilling to offer a loan to someone with a long-term disability.

- Workers' comp is mandatory for employers. This protects employees who are injured on the job or work-site. Fortunately, many employers go to great lengths to ensure that there are no accidents at work. This results in a very low percentage of disability claims and a statistically unlikely scenario for many gray and white-collar workers or those with desk jobs.

- SSDI is a federal program that pays Social Security Disability income, better known for payment of retirement benefits. Eligibility for benefits requires a vesting period like Social Security Retirement. Average benefits vary from $1000-$1500 per month. Applications are frequently denied. Second and third appeals are a routine practice when attempting to access SSDI benefits. Expect a delay of 15 months.

- State DI is not available in all states. In CA, SDI is designed to be a short-term disability plan for salaried employees. The benefit amount from CA SDI is limits benefits to 55% of wages up to $1100/week, and is payable only from Day 7 through Day 365. 1099 employees and other self-employed individuals are not automatically enrolled in this program. Anyone with plans to start a new business at any point in the future will need to understand that they may lose their SDI coverage.

- Group LTD is offered by many employers. Some things to consider, however, include the taxability of these employer-paid benefits. A common plan may pay 60% of income up to a designated maximum of $10,000/month, but remember the income tax burden on that benefit. Definitions typically change after a period of two or three years. Finally, it is important to consider what would happen if you left the company, or if the company decided to drop the coverage. All coverage could be lost if your company is forced to cut benefits or if you want to start your own business in the future.

- Individual DI policies can tackle most of the obstacles presented by the other options. Benefits are usually paid on a tax-free basis each month until retirement age. Coverage is comprehensive and is typically tied to your ability to do the substantial and material duties of your regular occupation. Since the policy belongs to you, only you can cancel your coverage. Features may include: level premium guarantees, future increases, and partial disability benefits. These plans are usually underwritten, but guarantee-issue products may be available.

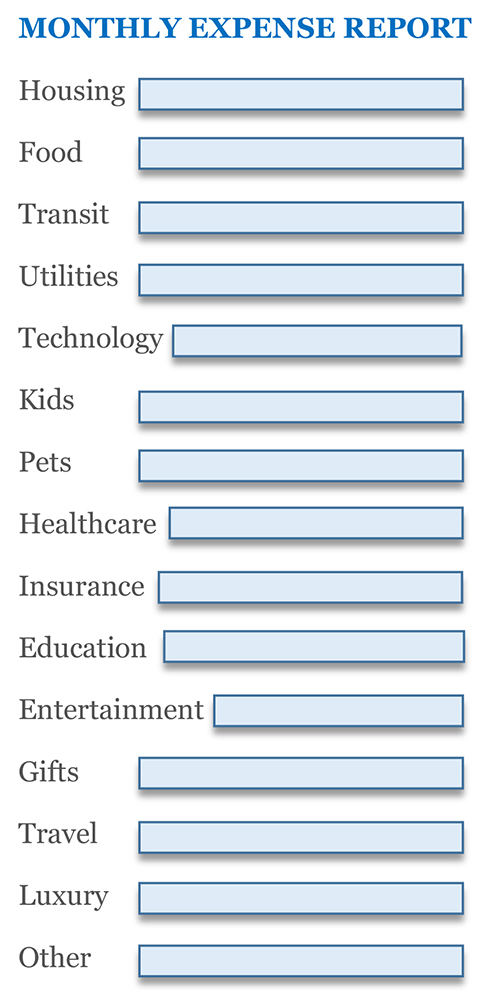

Disability income requires a personal evaluation of spending and lifestyle habits. Determine what level of income your client needs to maintain his or her lifestyle and prioritize their protection. Here are some suggested ways to help your client determine their need:

- Monthly Expense Report. Ask your client to list out the monthly amounts they spend on the following:

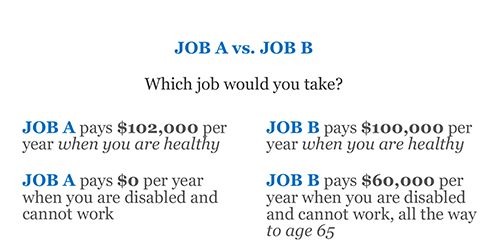

- Job A or Job B? Ask your client which job they'd take:

- Pulling Rank: Ask your client to rank their priorities on a scale of 1 to 5:

This FREE 10-page kit includes:

- 1-page worksheet to use with consumers

- 2 pages of pre-written social media posts, "The 21 Tweets of DIAM"

- 1-page Need vs. Reality guide

- 1-page guide: “Target Millennials for IDI Sales”

- 2-page consumer guide: “What Are Your Top Priorities?”

