We're here to help with all your questions about carrier availability, submitting business, our process, and more. Please bookmark this page for future reference. We'll keep everything on this page updated so you always have the resources you need at your fingertips.

What's on this page:

FAQs

Requirement: Acts of an Agent

Case Submission: Supported Carriers

Processing Methods

How to Submit Business to Pinney

The Pinney Process: What Our Team Does

Stage & Status Glossary

Note: There's more in the PDF than on this page. If you're looking for carrier information for the ApplicInt Drop-Ticket Process, E-Signature Availability, the Temporary Insurance (TIA) Carrier Matrix, or Carriers' Accepted Modes of Payment, please download the PDF.

FAQs

Have a question? We'll answer it here, or direct you to the person or resource who can help.

We cover this below, in the How to Submit Business to Pinney section. Click here to jump straight to the instructions.

If we contacted you about a case you submitted that isn't possible to process due to the Acts of an Agent requirements, most likely it's because you're not licensed in the state of sale. For more details, please read the Acts of an Agent below.

Our PDF document includes a full 5-page list of carriers' accepted modes of payment. Please click here to view/download the PDF and scroll to page 24 or click the Carriers' Accepted Modes of Payment link in the table of contents.

- Check out our Resources page - it has 15+ sales kits with tons of consumer and producer guides on topics ranging from life insurance as an asset class to retirement planning to long-term care. You're welcome to pull any consumer-facing guides, facts, stats, and wording from those guides and send them to your clients & prospects.

- Browse the Pinney blog. If it's marketing ideas and strategies you want, that's the best place to start. We've covered lead gen, social media marketing, and more in detail there.

- If you subscribe to Insureio and have the marketing package, you have access to hundreds of pre-written marketing emails. Click the megaphone icon in your left-hand nav menu, then select Marketing Templates to browse the available emails. For more info on using Insureio's marketing capabilities, click here.

Requirement: Acts of an Agent

Located on page 21 in the booklet

If you're the agent collecting information that's protected under the Health Insurance Portability and Accountability Act (HIPAA) and/or information considered Personal Identifiable Information, by law you must be licensed in the state of sale.

The following acts must be conducted by the agent who spoke with the proposed insured. Note: Acts of an Agent can vary by state and carrier regulations.

1. Providing pricing of any kind for an insurance product.

2. Collecting personal information: name, contact information, gender, date of birth, place of birth, SSN, and driver’s license number.

3. Collecting financial information: annual income, net worth, binding coverage or not.

4. Collecting information about any existing life insurance: details on the existing policy (including coverage amount, carrier, and when the policy was placed), as well as determining whether the client will replace existing coverage.

Case Submission: Supported Carriers

Located on page 4 in the booklet

| Carriers | Not Approved for ATeam at any Face Amount | Approved for ATeam at any Face Amount | Approved for ATeam if Annual Premium is $2,500+ |

|---|---|---|---|

| Corebridge Financial (American General) | X (GIWL excluded) |

||

| American National | X | ||

| Americo | X*** | ||

| Assurity | X | ||

| AXA | X | ||

| Banner | X | ||

| Brighthouse | X | ||

| Cincinnati Life | X^^ (WL excluded) |

||

| Fidelity | X | ||

| Foresters | X | ||

| Gerber | X | ||

| John Hancock | X***** | ||

| Lincoln Financial | X* | ||

| Mass Mutual | X | ||

| Minnesota Life/ Securian | X | ||

| Mutual of Omaha/ United of Omaha | X |

||

| National Life Group/LSW | X | ||

| Nationwide | X^^ | ||

| North American | X** | ||

| Pacific Life | X | ||

| Principal (non-NY states) | X**** | ||

| Principal (NY) | X**** | ||

| Protective | X^ | ||

| Prudential | X** | ||

| Sagicor | X | ||

| SBLI | X | ||

| Symetra | X | ||

| Transamerica | X** | ||

| United Home Life | X (GIWL excluded) |

*Case-by-case basis. LFG requires a notarized form from the agent stating we can use their electronic signature.

**A-Team submits over the phone, not via drop-ticket through ApplicInt.

***Americo Ultra Protector Series must be sold face-to-face; Eagle Series FE requires face-to-face in CA.

****Principal no longer accepts personal lines - only business applications.

*****John Hancock apps under $750,000 must be submitted through iGo or the JH eApp.

^New York only: Agents must submit all apps digitally using their Protective login as of 7/1/23; no paper or BGA submissions accepted.

^^Both Nationwide’s Intelligent Underwriting (accelerated UW) and Cincinnati Life's Accelerated Underwriting must be submitted via iGo and cannot be completed through the App Team.

Processing Methods: Drop-Ticket/eApplication

Located on page 3 in the booklet

Our A-Team processes all applications over $2,500 in annual premium, regardless of carrier; however, live transfers will only be taken for the carriers shown below.

| Corebridge Financial (American General) | Protective |

|---|---|

| Banner | Prudential |

| John Hancock | SBLI |

| Mutual of Omaha | Transamerica |

| Nationwide | United of Omaha |

| Pacific Life | William Penn |

Submissions will still be completed by our A-Team members; however, live transfer will no longer be available and ALL submissions will use the corresponding carrier drop-ticket model (see list below) for quicker processing, reduced or eliminated exam requirements, and real-time ordering of other underwriting requirements during the carrier-conducted phone interview.

| Corebridge Financial (American General) | Protective |

|---|---|

| Banner** | Prudential* |

| Cincinnati Life | SBLI |

| John Hancock | Transamerica* |

| Mutual of Omaha | United of Omaha |

| North American* | William Penn |

| Pacific Life** |

*Will be processed in-house by the application team regardless of premium

**Will be submitted via drop-ticket unless the annual premium is $5,000 or above or the case has a special circumstance

How to Submit Business to Pinney

Located on page 16-19 in the booklet

There are three ways to submit business to Pinney:

1. Using Insureio

Application tickets are assigned to an Application Specialist who will work directly with your client and/or the carrier using our diligent follow-up process to complete the application, obtain signatures, and schedule the exam (if one is required).

- Annual Premiums $2,501 or more: Barring any carrier-imposed restrictions, application completion, signature collection, exam scheduling, and follow-ups are handled by the ATeam on your behalf. Click here to see the list of ALL available carriers.

- Annual Premiums $2,500 or less: A limited list of carriers are available for submission via the ATeam, who will oversee but not conduct application completion, signature collection, exam scheduling, and follow-ups using the carrier’s designated application fulfillment partner or process.

- Agents are responsible for submitting the application using an alternative electronic submission option (iGo, agent portal, etc.) or paper application for carriers NOT shown on the limited list above.

- Applications for North American, Prudential, and Transamerica will be completed by the ATeam regardless of the premium.

Currently, iGo is NOT directly linked to Insureio and the client’s details will NOT populate in Insureio. You will need to manually enter any data you wish to save into Insureio and update the status throughout the application process as listed below:

- After you have submitted the drop ticket or application via iGo, change the status in Insureio to “Submit Direct to Carrier by agent – awaiting Client signature.”

- Once you confirm that the client signed the application, change the status in Insureio to “Submit Direct to Carrier by agent – App Signed – sent to underwriting.”