- Tax guidelines for DI products

- Quote request form

Take an active role in the field underwriting process. Your ability to identify a potential DI candidate will alleviate many headaches down the road.

Medical Underwriting. DI experts often say, “Money doesn’t buy disability insurance, your health buys it.” Several medical questions can be found on the application. Depending on the amount of coverage, an Attending Physician Statement may be ordered, along with health exams to include a blood and/or urine test. Pre-existing health conditions may be excluded or your application for coverage may be rated, postponed, or declined. It is always good to have realistic expectations about these past health issues. Be prepared and remember that there are hundreds, if not thousands, of disabling illnesses or injuries that can result in a DI benefit. If you do have a pre-existing condition, keep in mind that your DI coverage might not cover that one condition, but your policy may be absolutely vital to securing your financial well-being if any other unrelated health issues suddenly appear in your life. Simplified Issue and Guarantee Issue programs may be an option for certain employee groups, and these channels should be examined.

Medical Underwriting. DI experts often say, “Money doesn’t buy disability insurance, your health buys it.” Several medical questions can be found on the application. Depending on the amount of coverage, an Attending Physician Statement may be ordered, along with health exams to include a blood and/or urine test. Pre-existing health conditions may be excluded or your application for coverage may be rated, postponed, or declined. It is always good to have realistic expectations about these past health issues. Be prepared and remember that there are hundreds, if not thousands, of disabling illnesses or injuries that can result in a DI benefit. If you do have a pre-existing condition, keep in mind that your DI coverage might not cover that one condition, but your policy may be absolutely vital to securing your financial well-being if any other unrelated health issues suddenly appear in your life. Simplified Issue and Guarantee Issue programs may be an option for certain employee groups, and these channels should be examined.- Financial Underwriting. Both low incomes (below $24,000/year) and very high incomes ($1,000,000+ per year) may present some opportunity for a more creative solution outside of the typical disability insurance spectrum. Sometimes a quick W2 or paystub will suffice. Other cases may require two to three years of tax returns, such as for business owners or government employees. Investment income or income from other sources will also play a role in the insurability of the applicant. Not everyone has the same need for DI — and that’s perfectly okay — as long as we can identify the complication ahead of time.

- Occupational Underwriting. Not all occupations have the same rates. A roofer and a dentist and an attorney all have different specialties and different incidences of claims. Therefore, they all have different rates. Not all occupations are insurable by disability income carriers. Some special-risk companies focus on offering coverage for extra-risky occupations. Upgrades and discounts may be available for some business owners. Starter programs and simplified underwriting may be available for some students and new professionals. Work with us and we'll help you find the carriers that will be best for your particular client.

This FREE 8-page kit includes:

- 1-page guide to medical, financial, and occupational underwriting

- 2 pages of pre-written social media posts, "The 21 Tweets of DIAM"

- 2-page guide: “Six Words Can Help You Sell”

- Tax guidelines for DI products

- Quote request form

Remember, always consult the actual policy for specific definitions and details.

automatic increase – an annual increase to the insured’s monthly benefit maximum, usually based on a guaranteed fixed percentage.

catastrophic benefit – an additional benefit that may be granted to help cover the cost of long-term services and supports if the insured loses the ability to perform two or more Activities of Daily Living or is suffering a severe cognitive impairment.

cost of living adjustment – an automatic increase usually tied to the Consumer Price Index – Urban that increases the designated monthly benefit amount each year after becoming eligible for disability benefits.

disability insurance – a policy that is sold and supplied by an insurance company, specifically designed to pay a benefit to the policyholder upon the event of an eligible illness or injury.

future increase option – this rider or feature enables the policyholder to increase benefits at a later date without any medical underwriting, though financial underwriting must warrant any applied increases.

guaranteed renewable – ensures that the policy will continue, or renew, each year you pay premiums; guarantees that only the policyowner can cancel coverage.

income replacement % – this is the percentage of income that is substituted by disability income in the event of an injury or illness, usually computed before income taxes apply.

monthly benefit – income paid to you after meeting the required definition of Total or Partial Disability according to the terms of the policy.

noncancelable – a level premium guarantee, or rate guarantee, usually for the life of the policy and typically included in the base policy but may be a rider for additional premium.

occupation class – the categorical level of risk for a general grouping of occupations as determined by actuarial data and experience; may affect the price of the premium.

partial disability – benefits may be payable if not eligible for “total disability” benefits per the terms of your policy, typically requiring a loss of income of 20% or more.

total disability – the core of any disability insurance policy; dictates the terms of the insured’s eligibility triggers that are required to receive the total maximum monthly benefit; there are many variations.

waiting period – the “elimination period” or “deductible period” that applies immediately following a disability but before benefits are paid.