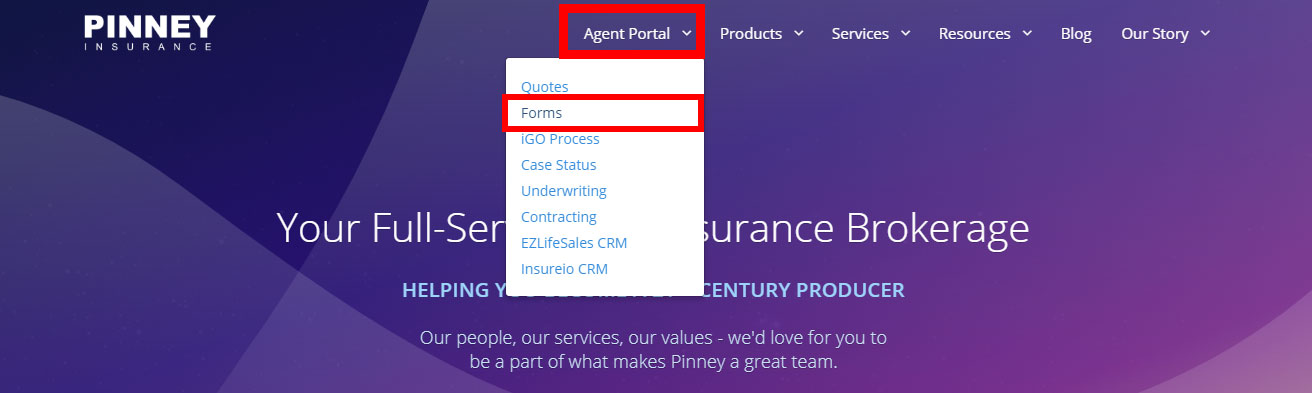

Printable versions of carrier forms can be found on this website. Hover over Agent Portal at the top of the page, then click Forms.

- Complete the interview, fill out required forms, and obtain all signatures with the client.

- Attach the signed application to the Insureio client record using the File Manager. For instructions on how to save documents to the File Manager, click here.

- Use the Enter Quote button within the policy section to add the application details.

- Change the status in Insureio to Brokerage Paper App Submitted.

2. Direct via the iGo Portal

Agents are responsible for checking status and following up with the client until the application has been signed when submitting directly via iGo.

- If using a full e-app, you will complete the interview with the client and assist the client until the application is signed. If using drop ticket or tele-app, the application interview will be completed by the carrier’s preferred vendor.

- The agency is only notified AFTER your client’s application has been completed, including signatures, and submitted to the carrier.

3. Paper/Traditional Application

Printable versions of carrier forms can be found on this website. Hover over Agent Portal at the top of the page, then click Forms.

- Complete the interview, fill out required forms, and obtain all signatures with the client.

- Once you complete the application with your client, forward the signed application:

Email to: [email protected]

Fax to: 916-773-2800

Mail: Attention: New Business

Pinney Insurance

2266 Lava Ridge Ct.

Roseville, CA 95661

Checking Case Status

Completed applications are automatically forwarded to the carrier and your case manager will proactively handle any additional requirements and provide regular status updates. Agents will receive a weekly case summary as well as status memos sent by the case manager if action is needed from the agent.

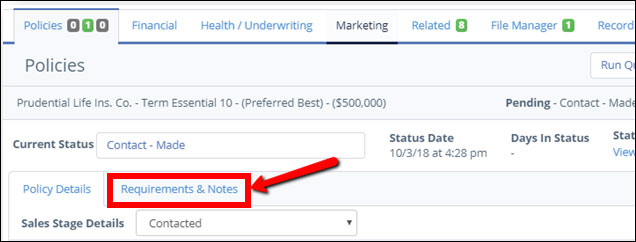

Check status 24/7 using this link: https://pinney.insureio.com/login

- Open the consumer file > click on the Policy tab for the application you would like to check status > underneath the section that reads Current Status, click on Requirements and Notes

- From there, you’ll be able to see any notes entered by the ATeam during the application process, as well as comments and requirements by Case Management during underwriting.

Check status 24/7 on PinneyInsurance.com > hover over Agent Portal at the top of the page > click Case Status.

The Pinney Process: What Our Team Does

Located on pages 7-12 in the booklet

We take our commitment to you and your clients seriously. When you work with us, we offer an 8-point service guarantee. This section explains what we do to provide those points of service. To learn more about the five teams working on your behalf, click here.

What Diligent Follow-Up Means

During the first 7 business days, we make 11 attempts to complete the application and order and schedule the medical exam for your client.

| Status: Submit to App Team | |

|---|---|

| Day 1 (first 24 hours) |

* 1st call to client (phone message left if contact is attempted but not successful) * Followed immediately by text message * System-generated email goes out to the client * Day 1 text or email will contain Calendly link to schedule application interview |

| Status: A-Team Follow-up 2 | |

| Day 2 | * 2nd call to client (2nd phone message) |

| Status: A-Team Follow-up 3 | |

| Day 3 | * 3rd call to client (3rd phone message) * Followed immediately by text message * System-generated email goes out to both client and agent |

| Status: A-Team Follow-up 4 | |

| Day 4 | * Call one time per day - alternate calling morning and evening, leaving no messages |

| Status: A-Team Follow-up 5 | |

| Day 5 | * Call one time per day - alternate calling morning and evening, leaving no messages |

| Status: A-Team Follow-up 6 | |

| Day 6 | * Call one time per day - alternate calling morning and evening, leaving no messages * System-generated email goes out to the agent |

| Status: A-Team Follow-up 7 | |

| Day 7 | * 7th call to client * If no response from client, phone message left stating file will be placed on hold until we hear back from them * Followed immediately by text message * If client is unresponsive to our contact attempts, case will be closed. If client has engaged in our contact attempts, we will continue our attempts |

| Status: If client unresponsive: Client Unresponsive to A-Team, Referred to Agent If client has responded at any point: we will continue attempting to contact them |

|

Once we complete the application, we will follow up directly with the client for additional items. You will receive a notification regarding your case a minimum of:

- Once every 5 business days

- Whenever the case is touched

- When there is a change in status

Feel free to check your case status anytime online!

What Diligent Follow-Up Means

| 3 business days after drop-ticket submitted | Check status |

|---|---|

| Days 6-30 | If interview isn’t complete, the application team will attempt to contact client (by phone, email, and/or text) every three days. |

| Day 10 | System email to client and agent (interview not completed). |

| Day 19 | System email to client and agent (interview not completed). |

| 30 days after drop-ticket submitted | If interview not completed, case will be placed on hold. Email will go out to client/ agent with fulfillment center phone # info. |

The above process is followed for all applications sent via Drop Ticket. The Application team (A-Team) will be submitting the drop ticket the same day you submit it in Insureio. The vendor fulfillment center will begin calling your client right away and the A-Team will check status every three days per the above guidelines. You will also receive a notification regarding your case when there is a change in status.

You will also receive a notification regarding your case when there is a change in status.

Feel free to check your case status anytime online!

What Diligent Follow-Up Means

During the first 7 days after the application is sent to your client, we make 11 attempts to recover the application from your client.

| Day 1 (Day after app is sent for e-signature) |

* Call client, leave voice message |

|---|---|

| Day 2 | * 2nd follow-up message voice mail * Send text to client |

| Day 3 | * 3rd follow-up message voice mail * Re-send the application to the client |

| Day 4 | * 4th follow-up message voice mail * Email to agent to ask for assistance with app recovery |

| Day 5 | * 5th follow-up message voice mail * Send text to client |

| Day 6 | * 6th follow-up message voice mail * Send text to client |

| Day 7 | * 7th follow-up message voice mail * Case will be placed on hold until client and/or agent responds * Email to client, CC agent RE: case placed on hold |

The above process is followed for all applications sent for e-signature via Marketech or Docusign. When applications are sent via mail, the initial calling would start one week after application was mailed to the client. Once we complete the application, we will follow up directly with the client for additional items. You will receive a notification regarding your case a minimum of:

- Once every 5 business days

- When there is a change in status

Feel free to check your case status anytime online!

What Diligent Follow-Up Means

The below follow-ups are based on business days.

| Day 1 | Case Manager (CM) calls client on all numbers to obtain requested info. If forms require signature advises that they will be sent to client via secure email. When voicemail left, also follows up via secure email for missing info. Case Manager Assistant (CMA) emails/DocuSigns forms to client. |

|---|---|

| Day 7 | CM calls client on all numbers. Leaves message, sends secure email, and texts client. |

| Day 12 | CM calls client on all numbers. No message left, sends text, and sends secure email. CM requests Agent assitance. |

| Day 17 | CM calls client on all numbers. Leaves message and sends secure email. |

| Day 22 | CM calls client on all numbers. No message left. Sends a Final Request email to client and Agent. |

| Day 27 | CM calls client on all numbers. No message left. Sends a Final Request email to client and Agent. |

Agents will receive notification when a new requirement is posted to the case in addition to a weekly status update on all outstanding requirements. They can also check status 24/7 online with Insureio or Data Viewer.

Feel free to check your case status anytime online!

What Diligent Follow-Up Means

The below follow-ups are based on business days.

| Day 1 | Case Manager (CM) orders APS; client notified that records were ordered. Copy Service begins contacting doctor's office to obtain records. |

|---|---|

| Day 4 | CM follows up with Copy Service and sets follow-up one day after the Copy Service is due to follow up next. When necessary, Case Manager Assistant (CMA) calls/emails client for special authorization form.* *CM will follow up every 3 days for special authorizations, wet-signed HIPPAs, additional Dr. info, and/or APS fee approval. |

| Day 5-14 | CM continues to track progress with Copy Service, sets follow-up one day after the Copy Service is due to follow up next. |

| Day 15 | CM calls client to request assistance with obtaining the APS. If leaving message, will also send text and secure email. CM will call doctor's office or medical facility as needed. |

| Day 15 - Completion | CM continues to follow up one day after the Copy Service is due to follow up until APS is received. CM will update client every 2 weeks until APS is received. |

| Day TBA | CMA updates case once APS is received; client and agent both notified that records were forwarded to the underwriter for review. |

Agents will receive notification when a new requirement is posted to the case in addition to a weekly status update on all outstanding requirements. They can also check status 24/7 online with Insureio or Data Viewer.

Feel free to check your case status anytime online!

What Diligent Follow-Up Means

Our delivery team will assist you with policy delivery. We will attempt to collect Delivery Requirements (DRs) on your behalf. Prep your clients when calling them about policy approval that the POLICY SPECIALIST will be sending their requirements to activate coverage.

| Day 1 | Policy Specialist will process policy, which includes scanning the necessary requirements for electronic delivery (when available), and notifying Agent that policy was sent. *sets Case Manager requirement follow-up out 1 week before due date* |

|---|---|

| Day 2 | Policy Specialist will email DocuSign Delivery Requirements (when available) and CC Agent. *DocuSign resends automatically every 2 days* |

| Day 5 | Policy Specialist will call owner on all available phone numbers (text messages as well). Email sent to Agent advising of outstanding requirements to assist the Agent in following up with their client. |

| Day 10 | Email reminder sent to client regarding the outstanding Delivery Requirements. The Policy Specialist is available to assist client as needed. |

| Day 15 | Email reminder sent to client regarding the outstanding Delivery Requirements. The Policy Specialist is available to assist client as needed. |

| 1 Week to DRs Due | Case Manager CALL to Agent Case Manager FINAL NOTICE email to Agent |

| DR Due Date | Case Manager CALL to Agent *If Agent is still attempting client contact, f/up 1 week *If Agent does not respond in 5 days, advises carrier to close case *If Agent requests more time, request extension from carrier and continue to f/up weekly w/Agent |

Please note: Our delivery team is available to assist when the client needs help completing their forms or accessing electronic documents. If your client is ever in need of assistance, please send a request to [email protected] with the client’s information & details regarding their question. A Policy Specialist will assist to the best of their abilities.

The following Carrier Delivery Requirements can be sent electronically to your clients:

Corebridge Financial (American General/US Life), ANICO, Assurity, Banner/William Penn, Brighthouse, Cincinnati Life, John Hancock, Lincoln Financial, Mutual/United of Omaha, Nationwide, North American, Protective, Pacific Life, SBLI, Symetra

Stage & Status Glossary

Located on pages 13-15 in the booklet

Stage: App Fulfillment

Submit to App Team: The initial status – the agent selects this status to submit the app to our team.

A-Team – Contact Made: Our team has talked to the applicant, but they are not moving forward yet (need to talk to a spouse, spoke to client and set a scheduled call-back time, etc.).

A-Team Follow-Up 2 – 7: These statuses reflect the contact attempts our team make by day, outlined in our diligent follow-up process (also included in this guide).

A-Team: Client Unresponsive – Referred to Agent: Our team has completed the diligent follow-up process during days 2-7, but received no response from the client. This status hands the case back to the agent.

Withdrawn - A-Team: The applicant was not interested, didn’t qualify, or is unresponsive.

Withdrawn - 2 day Uninterested: We reached the client on our first or second contact, but they decided not to proceed.

Withdrawn - PreUW Changeover: The agent changed carriers before an application was submitted to the carrier.

Contact Made - App Hold: The app is on hold waiting for additional info from agent or client.

App Hold - Missing Required Information: The app is on hold because it is missing required client information (usually associated with Acts of an Agent, required before submitting the app).

App Ticket Returned to Agent - Unable to Process: The app submitted is for a carrier ATeam can’t process due to premium requirements, or a carrier that requires an agent to submit directly.

App Ticket Returned - Agent Licensing: The app cannot be processed because the agent doesn’t have an active license.

Submit Direct to Carrier by Agent - Awaiting Client Signature: The agent has submitted directly to the carrier; the agent is responsible for checking status until app is signed.

App Sent – eSign: The app is out for signature.

App Sent - eSign NER: The app is out for signature; no exam required.

App Sent – Docusign: The app is out for signature.

App Sent – Docusign NER: The app is out for signature; no exam required.

App Sent – Paper: The app has been mailed to the client.

App Sent - Paper NER: The app has been mailed to the client; no exam required

App Sent – Drop Ticket (carrier name): Drop tickets the agent submits to us and we send off to the carrier.

App Sent – Vendor: We sent the app with the examiner to be signed by the client.

Withdrawn – Incomplete: Client has been unresponsive to outstanding requirements during underwriting.

Submitted – App Received: We have the signed app in-house; it has to be processed before it goes to the carrier.

Brokerage Paper App Submitted: We have the signed paper app in-house; it has to be processed before it goes to the carrier.

Stage: Submitted to Carrier

Submit Direct to Carrier by Agent - App Signed - Sent to Underwriting: The agent has submitted directly to the carrier and confirmed the client has signed the application.

Submitted – Carrier Drop Ticket: Indicates a drop-ticket app at the carrier; we’re changing the status to let our underwriting team know it’s ready.

Submitted – App Submitted: The most common status - we received the signed app back from the client and it has been sent to the carrier.

Awaiting Requirements: We are waiting for one or more requirements; for example, blood and urine may need to be processed through the lab. This status will task us to check the source of the delay.

Submitted – Tentative Offer: We have received a tentative offer from the carrier (after providing a quick quote, for example).

Approved - as Applied: The app went through and was approved as applied.

Approved - Other Than Applied: The app was approved, but other than applied. Whether it was approved up or down, we contact the agent and let them know what the carrier came back with. If it was approved down, we suggest alternatives.

Underwriting Review: The app was submitted and approved, but has been sent to our underwriter for review because the rate or health class does not seem correct.

Withdrawn - NTO: The client received the carrier’s offer and declined.

Withdrawn - Postponed: The carrier offered to look at the client’s app again later, usually within a specified date frame (i.e., if they can improve their numbers).

Withdrawn - Declined: The app was declined.

Withdrawn – Deceased: The client is deceased.

Approved – Reissued Case: The app was approved, but something changed afterward (the policy face value, for example). The case doesn’t need more underwriting, it just needs to be reissued.

Issued - Del Reqs: We are waiting for delivery requirements.

Issued - Holding: We are holding for more information (app may need to be resigned, we may be waiting for money, etc.).

Stage: Placed

Issued - Inforce: The policy is issued and in force.

Placed/In Force (No Follow-ups): The policy is issued and in force; no follow-up tasks will be generated by the system.

FREE Webinar Series: “Grow Your Business with IUL”

Watch these 5 webinars with North American, each with 20 minutes of sales tips and best practices, so you can start selling IUL now!

Take Our Agent Survey

Would you rather learn more about marketing or lead gen? Process automation or sales tips? Tell us in our agent survey!

Take Survey Now

Close Window